Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

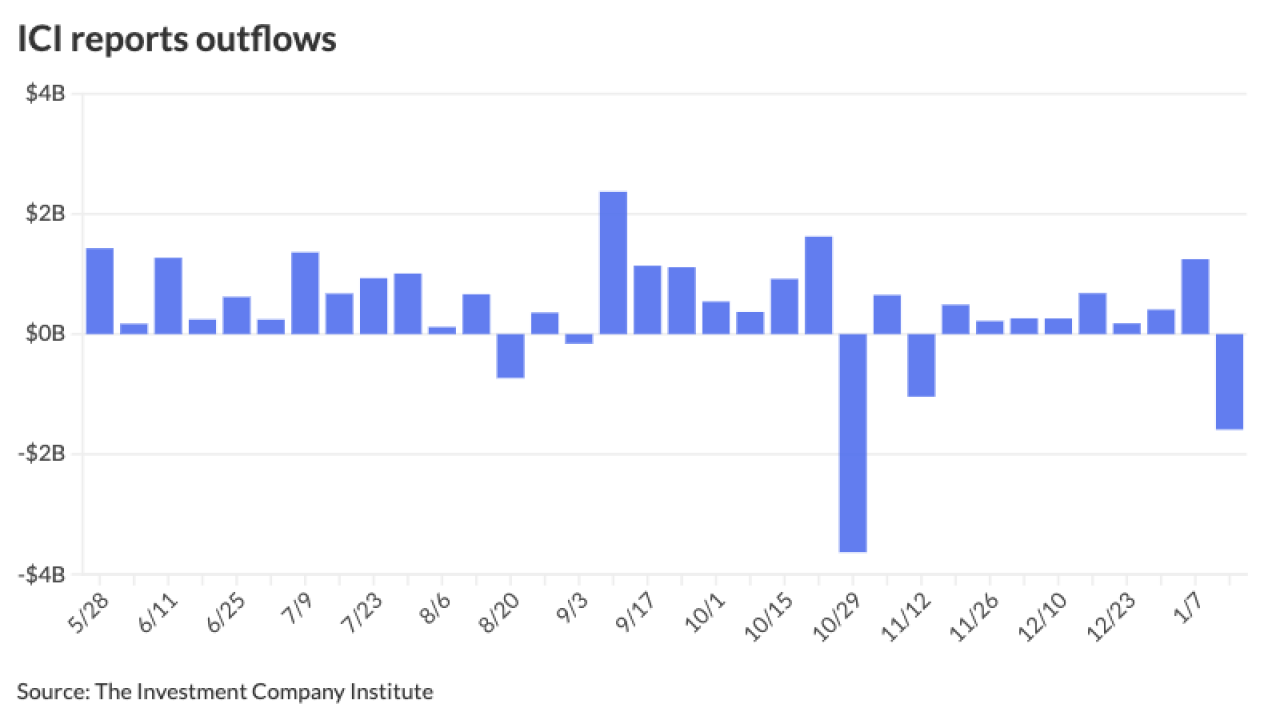

Munis were steady Monday following the large cuts the asset class saw last week, specifically on Tuesday, Jan. 20.

