Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

By Lynne FunkNovember 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

By Lynne FunkNovember 22 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

By Lynne FunkNovember 16 -

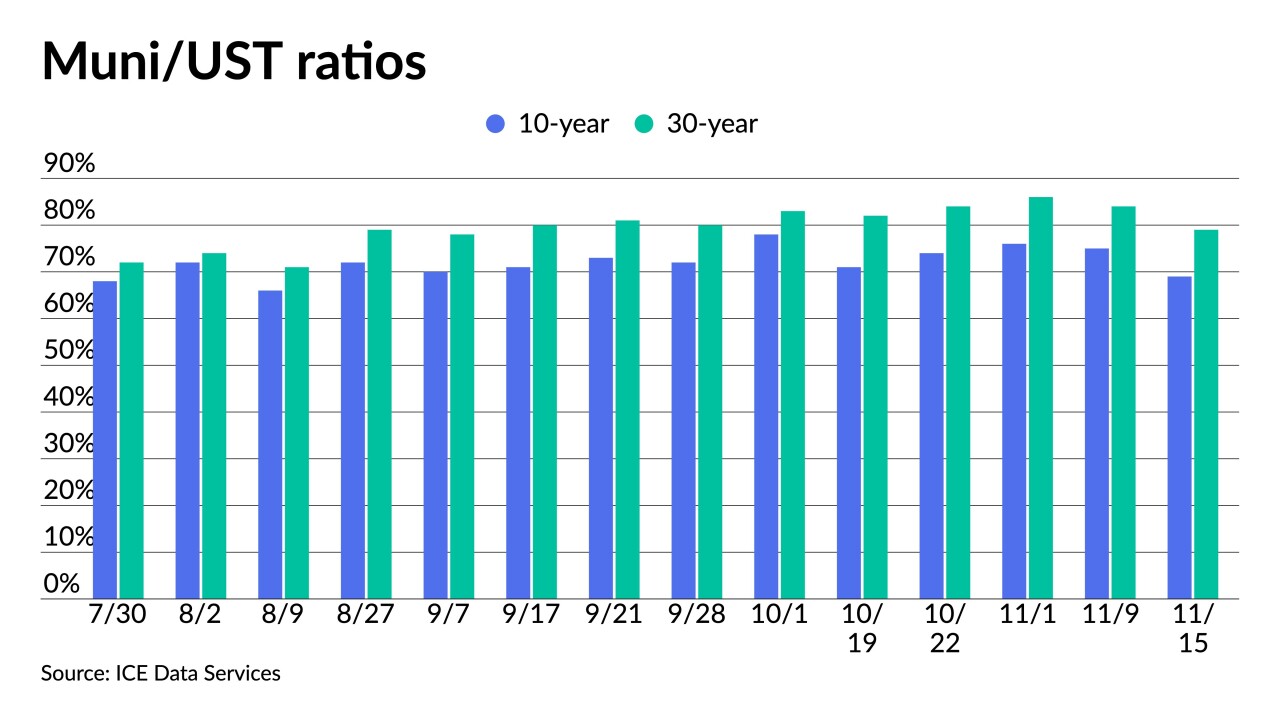

Outside influence "beyond the control of the muni bond market" is needed to derail the recent positive momentum.

