Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

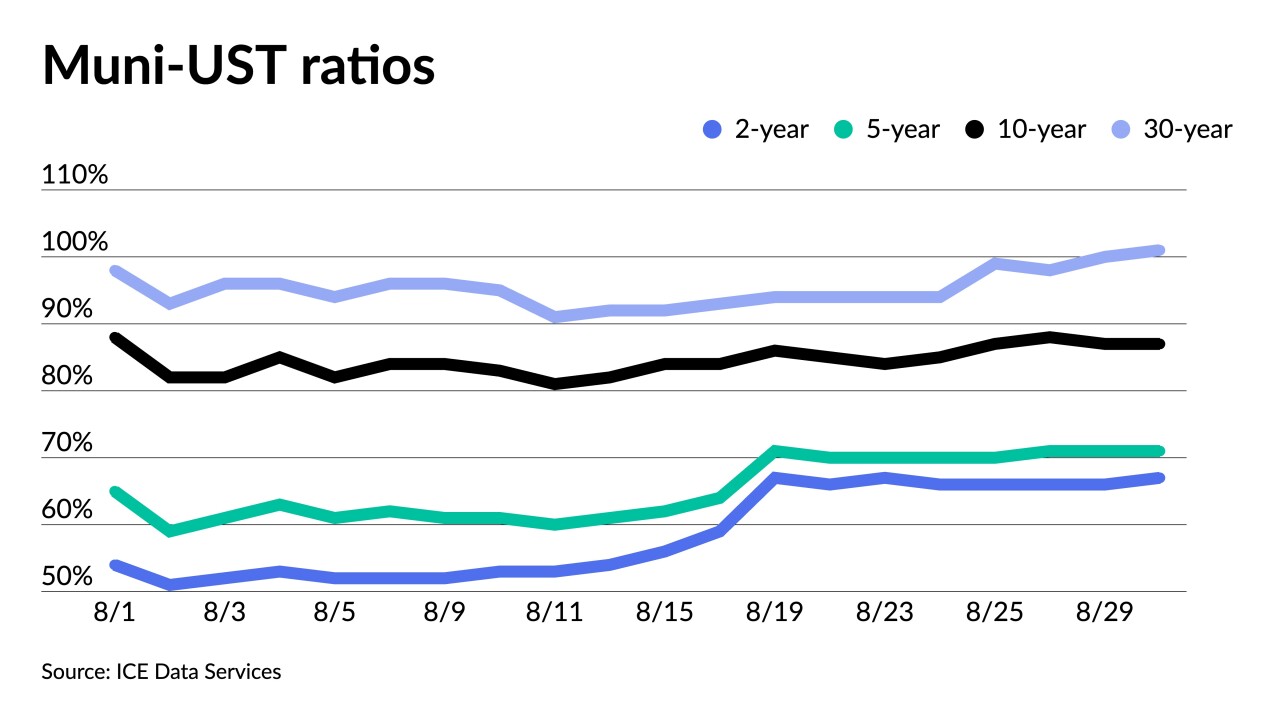

After underperforming USTs last week, "munis have given up their earlier performance advantage for August with both asset classes currently earning virtually the same negative returns," said Jeff Lipton, managing director of credit research at Oppenheimer Inc.

August 30 -

Fed Chair Jerome Powell's message on rates last week combined with seasonal factors to give the market a "weird" vibe this week, one trader said.

August 29 -

Investors will be greeted Monday with decreased supply with the new-issue calendar estimated at $5.882 billion, down from total sales of $6.134 billion in the week of Aug. 22.

August 26 -

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

The Investment Company Institute reported $230 million of inflows into muni bond mutual funds in the week ending August 17. ETFs see second week of outflows.

August 24 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

Investors pulled $229.263 million out of muni bond mutual funds in the latest week, versus the $635.177 million of outflows the prior week, according to Refinitiv Lipper. High-yield continues to see inflows.

