Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Relative cheapness, wider spreads and underperformance in munis are providing better value, all set against a very solid and resilient credit background, analysts say, but supply is testing investor sentiment amid volatility.

April 26 -

The significant cheapening of municipals in recent weeks continues to create headwinds for the overall tax-exempt market on a daily basis.

April 19 -

Investors pulled more from municipal bond mutual funds last week, with Refinitiv Lipper reporting $4.106 billion of outflows, bring the total to $22.3 billion of outflows year-to-date.

April 18 -

Like last week, supply for the new-calendar issuance is light at $4.804 billion with $3.182 billion of negotiated deals and $1.622 billion of competitive loans.

April 14 -

Investors pulled more from municipal bond mutual funds as the Investment Company Institute on Wednesday reported $4.786 billion of outflows, up from $4.459 billion of outflows in the previous week.

April 13 -

The March consumer price index offered little to deter the Federal Reserve from its aggressive plans, but markets saw it as a positive, having feared an upside miss.

April 12 -

With the Federal Reserve planning aggressive rate hikes and balance sheet reduction, Dec Mullarkey, managing director of investment strategy and asset allocation at SLC Management, discusses the Federal Open Market Committee meeting minutes, his analysis of the economy and what to expect going forward. Gary Siegel hosts. (33 minutes)

By Gary SiegelApril 12 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $3.247 billion of outflows, of that $1 billion was high-yield. ETFs are still seeing inflows.

April 7 -

Investors pulled more from municipal bond mutual funds as the Investment Company Institute reported $4.5 billion of outflows in the week ending March 30.

April 6 -

Next week's supply is slated to be $10.166 billion, $8.982 billion of negotiated deals and $1.184 billion of competitive loans. A larger primary calendar is led by two billion-dollar airport deals.

April 1 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.038 billion of outflows, up from $1.503 billion of outflows in the previous week.

March 31 -

The Investment Company Institute on Wednesday reported $2.728 billion of outflows in the week ending March 23, down from $3.615 billion of outflows in the previous week.

March 30 -

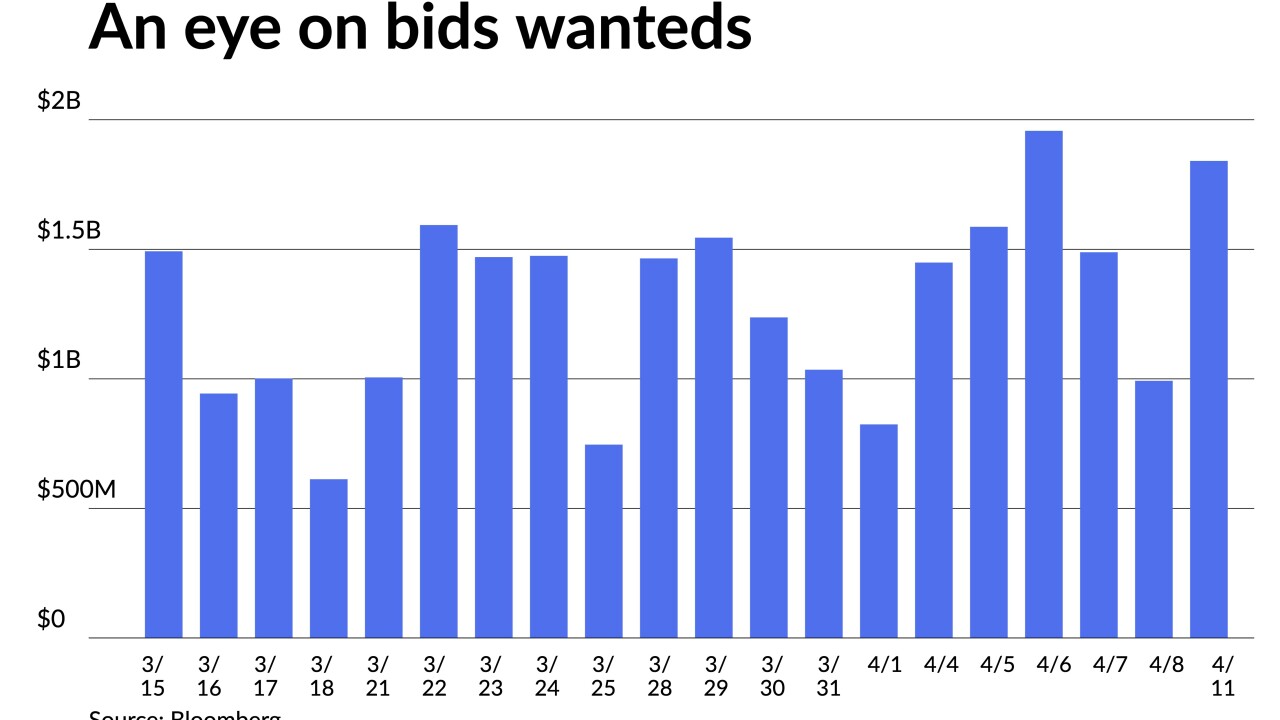

With massive secondary selling pressure and a larger calendar, credit spreads are likely to continue to widen.

March 28 -

Next week's potential volume is slated to be more than $8 billion, led by $1.25 billion of taxable and tax-exempt future tax-secured subordinate bonds from the New York City Transitional Finance Authority.

March 25 -

Outflows continued, with Refinitiv Lipper reporting investors shed $1.503 billion from municipal bond mutual funds in the week, following outflows of $2.136 billion in the previous week. High-yield saw small inflows.

March 24 -

The triple-A 10-year yield is above 2% on all scales, the highest since March 2020.

March 22 -

Muni performance has been strong as of late, and spreads have actually corrected after a month of gradual widening.

March 21 -

Next week's potential volume is slated to be $7.7 billion. The largest deal of the week comes from New York City with $891 million of tax-exempt general obligation bonds. Recent New York paper traded up Friday.

March 18 -

Outflows continued, rising significantly in the latest week, with Refinitiv Lipper reporting $2.136 billion coming out of municipal bond mutual funds, following outflows of $661.675 billion in the previous week.

March 17 -

The Investment Company Institute on Wednesday reported $2.258 billion of outflows in the week ending March 9, down from $3.502 billion of outflows in the previous week.

March 16