Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"Munis are grappling with a storm of uncertainty," said James Pruskowski, chief investment officer at 16Rock Asset Management.

December 19 -

It's hard enough convincing local governments to spend money on cyber insurance that covers ransomware attacks, said Omid Rahmani, public finance cybersecurity lead at Fitch Ratings. The new and very specific threat of a hacked financing process, is "absolutely" underappreciated by the public finance industry.

December 19 -

As the market prepares for 2025, there's a lot of uncertainty around what the new administration will mean for the macroeconomic environment and interest rates, the latter of which may be impacted by policy around the deficit, said Steve Shutz, portfolio manager and director of tax-exempt fixed income at Brown Advisory.

December 18 -

With investors now anticipating Wednesday's expected rate cut may be the last one for a while, "an overall bullish paradigm has been seriously weakened," noted Matt Fabian, a partner at Municipal Market Analytics, Inc.

December 17 -

As investors start shutting down for the year, there may be some mixed sessions ahead "especially for any accounts that find themselves as forced sellers," Birch Creek Capital said.

December 16 -

The face amount of munis outstanding rose to $4.171 trillion, a 0.8% increase from Q2 2024 and 2.9% from Q3 2023, according to the latest Fed data.

December 13 -

Muni mutual funds saw outflows after 23 weeks of inflows as LSEG Lipper reported investors pulled $316.2 million for the week ending Dec. 11. High-yield municipal bond funds, though, saw inflows of $192.3 million.

December 12 -

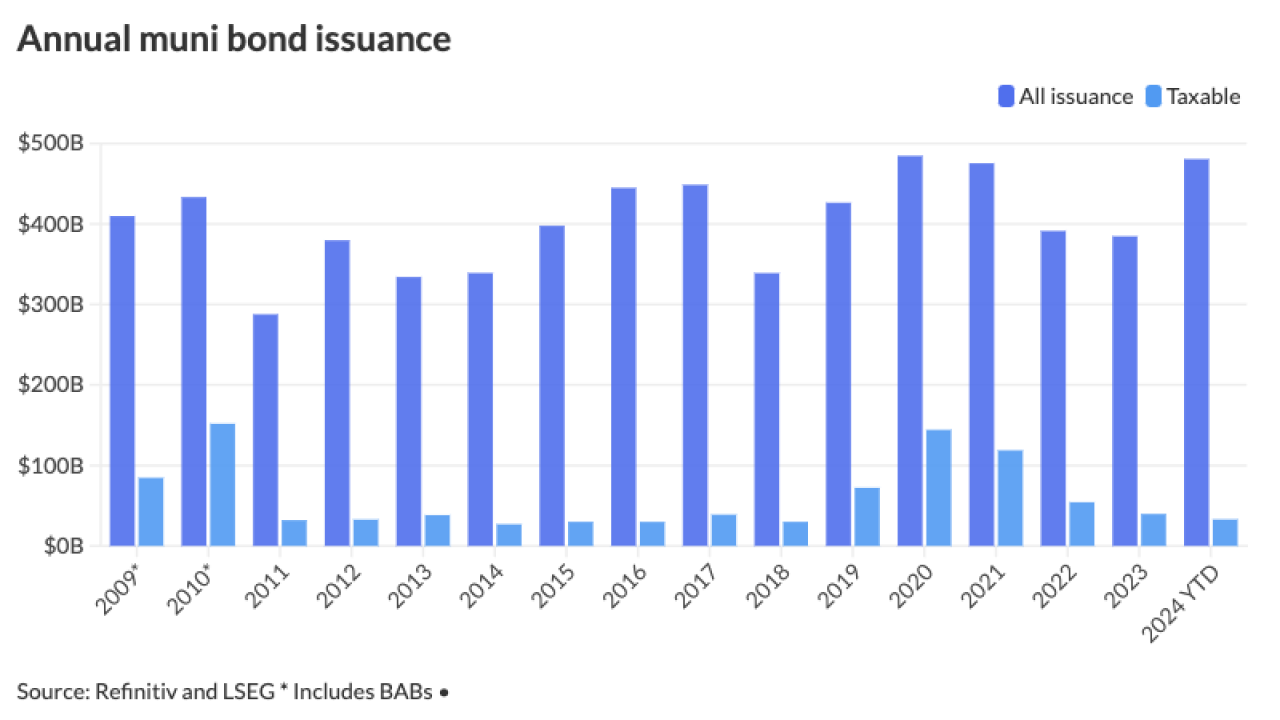

Most on the Street expect issuance to come in around $500 billion, but a few think volume will be much higher, primarily because of potential changes to the tax exemption. Most firms expect refunding volumes to also grow in 2025.

