Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

The municipal market was marked by some skittishness among investors on Tuesday as a new month gets underway.

May 3 -

Investors will be greeted Monday with a steep drop in volume, with the new-issue calendar estimated at $4.583 billion — less than half of this week's supply.

April 29 -

Investors pulled more from municipal bond mutual funds in the latest week, with Refinitiv Lipper reporting $2.875 billion of outflows, down from $3.548 billion of outflows in the previous week.

April 28 -

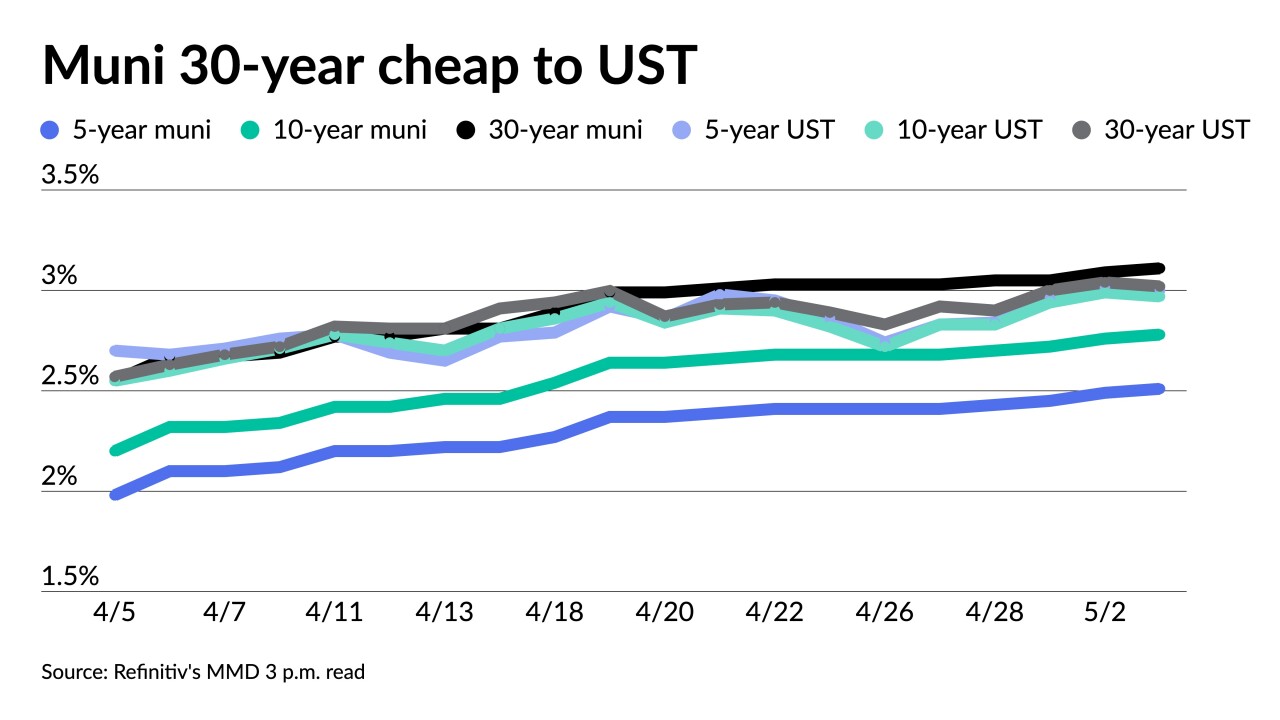

Relative cheapness, wider spreads and underperformance in munis are providing better value, all set against a very solid and resilient credit background, analysts say, but supply is testing investor sentiment amid volatility.

April 26 -

The significant cheapening of municipals in recent weeks continues to create headwinds for the overall tax-exempt market on a daily basis.

April 19 -

Investors pulled more from municipal bond mutual funds last week, with Refinitiv Lipper reporting $4.106 billion of outflows, bring the total to $22.3 billion of outflows year-to-date.

April 18 -

Like last week, supply for the new-calendar issuance is light at $4.804 billion with $3.182 billion of negotiated deals and $1.622 billion of competitive loans.

April 14 -

Investors pulled more from municipal bond mutual funds as the Investment Company Institute on Wednesday reported $4.786 billion of outflows, up from $4.459 billion of outflows in the previous week.

April 13 -

The March consumer price index offered little to deter the Federal Reserve from its aggressive plans, but markets saw it as a positive, having feared an upside miss.

April 12 -

With the Federal Reserve planning aggressive rate hikes and balance sheet reduction, Dec Mullarkey, managing director of investment strategy and asset allocation at SLC Management, discusses the Federal Open Market Committee meeting minutes, his analysis of the economy and what to expect going forward. Gary Siegel hosts. (33 minutes)

By Gary SiegelApril 12