January 26 -

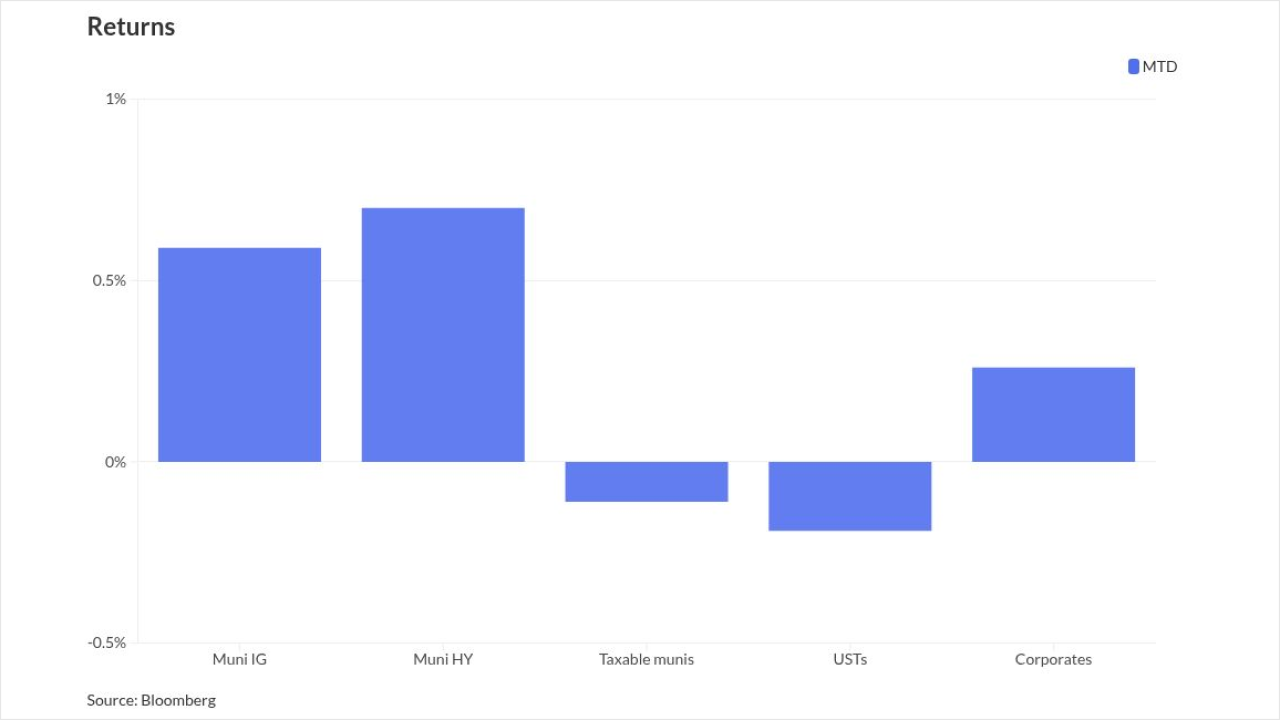

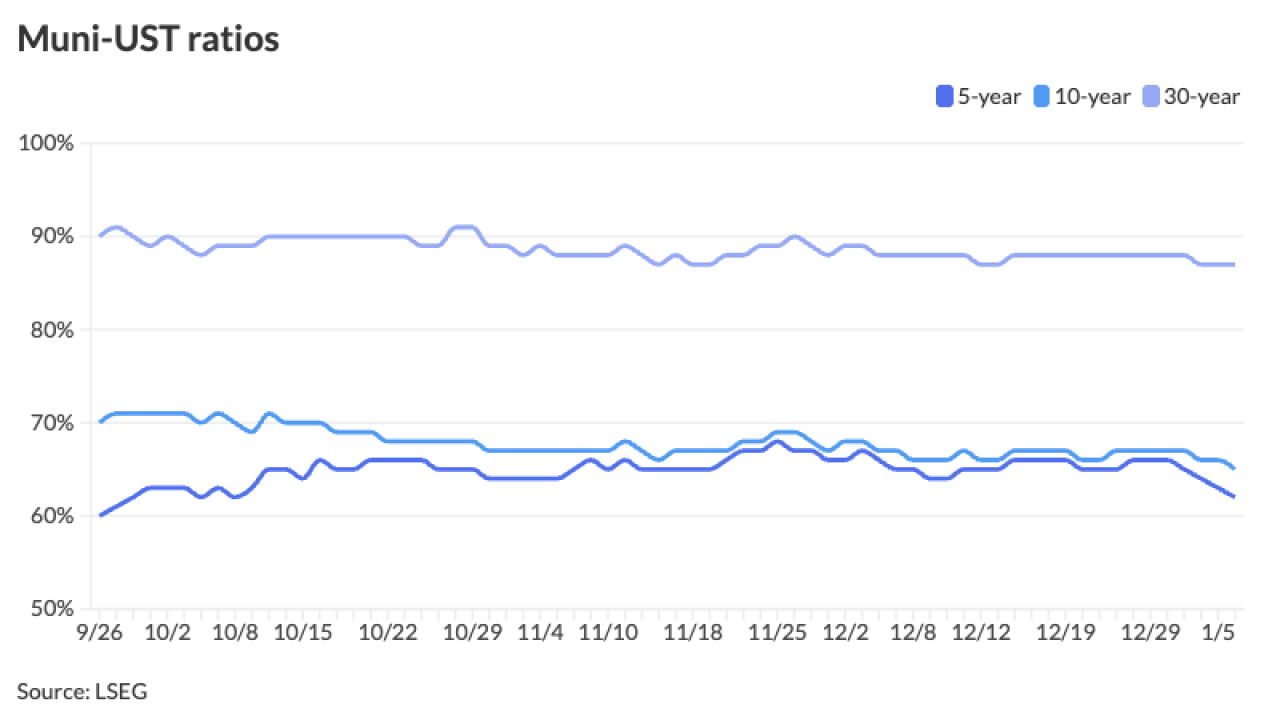

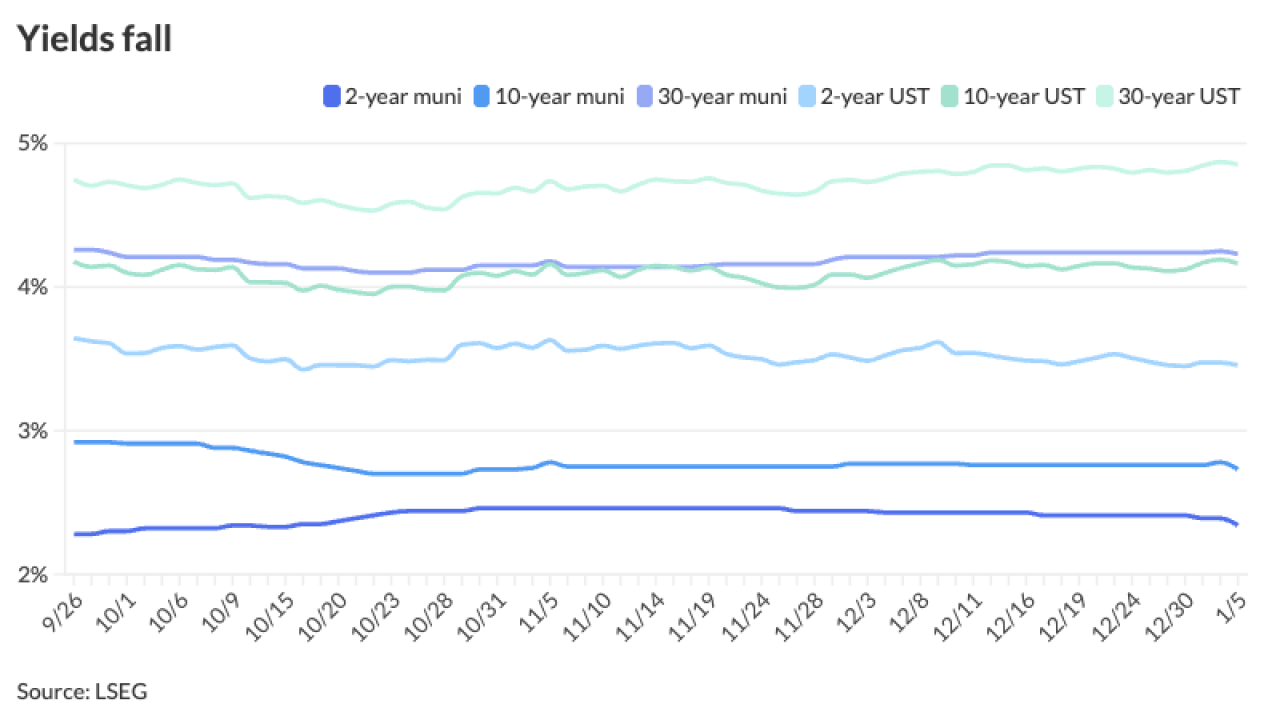

Munis were the best-performing U.S. fixed-income asset class through the first three weeks of January, but the strong performance has created some problems, Barclays strategists said.

January 23 -

"Of all these headlines, there's no direct concern for the muni market or municipal issuers. It's just tangential concerns of what this does for the economy and rates," said Brad Libby, fixed income credit analyst at Wellington Management and a fixed income portfolio manager with Hartford Funds.

January 22 -

Current events and financial developments outside of the muni sector mean that investors should hold off buying munis until rates correct, said Matt Fabian, president of Municipal Market Analytics.

