Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

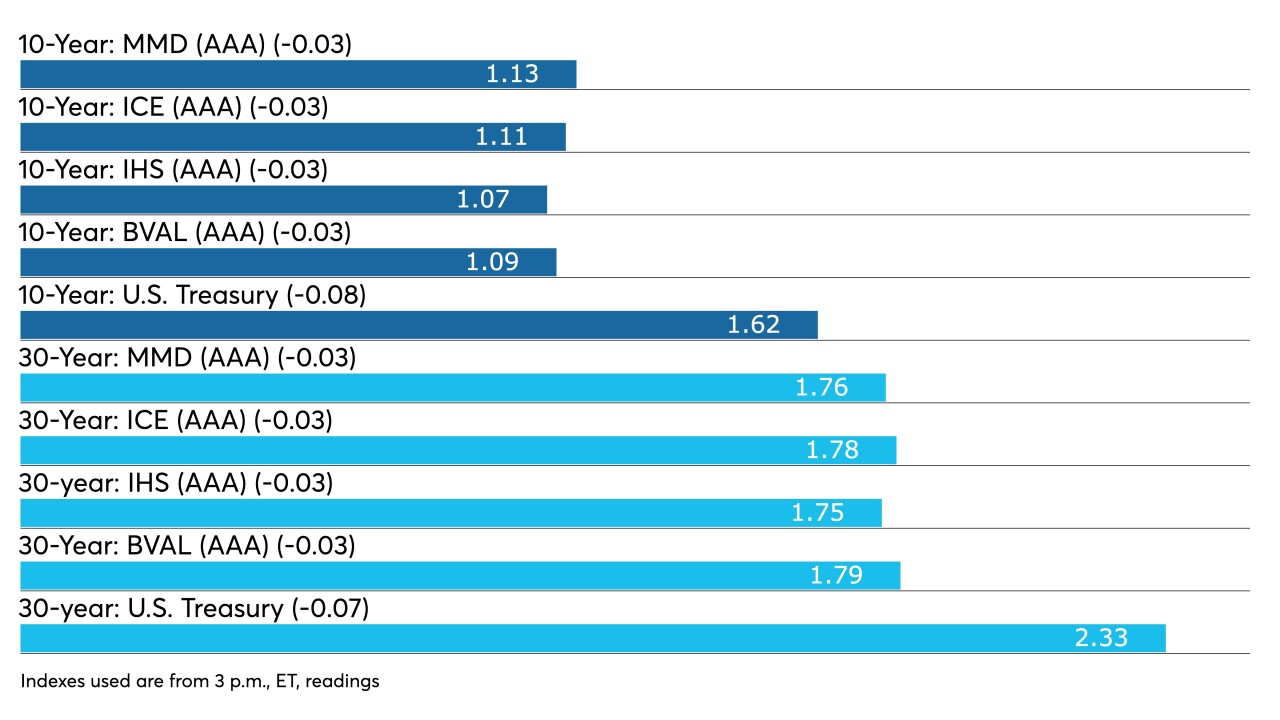

The municipal market largely ignored the FOMC news that it would hold rates steady. New Jersey was 20 times oversubscribed and ICI reported $2.5 billion of inflows into long-term municipal bond mutual funds.

April 28 -

Sub-1% 10-year municipals and low ratios may test investor appetite for the asset class but it is hard to ignore the strong fundamentals and substantial fund flows in the backdrop.

By Lynne FunkApril 16 -

Jack Janasiewicz, senior vice president, portfolio manager and portfolio strategist at Natixis Investment Managers Solutions, discusses inflation and why there is disagreement on whether it will become an issue this year. He talks about how stimulus money and the employment situation factor in. Gary Siegel hosts. (Taped March 9 / 30 minutes).

By Gary SiegelApril 6 -

The services sector showed improvement and employment made big gains in March, but economists note the labor market remains far from full employment.

By Gary SiegelApril 5 -

Veneta Dimitrova, senior U.S. economist at Ned Davis Research, says the COVID pandemic showed us the government has more fiscal space than thought. She also discusses inflation, housing, the manufacturing sector, global supply chain challenges and the Fed’s balance sheet. Hosted by Gary Siegel. Taped Feb. 24. (32 minutes)

By Gary SiegelMarch 25 -

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

By Lynne FunkMarch 23 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

By Lynne FunkMarch 18 -

Inflows return, stimulus set, new deals on fire — the municipal market reaped all the benefits. Initial jobless claims dropped more than expected in the week, as reopening continued slowly, but the total remains higher than any week before the COVID crisis hit.

By Lynne FunkMarch 11 -

Hank Smith, head of Investment Strategy at Haverford Trust, discusses the upcoming Federal Open Market Committee meeting, the coronavirus pandemic, inflation, and economic growth. He says, “at some point the Fed will have to acknowledge the economy may really take off.” Gary Siegel hosts. (Taped March 2. 26 minutes)

By Gary SiegelMarch 11 -

The Investment Company Institute reported outflows from municipal bond mutual funds but inflows into exchange-traded funds. The February consumer price index came in as expected, while the core was below expectations, and analysts expect bigger rises ahead.

March 10