Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

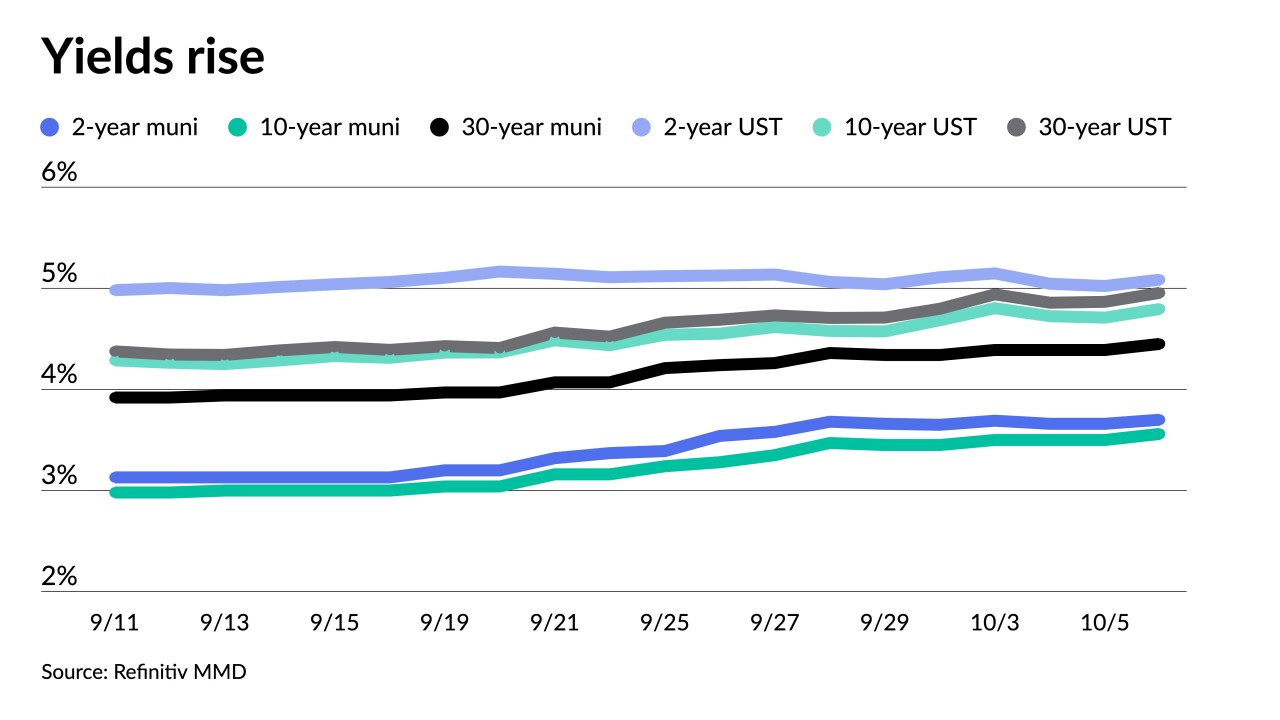

"Despite the breathtaking selloff in longer rates, Barclays' macro strategists see no clear catalyst to stem the bleeding," Barclays strategists said. "Data are unlikely to weaken quickly or enough to help bonds."

By Lynne FunkOctober 6 -

With the Federal Open Market Committee expected to skip an interest rate hike, all eyes turn to the Summary of Economic Projections and Chair Powell's remarks.

By Gary SiegelSeptember 18 -

"Part of the mission of the New York Fed is making the U.S. economy stronger and the financial system more stable for all segments of society," Timothy Little said, "and I really feel the municipal market is a critical component of that."

By Gary SiegelSeptember 13 -

Another day of mixed inflation data led Treasury yields to rise but munis mostly stayed put after underperforming a UST rally earlier in the week. The market is also focused on the $9 billion of redemption flows coming on Tuesday.

By Lynne FunkAugust 11 -

Refinitiv Lipper reported $278.559 million of inflows into municipal bond mutual funds for the week ending Wednesday, led by exchange-traded funds.

By Lynne FunkAugust 10 -

After July's hike, analysts are mixed on whether the Federal Open Market Committee is done raising rates.

By Gary SiegelAugust 1 -

Analysts look at whether the FOMC will bring the last rate hike in the cycle, whether recession is coming, and whether the Fed is making a policy mistake.

By Gary SiegelJuly 24 -

Much uncertainty remains as the second half of the year begins, with Federal Reserve rates, recession and inflation all still to be decided.

By Gary SiegelJuly 5 -

Analysts agree with the market that the Federal Open Market Committee will hold rates in a range of 5% to 5.25%, but guidance will suggest a future hike.

By Gary SiegelJune 13 -

The CPI numbers coming in pretty much as expected "was a relief" to the markets, with the bond market rallying after the release, said Luke Bartholomew, senior economist at abrdn.

May 10