January 21 -

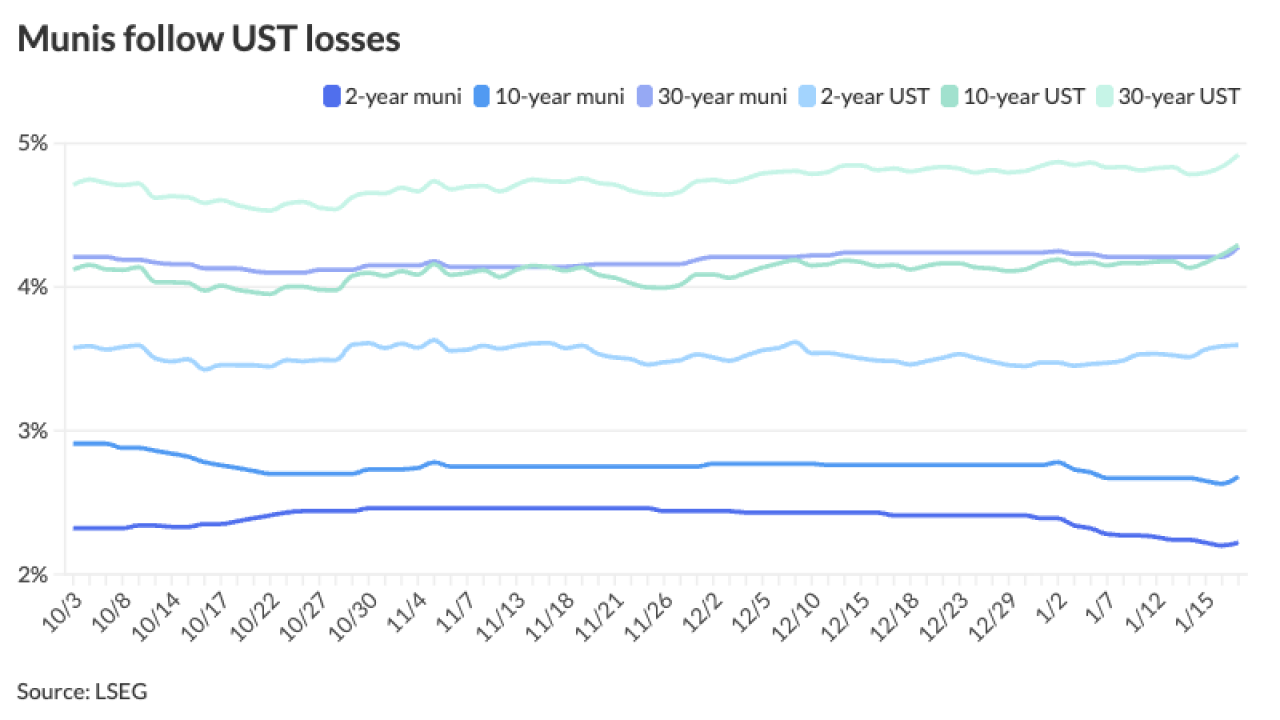

The rates market is "on edge" as global fiscal and geopolitical pressures collide, said James Pruskowski, managing director at Hennion & Walsh.

January 20 -

The new-issue calendar is an estimated $10.836 billion, with $6.979 billion of negotiated deals on tap and $3.857 billion of competitives.

January 16 -

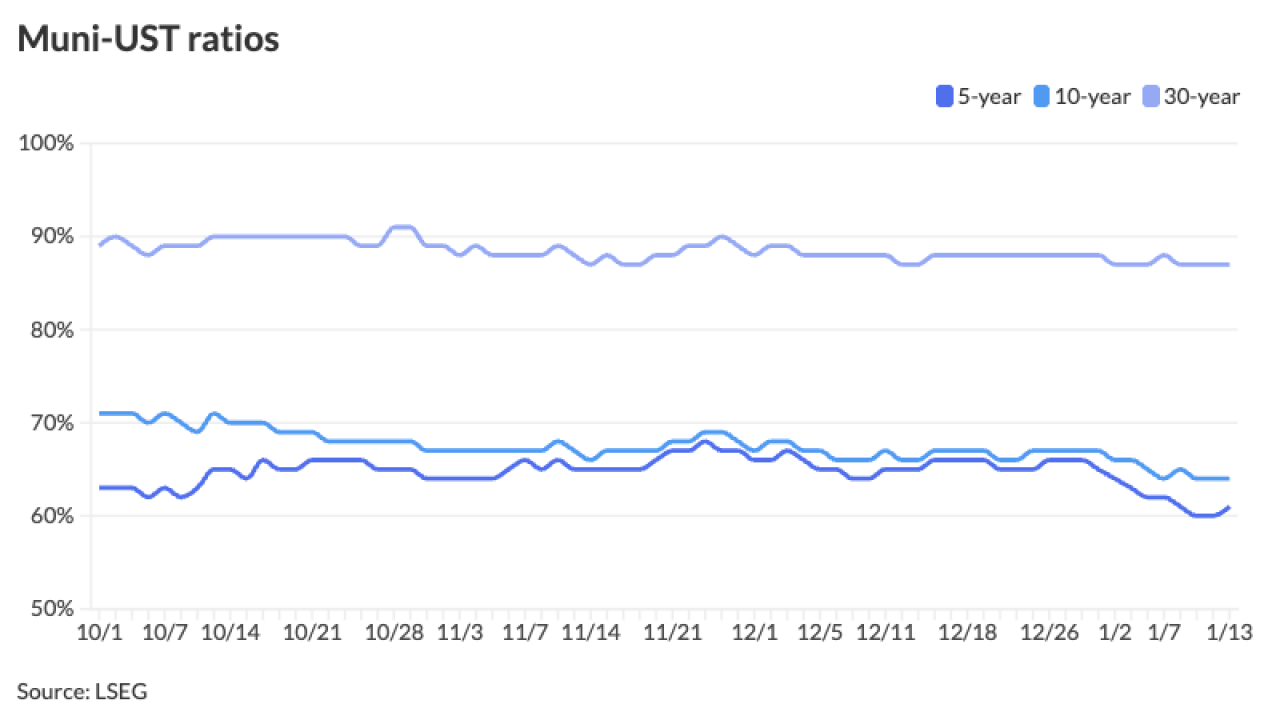

"We're starting off from a really high tax equivalent yield and that really starts the market from a position of strength," said Matt Norton, CIO for municipal bonds at AllianceBernstein.