August 18 -

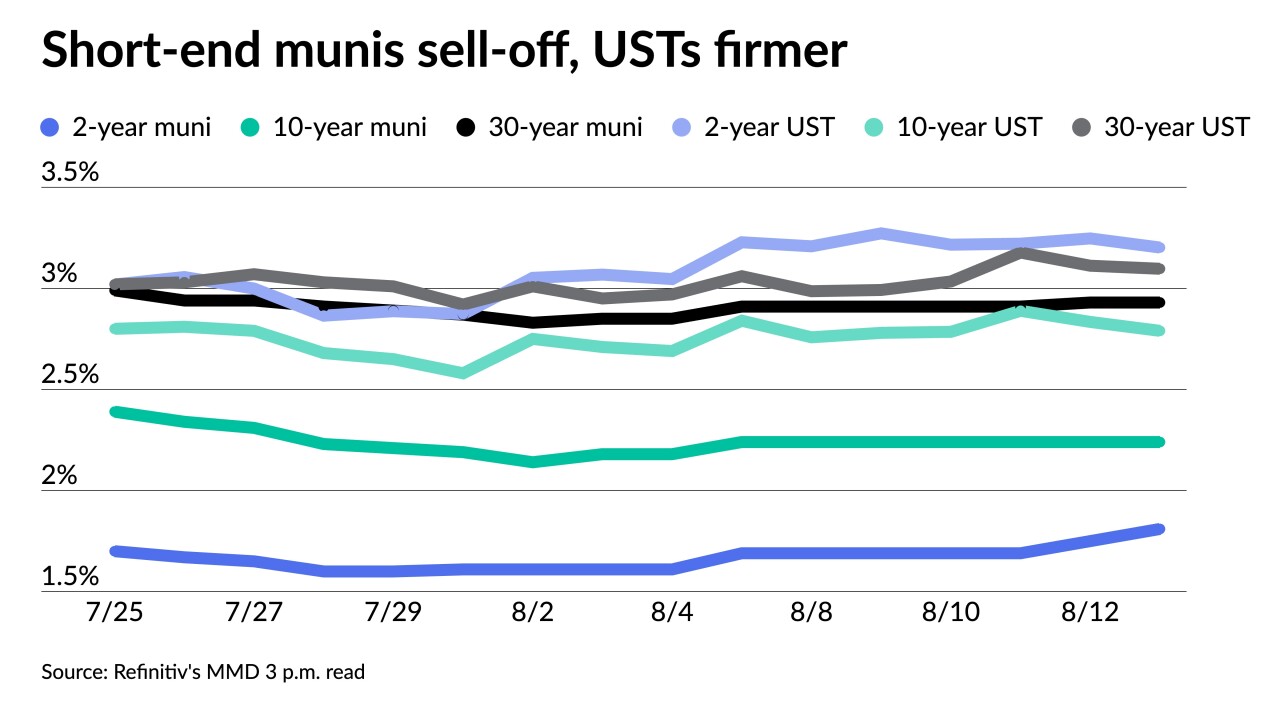

The short end was hammered in the secondary with large blocks of high-grades showing big swings to higher yields while the rest of the curve wasn't spared the damage and triple-A yields rose by seven to 16 basis points.

August 17 -

It was a busy day in the primary Tuesday, with New York City pricing $950 million of GOs for retail and Miami-Dade County, Florida, and Mecklenburg County, North Carolina, selling in the competitive market.

August 16 -

"Demand for low-duration tax-exempts has been so strong that short maturity benchmark yields are now lower than the after-tax yields for comparably rated benchmark taxable muni and corporate bonds," said CreditSights strategists Pat Luby and John Ceffalio.

August 15 -

Total volume in the first half of the year was at $209.718 billion in 5,153 deals, down 11.2% from the $235.836 billion in 6,793 over the same period in 2021, according to Refinitiv data.

August 15 -

The two main insurers, Assured Guaranty Municipal Corp. and Build America Mutual, accounted for $17.132 billion of deals in the first two quarters compared to $18.794 billion a year earlier.

August 15 -

Investors will be greeted Monday with an increase in supply with the new-issue calendar estimated at $5.941 billion, up from total sales of $1.700 billion.

August 5 -

Investors poured $1.094 billion into municipal bond mutual funds in the latest week, versus the $236.491 million of inflows the week prior. It marks only the second time this year inflows eclipsed $1 billion.

August 4 -

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2 -

Summer redemption season starts winding down; Net negative supply stands at $18.777 while 30-day visible is at $12-plus billion.

