Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

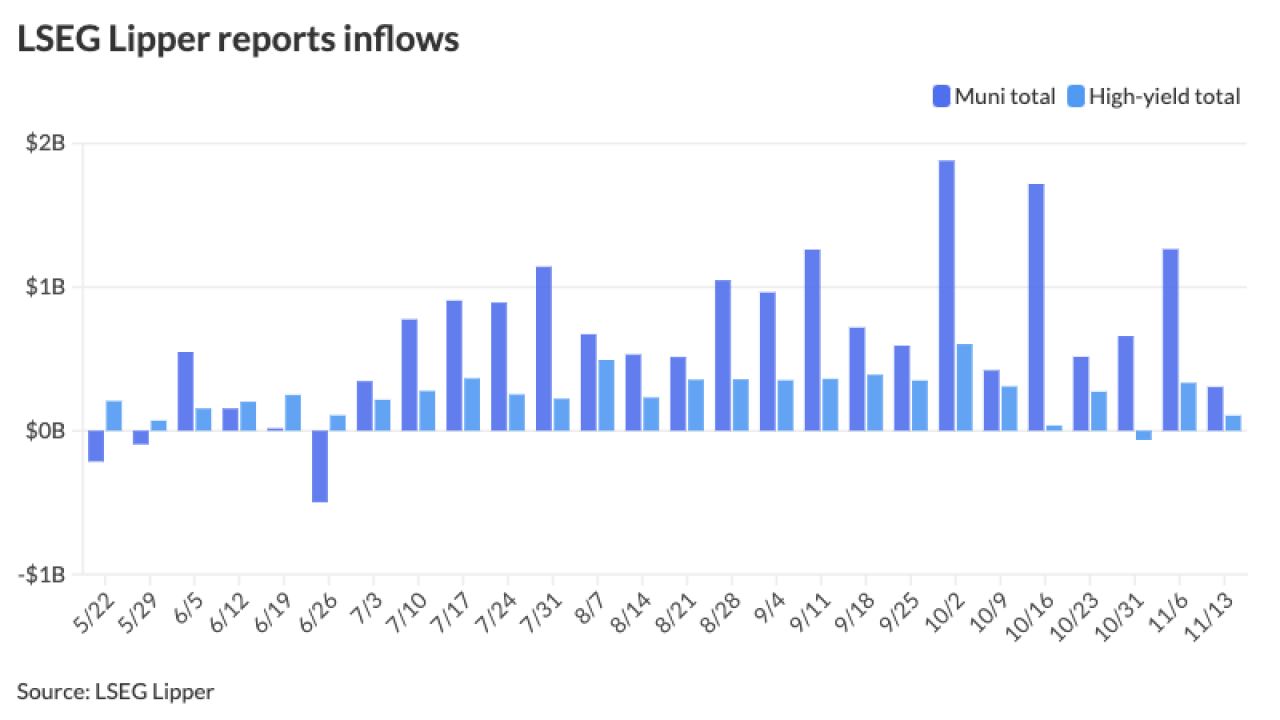

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

"This matter is now under active investigation by federal authorities and impacted financial institutions, who are coordinating with the White Lake Township Police Department," said Daniel Keller, chief of police, in a statement.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