By Lynne FunkNovember 15 -

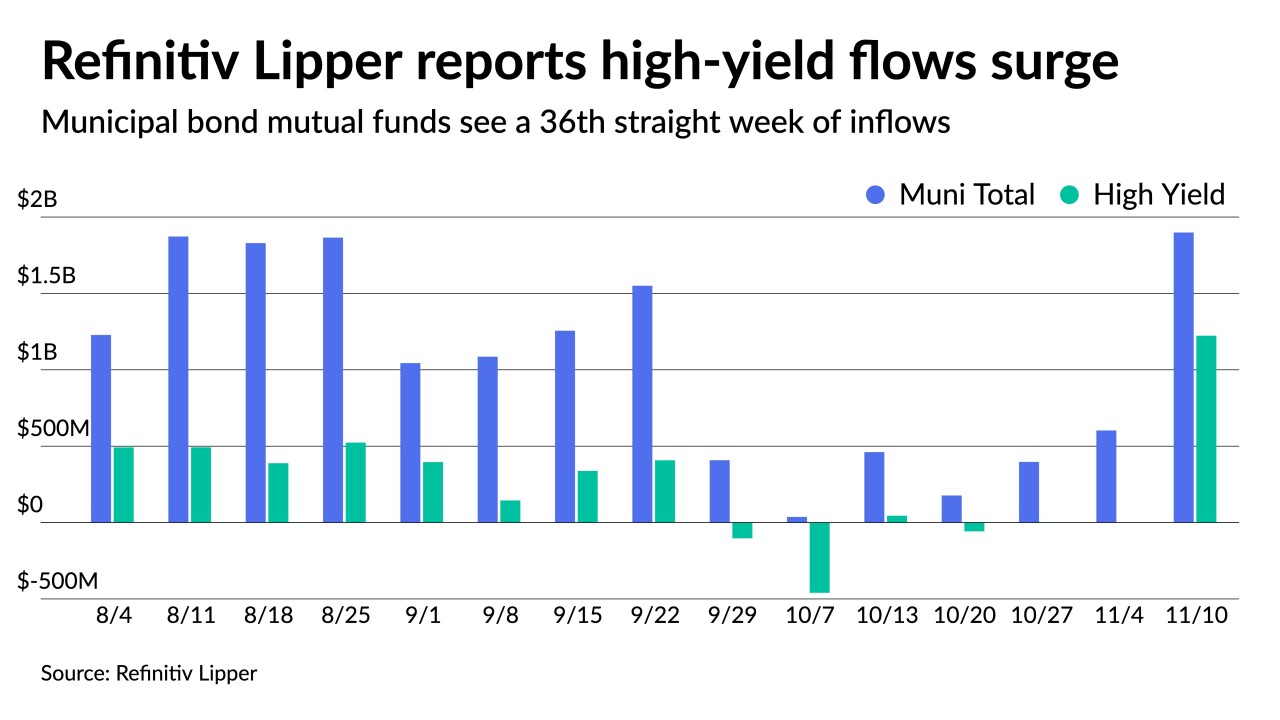

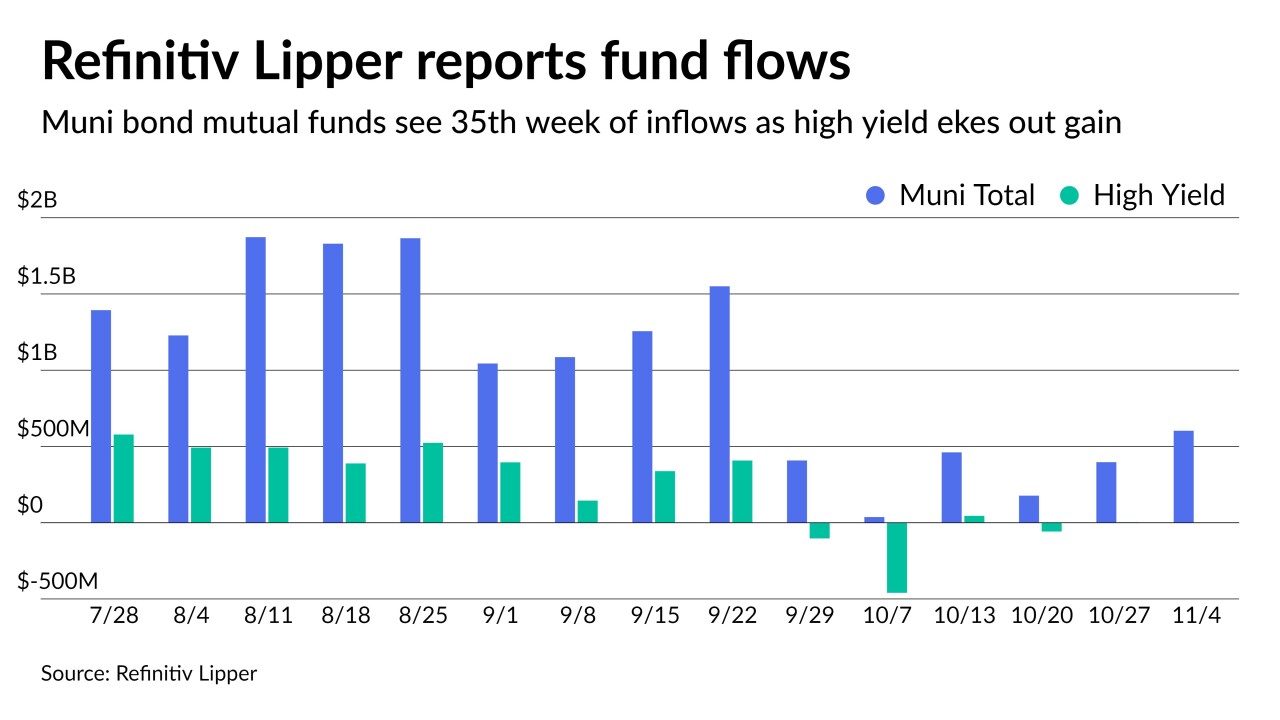

Investors put nearly $2 billion into municipal bond mutual funds for the most recent week with high-yield reversing a downward course to hit $1.2 billion following just $1 million a week prior.