January 15 -

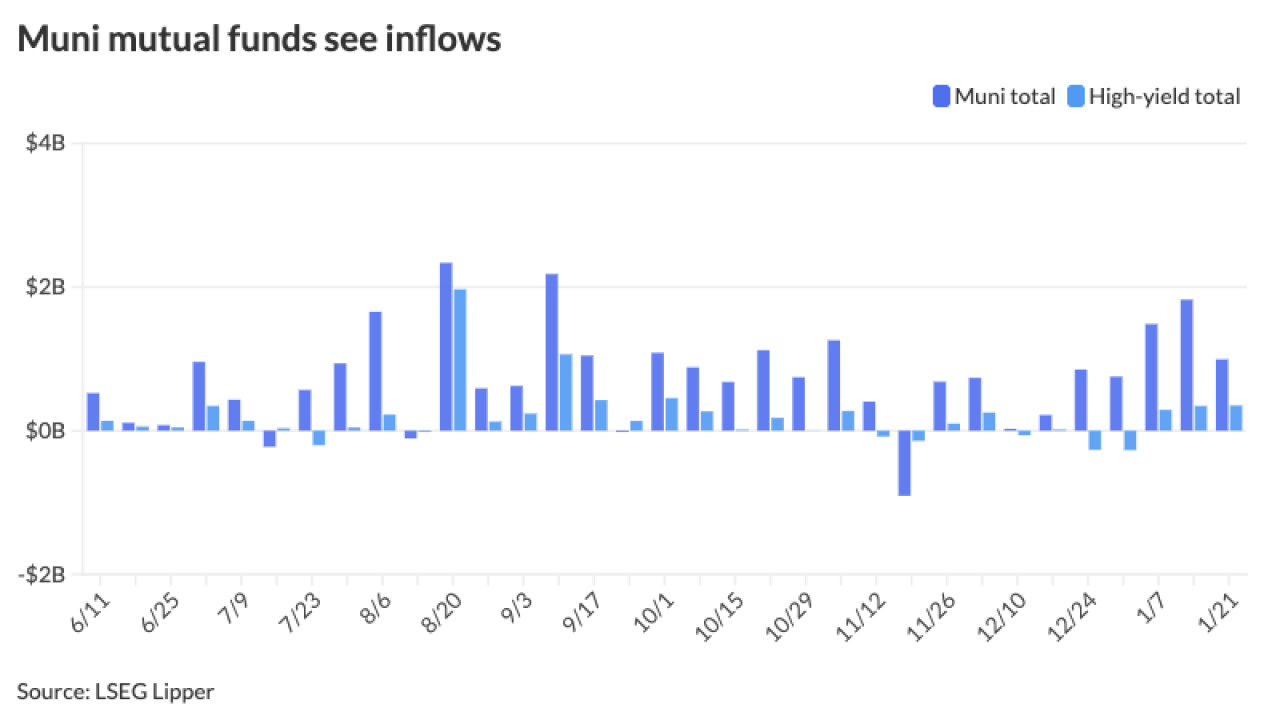

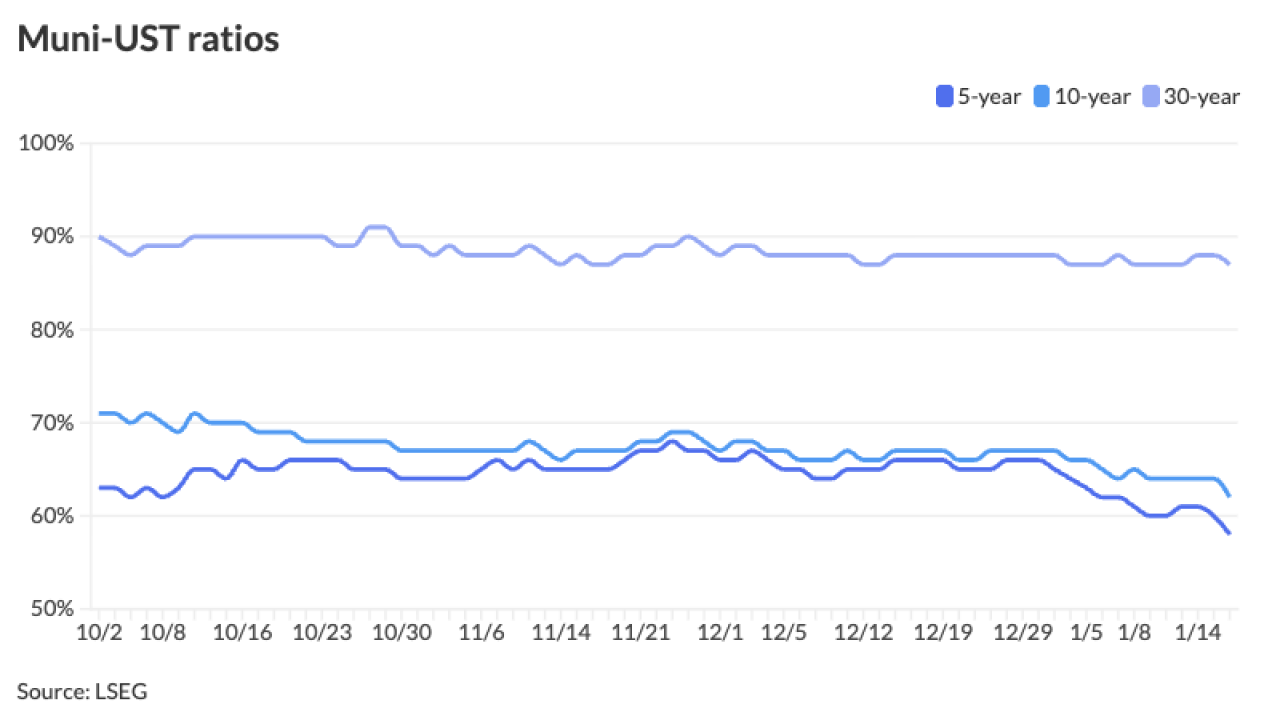

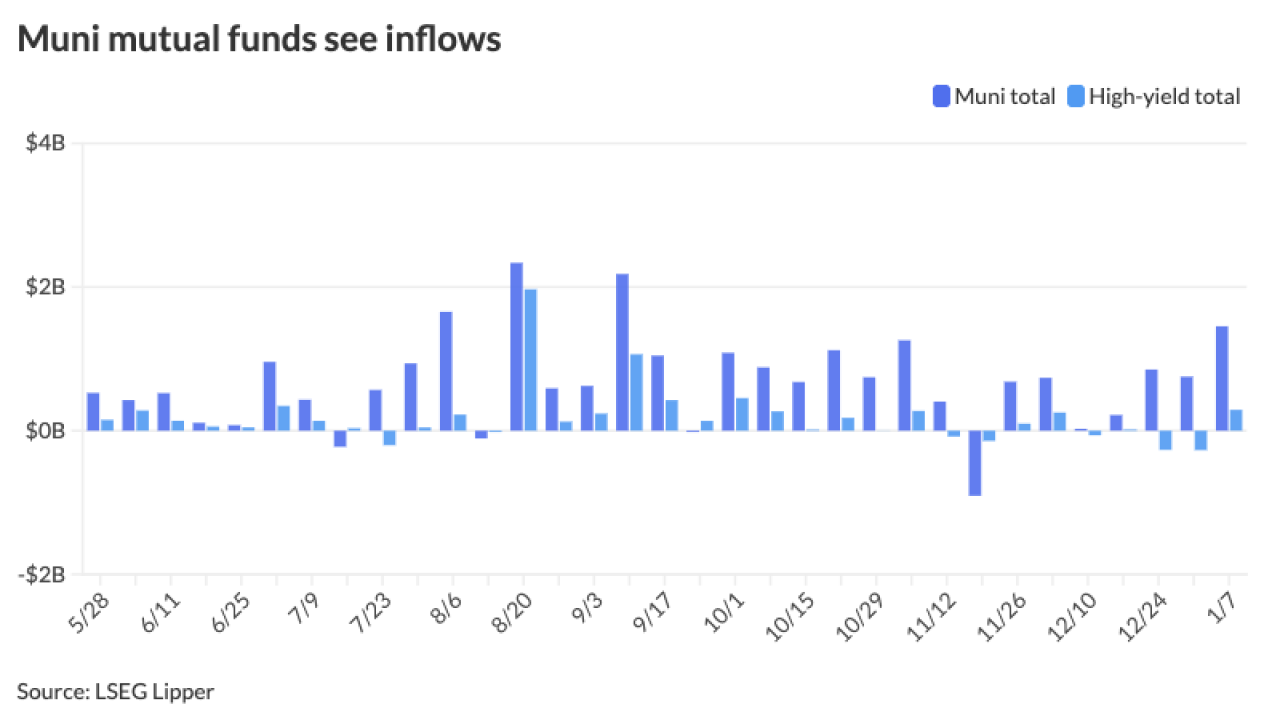

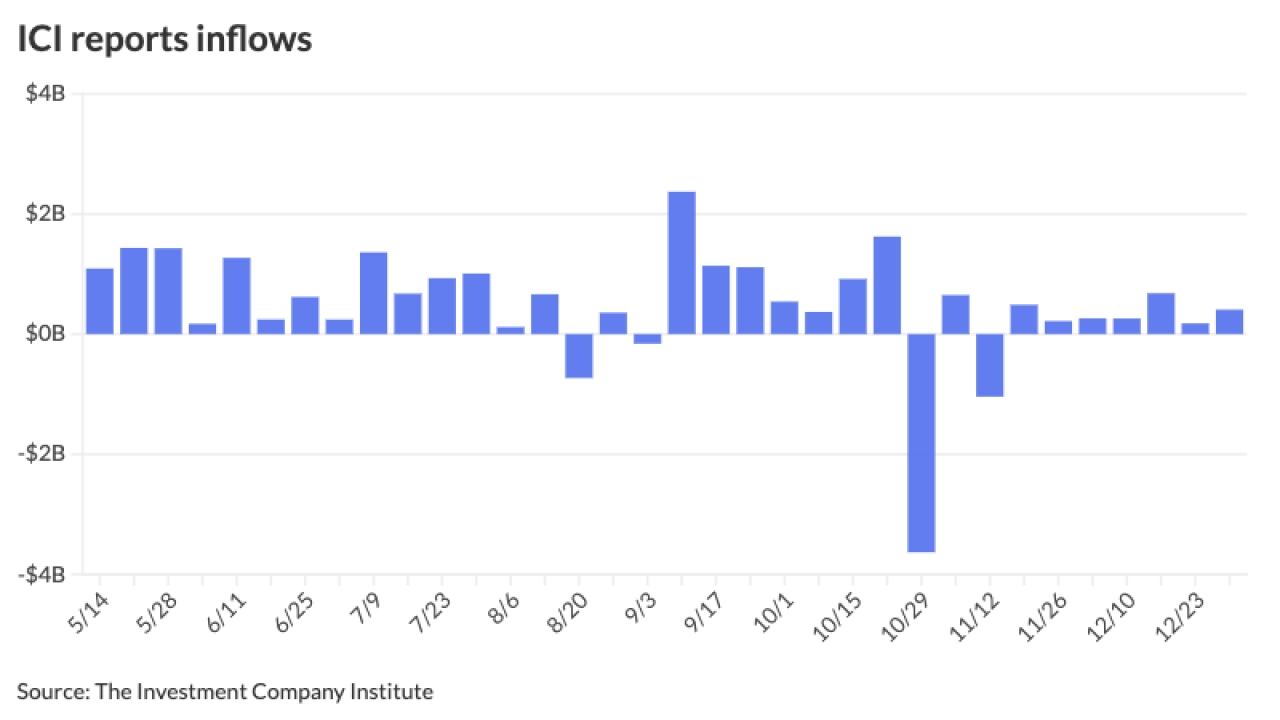

January got off to a good start, with muni yields rallying through Jan. 7. Since then, yields have been steady to slightly richer in spots, with muni yields seeing some strength in the front end and belly of the curve.

January 14 -

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

Despite the quiet start to the week for munis, all financial markets may feel a "heightened level of risk for rate volatility over the next few days," said Tim Iltz, a fixed income credit and market analyst at HJ Sims.

January 12 -

"With decent job growth in December and a downtick in the federal funds rate, the Federal Reserve will likely hold the federal funds rate steady at [its] next decision in late January," said Comerica Bank Chief Economist Bill Adams.

January 9 -

The platform uses AI to provide users with an analysis of any municipal bond issuer by centralizing all data and delivering easy-to-understand results instantly, its developer said.

January 9 -

Munis are off to a "hot start" this year, said Jeremy Holtz, a portfolio manager at Income Research + Management.

