Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Analysts homed in on the phrase “some time” and the absence of rate cut discussion in the minutes of the last Federal Open Market Committee meeting..

By Gary SiegelMay 23 -

The latest slip in inflation will likely be short-lived and interest rates could stay where they are “for some time.”

By Gary SiegelMay 22 -

Trade issues with China should end with a deal, leaving the U.S. economy mostly unscathed, the Federal Reserve Bank of Boston president said.

By Gary SiegelMay 21 -

Two Federal Reserve Bank presidents discussed how trade policy is effecting the economy; neither seemed ready to cut interest rates.

By Gary SiegelMay 20 -

During the Great Recession, interest rates hit zero lower bound, which caused the Fed to make unprecedented moves, or quantitative easing, to spur the economy.

By Gary SiegelMay 17 -

Financial markets ignored surprisingly strong data and stayed focused on tariffs and developments in talks with China.

By Gary SiegelMay 16 -

Worse-than-expected economic data released on Wednesday may signal softer growth — and greater demand for bonds.

By Gary SiegelMay 15 -

While tariffs will certainly cause an uptick in inflation, the Federal Reserve can hold rates, according to Federal Reserve Bank of New York President John Williams.

By Gary SiegelMay 14 -

While futures signaled traders' expectations, analysts said conditions aren't ripe for the Federal Reserve to ease credit.

By Gary SiegelMay 13 -

Atlanta Fed President Rafael Bostic said he would do "whatever it takes" should tariffs cause consumers to cut back spending.

By Gary SiegelMay 10 -

The April producer price index grew less than expected, suggesting inflationary pressure will remain weak.

By Gary SiegelMay 9 -

The debate over the success of quantitative easing continues, even as the threat of recession slips.

By Gary SiegelMay 8 -

President Trump’s tariff threats may trigger a flight to quality to the benefit of the municipal bond market.

By Gary SiegelMay 7 -

Change is always difficult, and the Federal Reserve’s attempt to find a better monetary policy framework is no exception.

By Gary SiegelMay 6 -

The April employment report topped estimates for jobs created, while the jobless rate fell to a 49-year low; wage increases missed projections.

By Gary SiegelMay 3 -

Federal Chair Jerome Powell doused market hopes for a rate cut, but it was not the result of a shift in Fed policy.

By Gary SiegelMay 2 -

The Fed Chair said the FOMC is “comfortable with our current policy stance,” which he termed “appropriate.”

By Gary SiegelMay 1 -

The last day of the month brings a host of economic indicators, which showed much good news for housing and labor, strong consumer confidence, but mostly softer manufacturing conditions.

By Gary SiegelApril 30 -

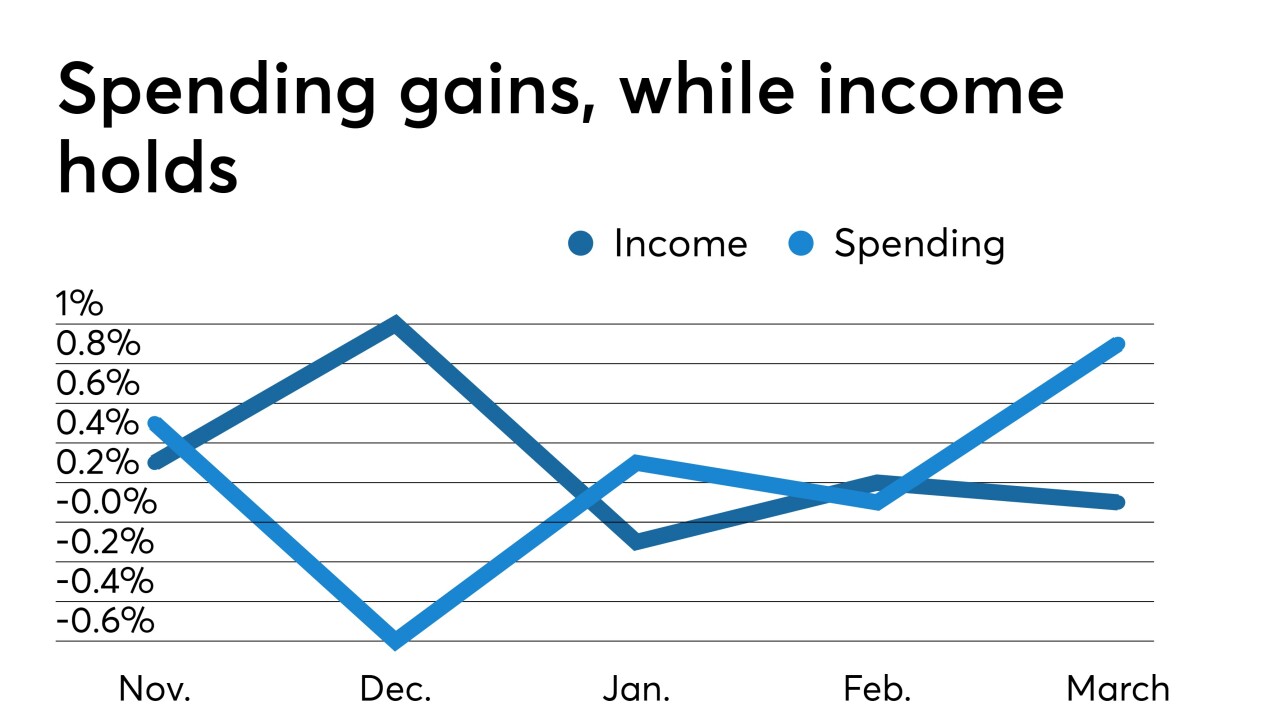

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

By Gary SiegelApril 29 -

Andrew Dassori, CIO of Wavelength Capital Management, discusses why it’s getting harder to predict the economy; yield curve inversion; mixed economic signals and headwinds; and how new ideas from the upcoming conference on monetary policy could help transform the Fed. Gary Siegel hosts.

By Gary SiegelApril 25