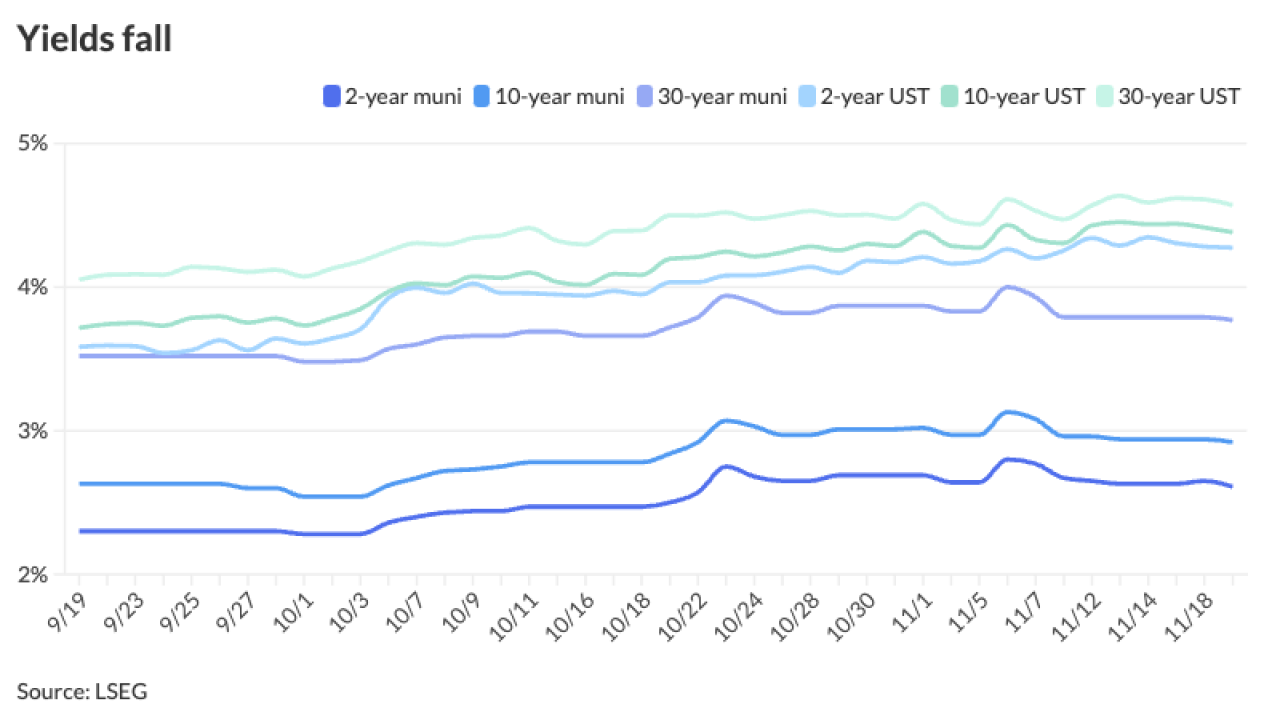

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

Munis ended November in the black with the asset class seeing gains of 1.73% for the month, pushing year-to-date returns to 2.55%.

