Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

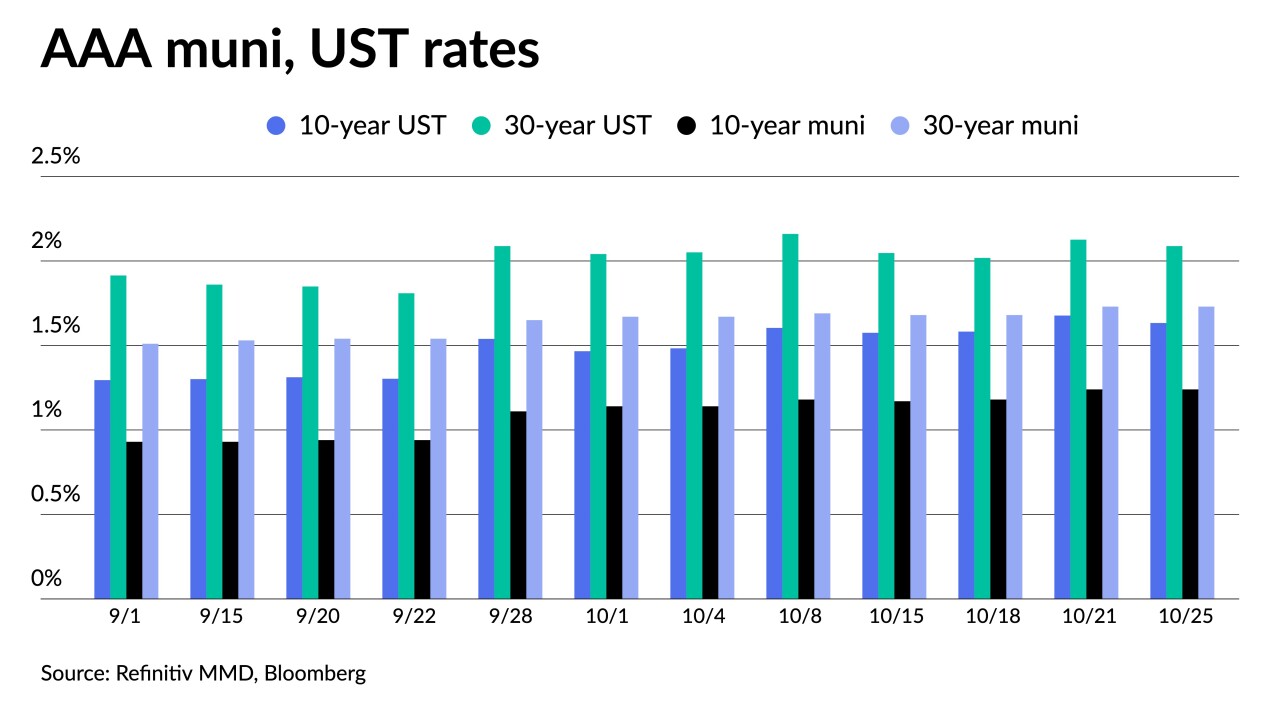

After the FOMC made taper official, high-grade benchmark yields ended the day one to three basis points better while USTs ended the day higher after an up-and-down trading session that moved the 30-year back above 2%.

By Lynne FunkNovember 3 -

Most bond issues appear to be approved, but many were rejected.

By Gary SiegelNovember 3 -

The FOMC will likely take the opportunity to profess its reliance on data to decide liftoff and reiterate the threshold for a rate hike remains higher than for taper.

By Lynne FunkNovember 2 -

Though monetary policy has been in the forefront, at mid-month the tone changed with global inflation outlooks and federal infrastructure and social package in flux.

By Lynne FunkNovember 1 -

A lighter, $5 billion calendar, heavy on healthcare, kicks off November. Most participants agree volatility in U.S. Treasuries will be a leading factor for municipal market performance. Uncertainty in Washington also isn't helping the asset class.

By Lynne FunkOctober 29 -

Amid a flattening municipal yield curve and inversion of the Treasury market, new issues fared better than the secondary on Thursday as participants prepared for month end.

October 28 -

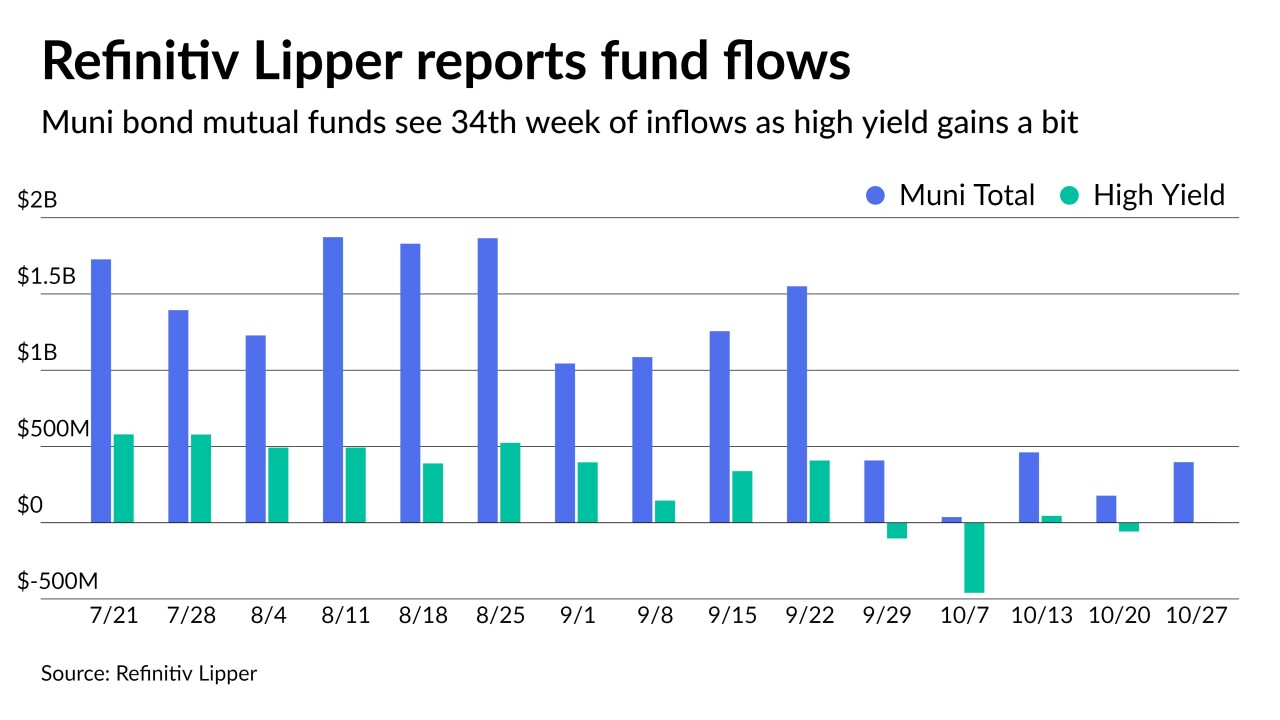

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

By Lynne FunkOctober 27 -

As of now, returns for the month will very likely end in the red. The Bloomberg U.S. Municipal Index is at -0.40% for the month and +0.39% for the year.

By Lynne FunkOctober 26 -

Jeffrey Cleveland, chief economist at Payden & Rygel, discusses the Federal Reserve’s upcoming meeting, inflation, what taper will mean, when the Fed might decide to lift off, and possible leadership changes. Gary Siegel hosts. (30 minutes)

By Gary SiegelOctober 26 -

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

By Lynne FunkOctober 25