Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

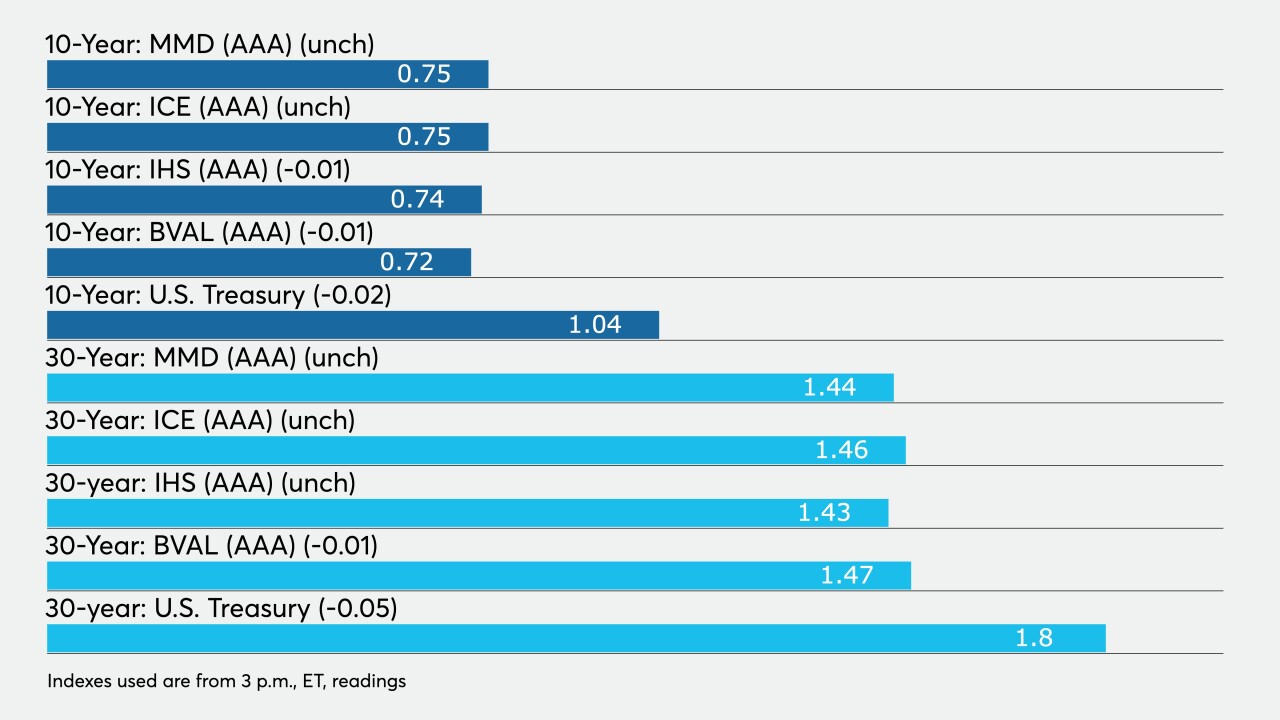

New issues priced with ease with high-grade issuers tight to triple-A benchmarks. It was the first time the municipal yield curve saw such noticeable movement, following little changed secondary activity for nearly the past two weeks.

January 26 -

Returns of all the investment grade options "pale in comparison to those for municipal high-yield," which should bolster Texas gas and Chicago public schools deals.

By Lynne FunkJanuary 25 -

Refinitiv Lipper reports another multi-billion week of inflows, the domino effect from such strong flows is that secondary selling doesn’t need to be so active, creating fewer opportunities for new inquiry, analysts say.

By Lynne FunkJanuary 21 -

Tax-exempt performance is dependent on what supply looks like versus taxables. The 30-day visible supply shows more than 30% taxables on tap, though some analysts say the taxable increase makes exempts more attractive.

January 19 -

Friday’s data showed economic weakness. Consumers, the drivers of the economy, pulled back during the holiday season and have exhibited weakening sentiment.

January 15 -

Powell, speaking on a livestreamed event, said interest rates will be raised "no time soon" and there will be plenty of notice "well in advance of active consideration."

By Lynne FunkJanuary 14 -

KC Mathews, executive vice president & chief investment officer at UMB Bank, discusses how the coronavirus pandemic has affected the economy and what he expects going forward. He speaks about what the incoming Biden administration and the Democrats' control of Congress will mean for the economy; and the Federal Reserve's stance and role in recovery. Gary Siegel hosts. (Recorded Jan. 7; 28 minutes)

By Gary SiegelJanuary 14 -

Municipal bonds continue to ignore UST and ICI reports $2.67 billion of inflows. While CPI should stay soft through the first quarter, expectations for future inflation should be considered.

January 13 -

The employment report showed 140,000 decline in nonfarm payrolls in December, but economists found some positives in the numbers.

By Lynne FunkJanuary 8 -

It was inevitable that muni yields would need to rise somewhat as the UST 10-year broke above 1%, however participants said the supply/demand imbalance will keep munis from rising as quickly as Treasuries. More than $1 billion inflows reported.

By Lynne FunkJanuary 7 -

FOMC members backed maintaining asset purchases, although “a couple” were “open” to “weighting purchases of Treasury securities toward longer maturities,” according to minutes released Wednesday.

By Lynne FunkJanuary 6 -

Without the benefit of a larger new-issue calendar, secondary trading is likely to continue the theme of the final two months of 2020: more bidders than bonds.

By Lynne FunkJanuary 5 -

Federal Reserve Bank of Chicago President Charles Evans says monetary policy will need to remain “accommodative for quite a while,” since inflation won’t hit a 2% average for “a long time.”

By Chip BarnettJanuary 4 -

The Federal Reserve's Summary of Economic Projections forecasts inflation won't hit its 2% target next year, and others agree.

By Gary SiegelDecember 18 -

The Federal Open Market Committee announcement commits it to buying at least $120 billion of securities a month until “substantial further progress” is made on its dual mandate of stable prices and maximum employment, suggesting it will continue well into 2022.

By Gary SiegelDecember 16 -

The rising number of COVID-19 cases and the restrictions imposed to stop its spread, led to a pullback in consumer spending and has a regional service sector reeling.

By Gary SiegelDecember 16 -

The deal helped pave the way for the reopening of the capital markets for not-for-profit health systems amid the then-insurgent COVID-19 pandemic.

By Gary SiegelDecember 11 -

The 245,000 increase in nonfarm payrolls indicated a slowing, and with lockdowns rising, December's numbers could fall again.

By Gary SiegelDecember 4 -

Christopher Waller was confirmed to a seat on the Federal Reserve Board on Thursday by a 48-47 vote along party lines.

By Gary SiegelDecember 3 -

The consumer confidence index suggested expectations have slipped, and the Richmond Fed's services survey also offered a dim view ahead.

By Gary SiegelNovember 24