December 2 -

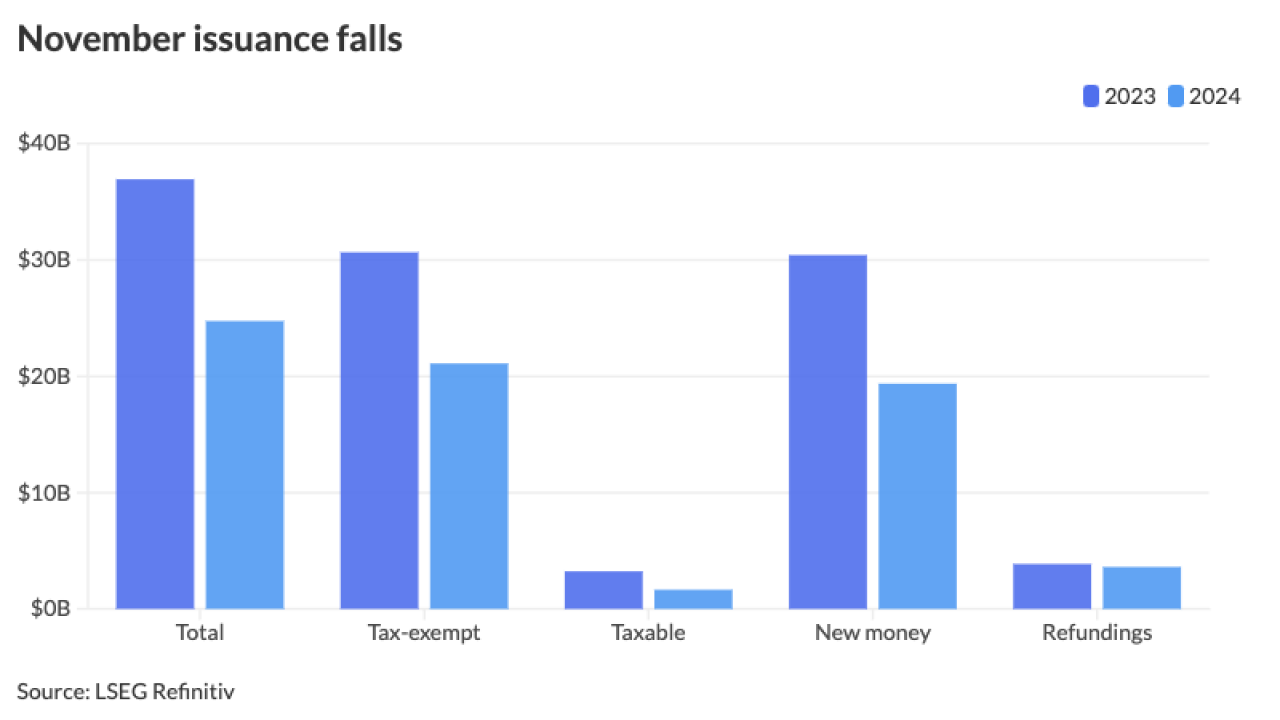

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25 -

"It became apparent that building this new critical care, advanced care bed tower was a strategic imperative," said John Morgan, interim CFO at WMCHealth.

November 25 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21 -

"Volatility creates all kinds of opportunities in the municipal space, not just for tax-loss harvesting, but for positioning and parts of the yield curve that might be undervalued or certain sectors or states that are poised to perform well going into yearend," said Tim McGregor, a managing partner at Riverbend Capital Advisors.

November 21 -

JoAnne Carter, managing director and president of PFM, will succeed Hartman as CEO.

November 20 -

"This year, with the tax-exemption clearly threatened, primary calendars should (although, of course, might not) be larger, putting a $500 billion full-year supply total in range, with $451 billion already in the books through 46 weeks," said MMA's Matt Fabian.

November 19 -

Houston is set to price Tuesday $1 billion of United Airlines Terminal Improvement Projects AMT revenue bonds while the Public Finance Authority will bring $125 million of non-rated Million Air Three General Aviation Facilities Project revenue bonds.

November 18 -

This month is experiencing similar volatility as 2016 when generic yields traded higher by 50 to 70 basis points during November of that year, said Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital.

November 14 -

The number of active ETFs launched has skyrocketed this year, with 20 new funds launched year-to-date. This compares with the four passive ETFs created so far in 2024, according to Morningstar Direct data.

November 14 -

Market reaction to inflation numbers was "tempered," said Richard Flax, chief investment officer at Moneyfarm. But should inflationary pressures hold in 2025, "markets may anticipate that further rate cuts could be limited in scope, suggesting a more cautious investment outlook."

November 13 -

Municipals ignored USTs losses, leading to lower muni to UST ratios and adding to the better performance across the curve and credit spectrum.