December 12 -

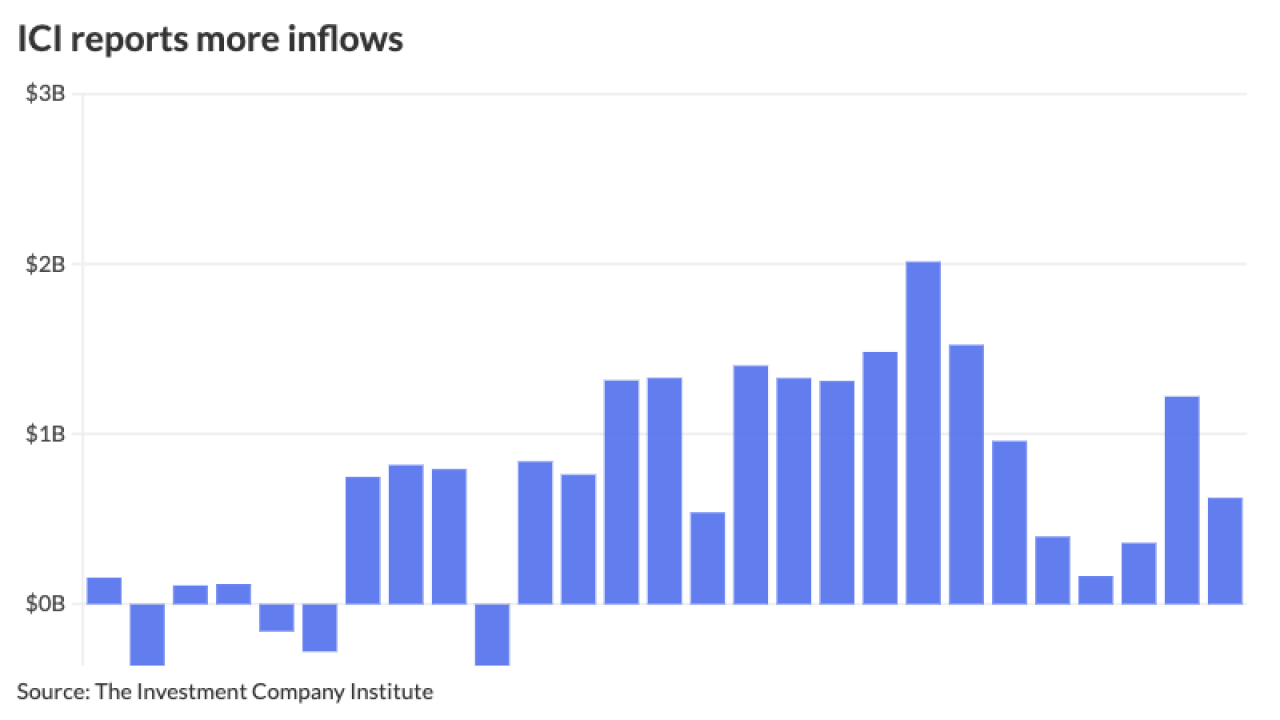

Municipal investors are more focused on the final new-issues coming down the pike and repositioning books as 2024 heads to a close. ICI reported another week of inflows into municipal bond mutual funds.

December 11 -

"With strong demand, rate cuts and favorable technicals, the muni market — outside of an unexpected shock — is set up to perform well over the next couple of months," said Daryl Clements, a municipal portfolio manager at AllianceBernstein.

December 10 -

High-yield municipal bond funds saw inflows of $534.1 million compared to $300.6 million compared the previous week, per LSEG Lipper data.

December 5 -

"This matter is now under active investigation by federal authorities and impacted financial institutions, who are coordinating with the White Lake Township Police Department," said Daniel Keller, chief of police, in a statement.

December 5 -

Technicals could "break down" if there is a potential decline in risk assets or rising unemployment, particularly in white-collar jobs, said Jeff Timlin, a managing partner at Sage Advisory.