By Lynne FunkNovember 12 -

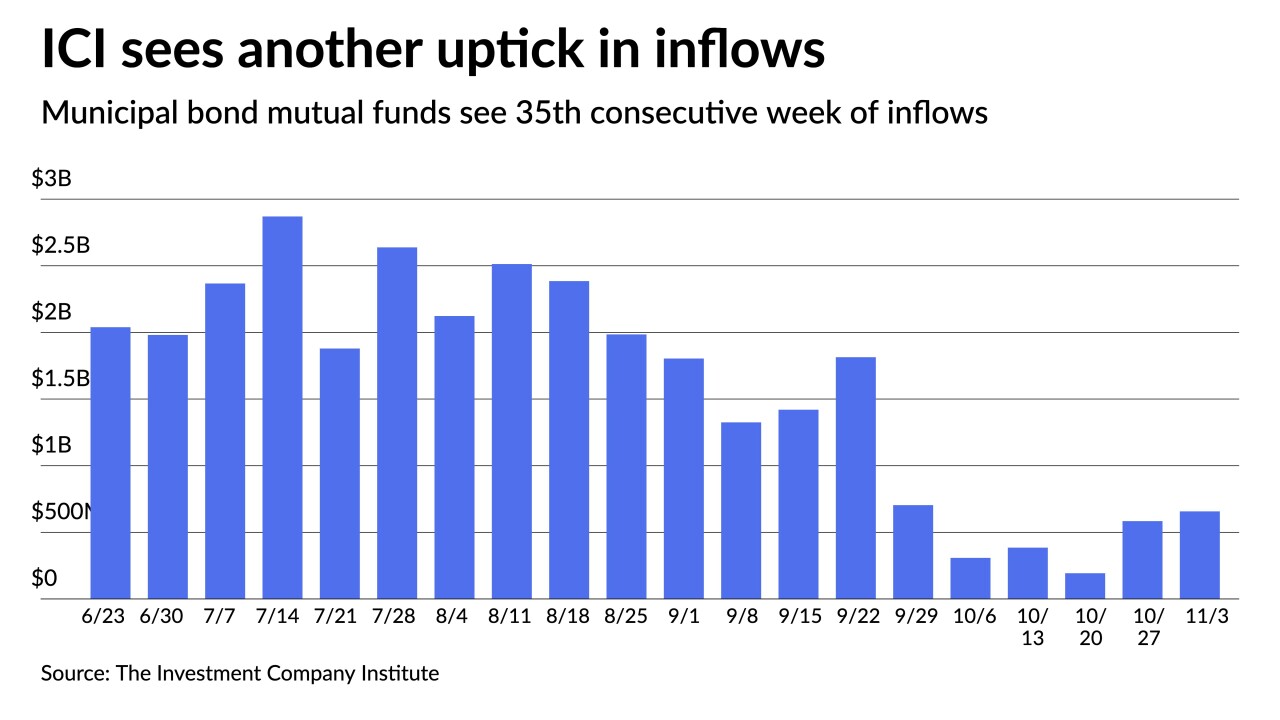

The Investment Company Institute reported $657 million of inflows into municipal bond mutual funds while ETFs saw $828 million of inflows, a massive increase over the $43 million reported a week prior.