August 1 -

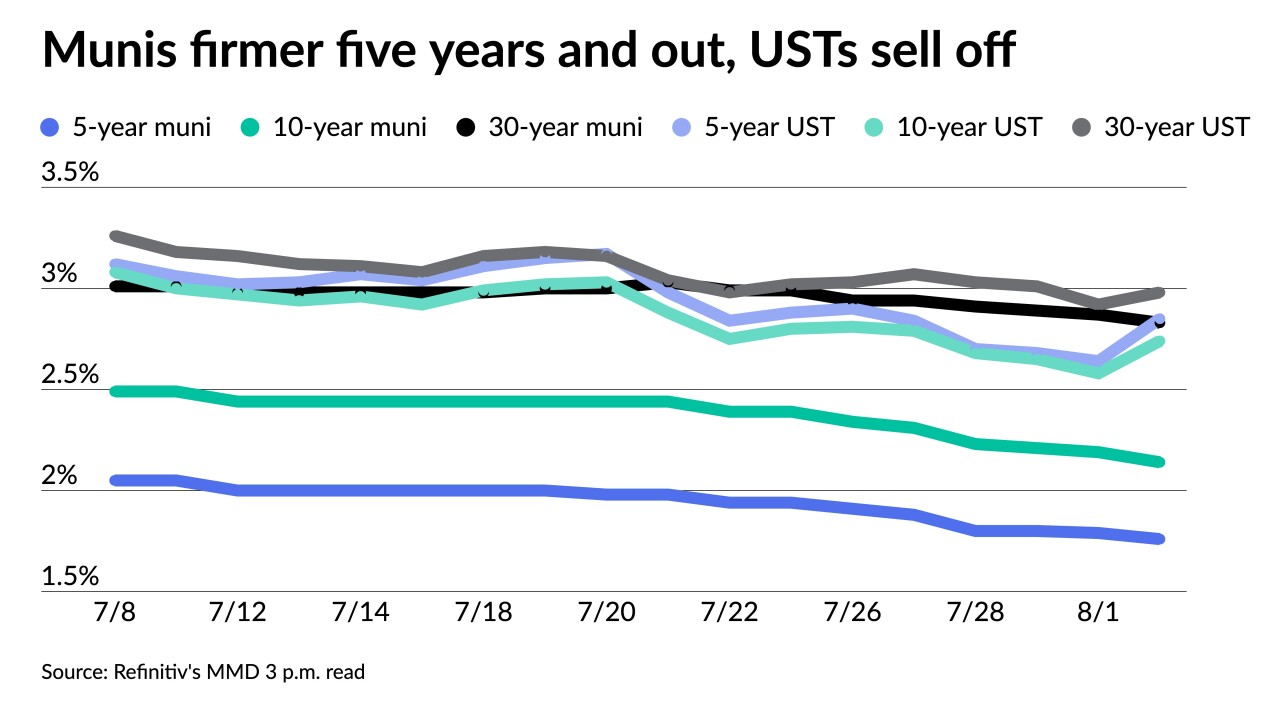

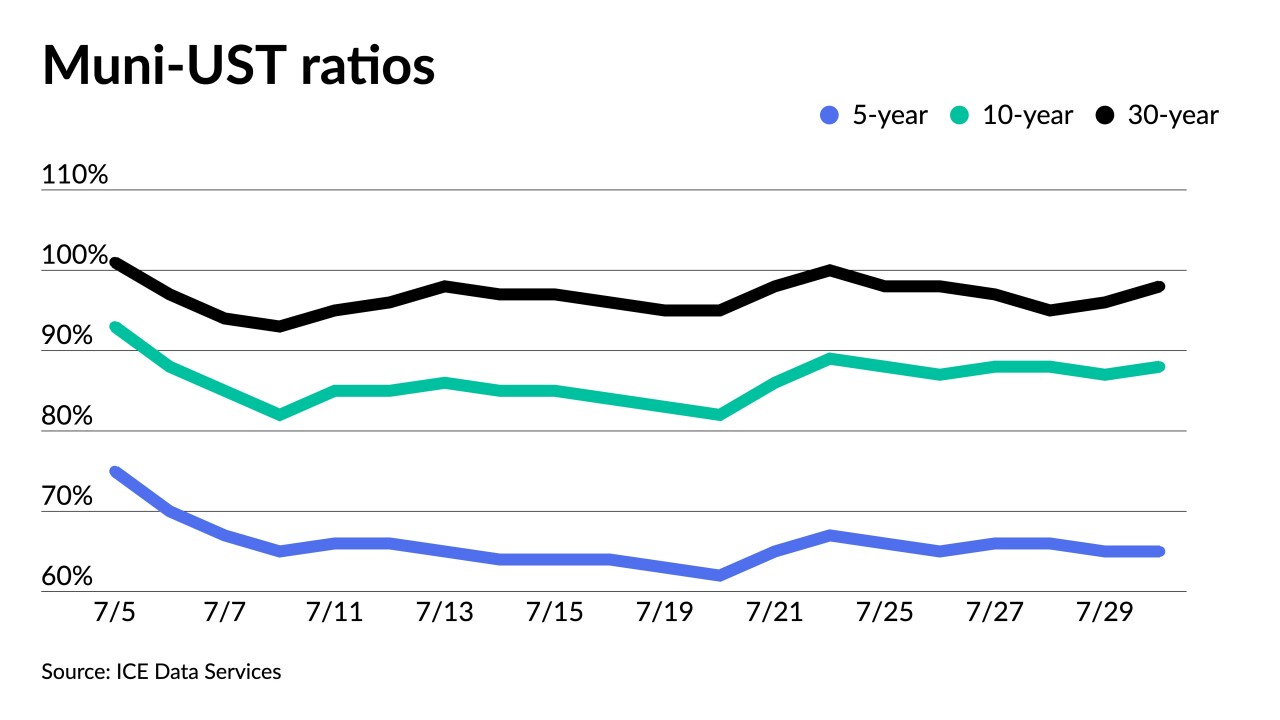

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28