November 12 -

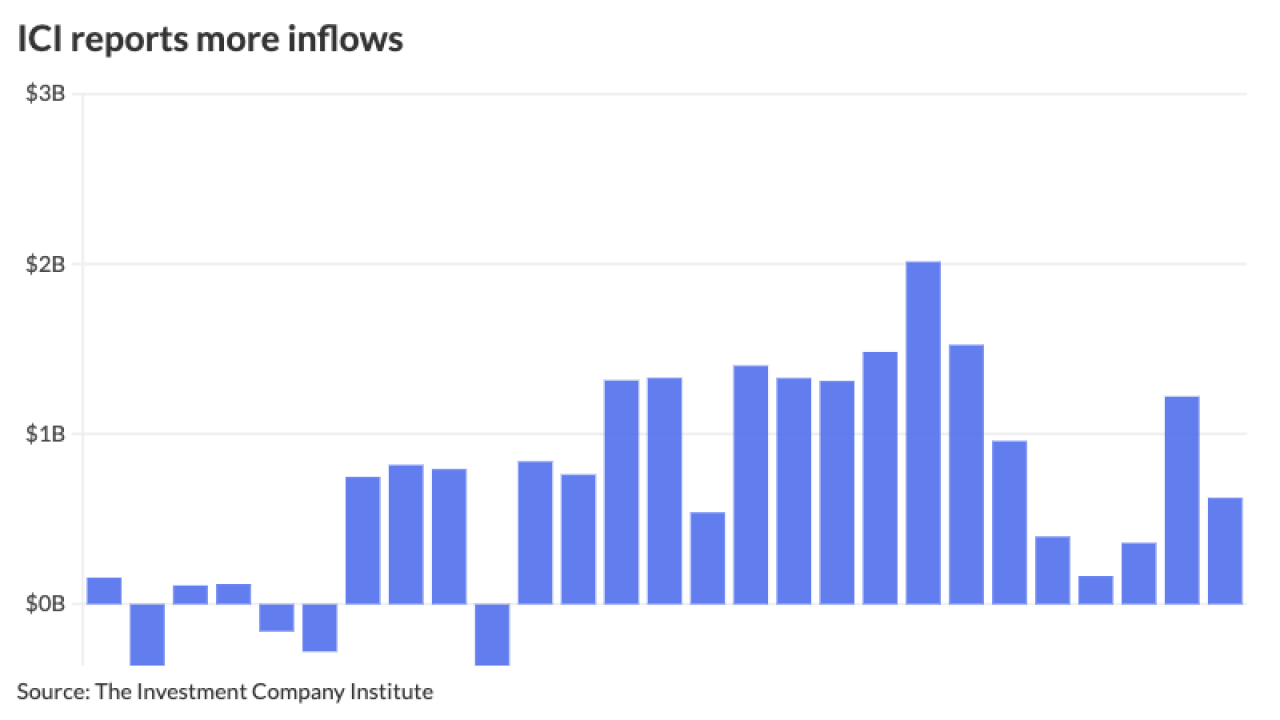

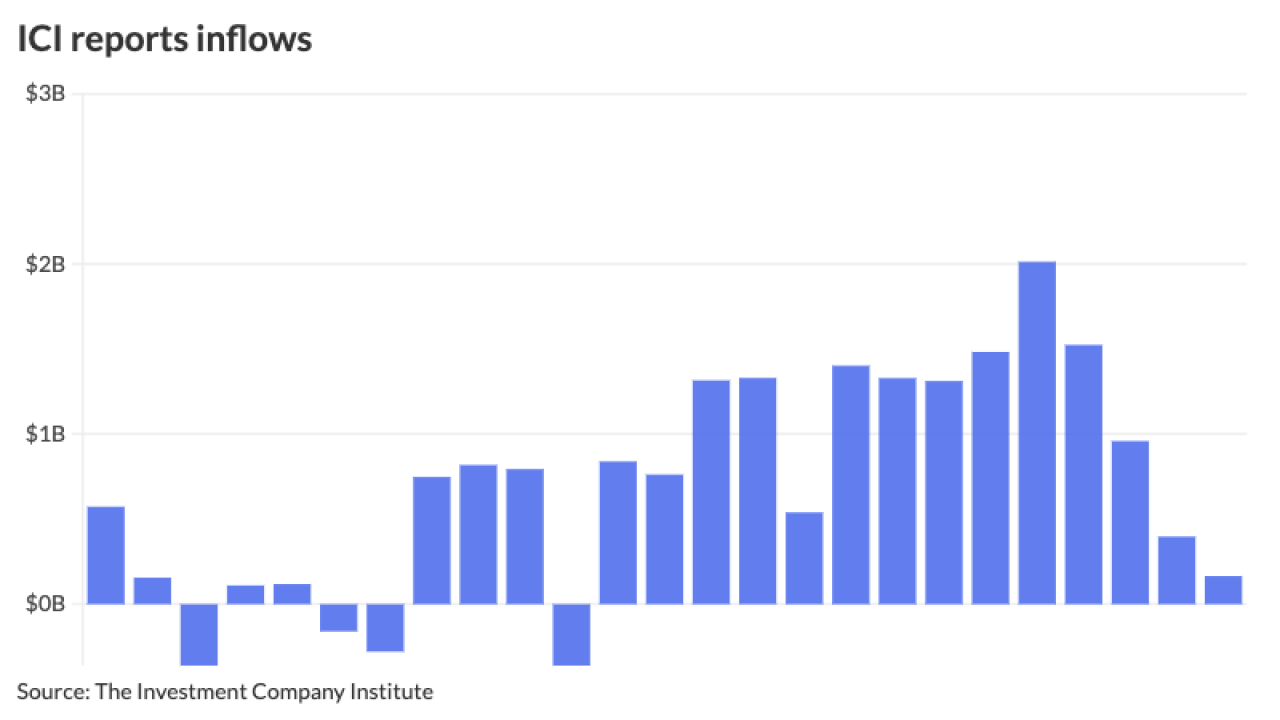

Tax-exempt money market funds reached a 2024 high of assets under management at $136.84 billion for the week ending Wednesday, according to the Investment Company Institute.

November 11 -

"A sharply lower new-issuance calendar, peak yields, large redemption money and mutual funds inflows are all positive performance factors for the market," BofA strategists said.

November 8