By Lynne FunkNovember 10 -

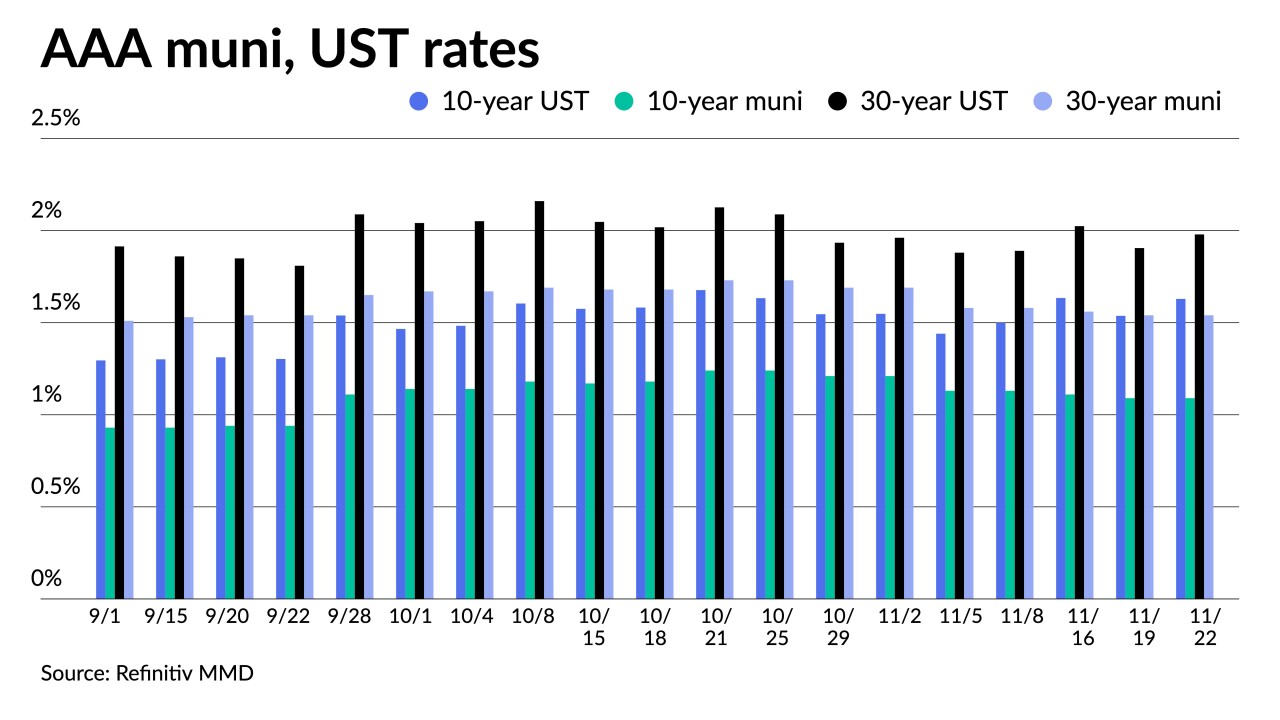

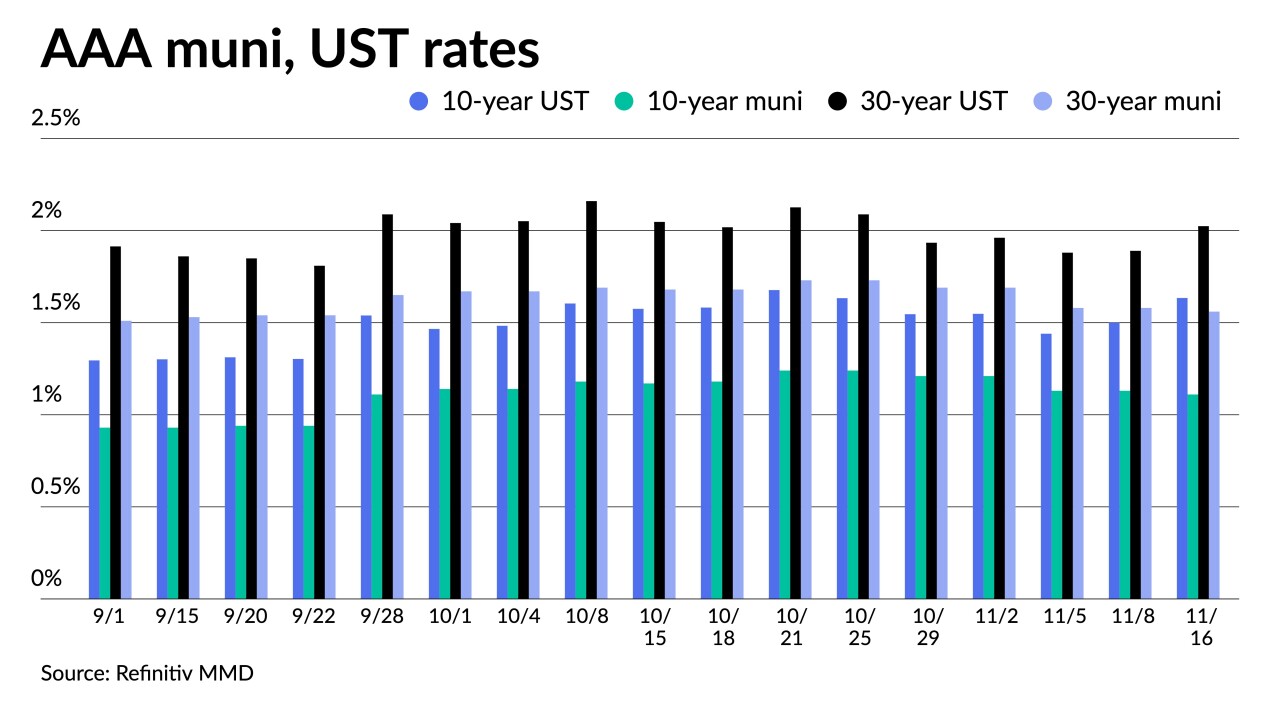

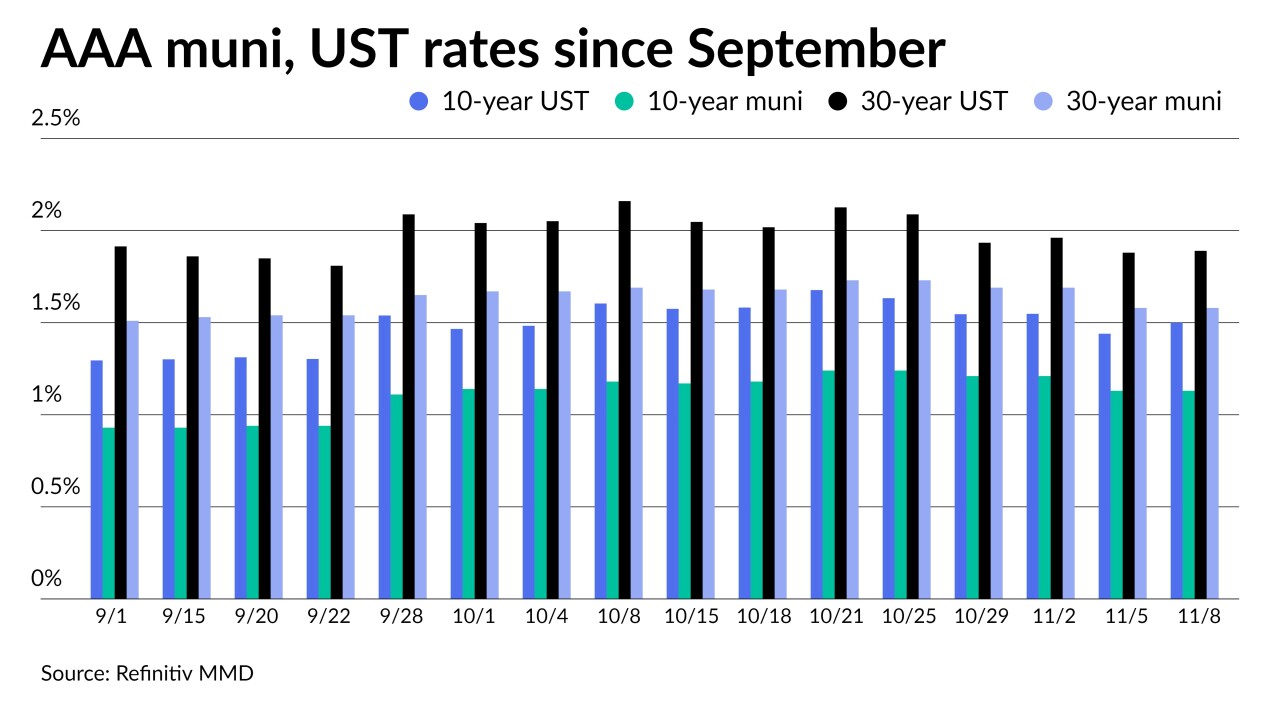

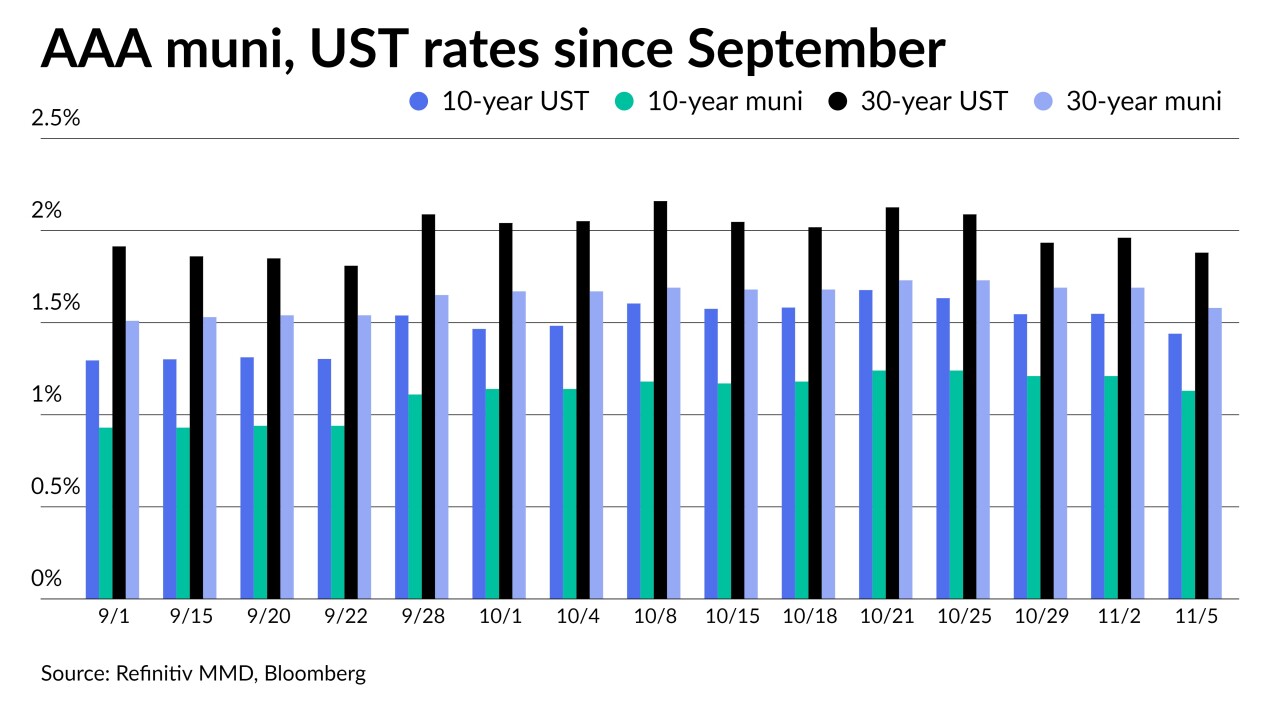

Triple-A benchmarks have fallen double digits since Nov. 1, with the largest moves out long. California, the District of Columbia, Wisconsin and other issuers part of a $6 billion new-issue calendar priced.

By Lynne FunkNovember 9 -

Municipals were quiet on Monday following Friday's rally and ahead of the $9.6 billion estimated to be priced early in the week before the Veterans Day holiday close Thursday. Connecticut priced for retail.

November 8 -

The long end of the municipal curve rallied under a backdrop of stronger-than-expected October jobs data and upward revesions to the prior two months ahead of the arrival of $9.6 billion next week.

November 5 -

For 35 weeks in a row, investors have put cash into municipal bond funds as Refinitiv Lipper reported $603 million of inflows while high-yield funds eked out a gain of slightly more than $1 million.

By Lynne FunkNovember 4