January 8 -

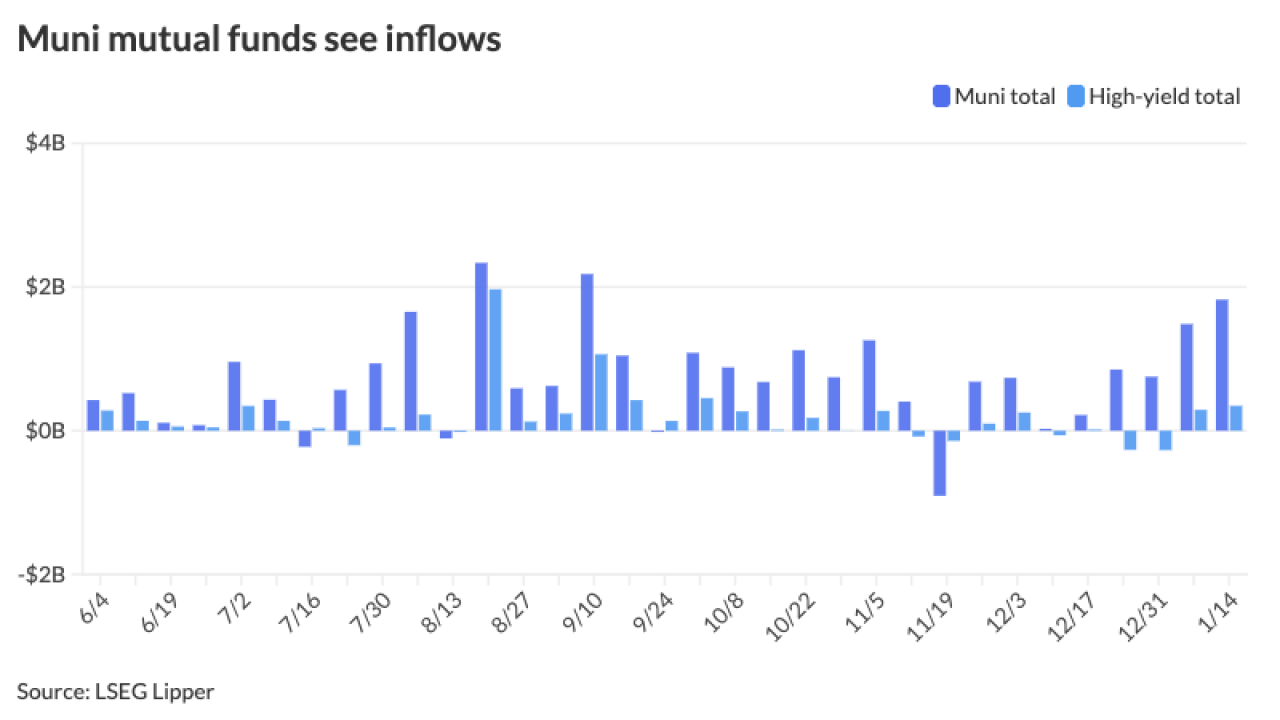

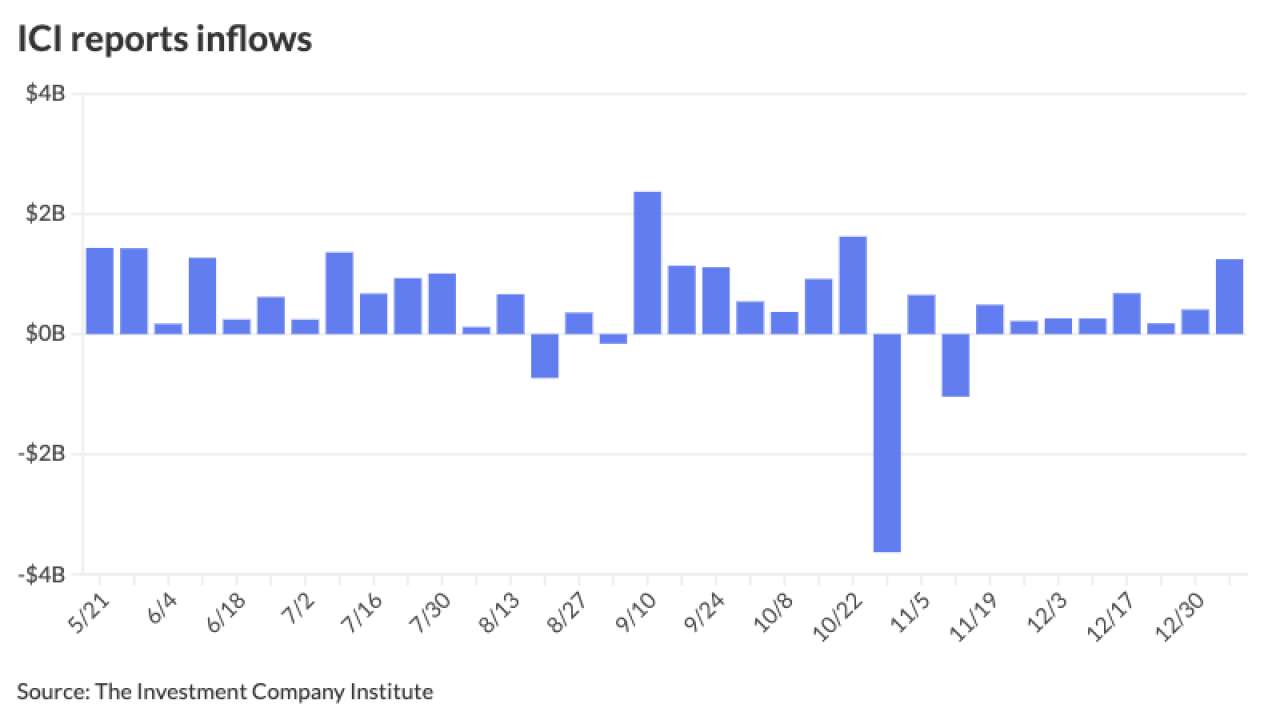

Surprisingly, the expected surge in net supply last year did not elicit a major repricing in the muni market, said Pat Luby, head of municipal strategy at CreditSights.

January 7 -

Confidence in the muni market is "well placed," said Matt Fabian, president of Municipal Market Analytics.

January 6 -

These moves come as Huntington Securities and Capstone Partners, both subsidiaries of Huntington Bancshares Inc., finished their acquisition of three business units from Janney's capital markets division.

January 6 -

Improved risk sentiment after the capture of Venezuelan President Nicolás Maduro helped pull investors into all markets and munis are a "beneficiary" of that shift, said James Pruskowski, an investor and market strategist.

January 5 -

With the muni calendar "heating up" ahead of another projected year of record issuance, Jeff Lipton, The Bond Buyer's market intelligence strategist, expects "investor demand to comfortably digest the new supply given reinvestment needs and compelling yield and income opportunities."

January 2 -

The muni market saw a record $579.936 billion of debt issued in 2025, up 12.9% from $513.652 billion in 2024, according to LSEG data.

January 2 -

The Federal Open Market Committee meeting minutes showed the decision was closer than the vote indicated, with "a few" voters suggesting they would have supported no change at the meeting.

December 30