December 4 -

Muni investors hope "any move toward higher yields is steady, even dignified, such that it doesn't catalyze an outflow cycle that would countervail year-to-date total returns just before we close out the year," said Vikram Rai, head of municipal strategy at Wells Fargo.

December 3 -

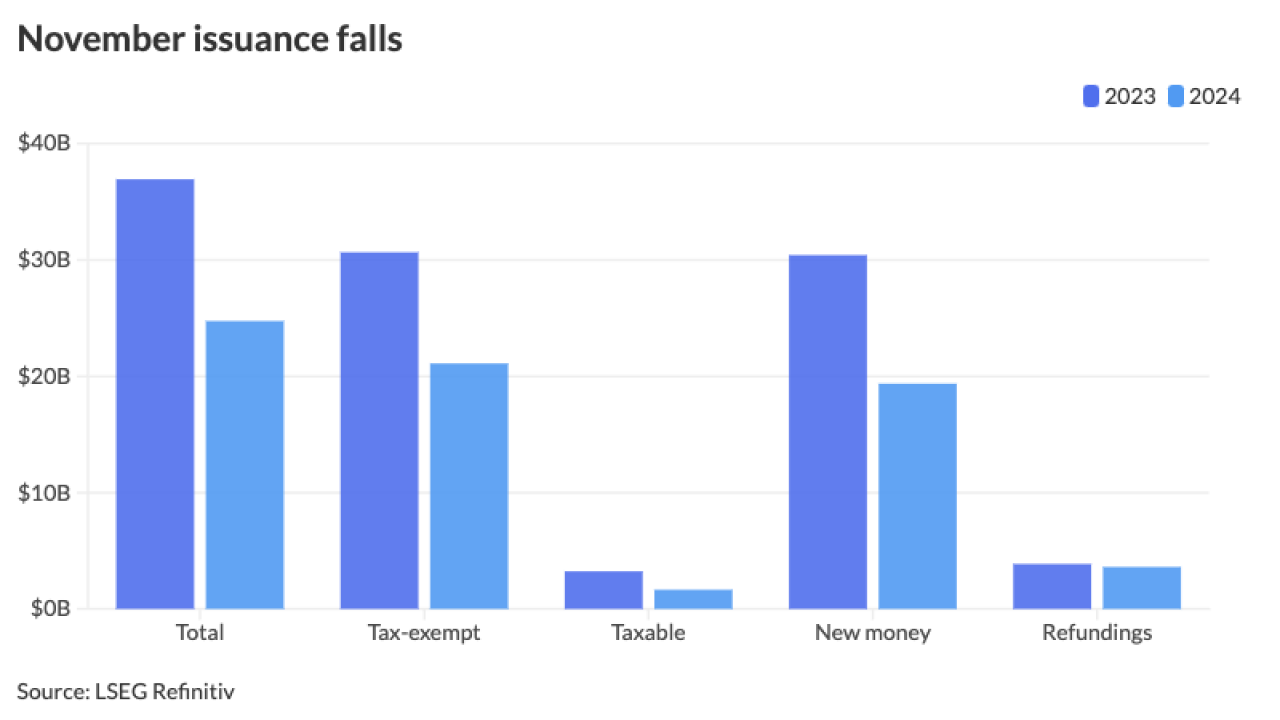

Munis ended November in the black with the asset class seeing gains of 1.73% for the month, pushing year-to-date returns to 2.55%.

December 2 -

November's total is below the 10-year average of $32.278 billion and is the lowest monthly total this year. The year's total is about $25 billion short of $500 billion.

November 27 -

"Earlier this month, Chair [Jerome] Powell noted that there was no 'hurry' to cut rates," noted BMO Senior Economist Priscilla Thiagamoorthy. The minutes, she noted, "confirm a broad support for taking a more cautious approach in easing monetary policy."

November 26 -

Markets could see that "the risks of higher inflation and interest rates are implicit constraints on the Trump policy agenda, with the eventual policy outcomes potentially less inflationary than some investors previously feared," UBS strategists noted.

November 25 -

"It became apparent that building this new critical care, advanced care bed tower was a strategic imperative," said John Morgan, interim CFO at WMCHealth.

November 25 -

High-yield funds saw $608.9 million of inflows compared with inflows of $150.3 million the week prior.

November 21