Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Until supply comes, market participants appear to be content to sit back and let the calendar flip to a new year without making any big moves.

By Lynne FunkDecember 27 -

Municipals are sitting out the ups and downs in equities and UST, with $12 million scheduled for the primary in the final week of 2021.

By Lynne FunkDecember 23 -

Tax risks continue to linger as they are preserved as a potential offset for whatever level of spending all 50 Democratic senators can agree to, but potential approval of the legislation remains a question mark.

By Lynne FunkDecember 22 -

The Build Back Better in its current form essentially has been killed by Sen. Joe Manchin, likely limiting the potential for tax hikes in the coming year.

By Lynne FunkDecember 20 -

Despite outside pressures, municipal fundamentals are strong with improving credit pictures, issuers flush with federal cash and the ongoing supply-demand imbalance.

By Lynne FunkDecember 16 -

It marked the 40th straight week of positive flows into the long-term funds and brought the total inflows for this year near $82 billion. Exchanged-traded funds saw $168M of inflows.

By Lynne FunkDecember 15 -

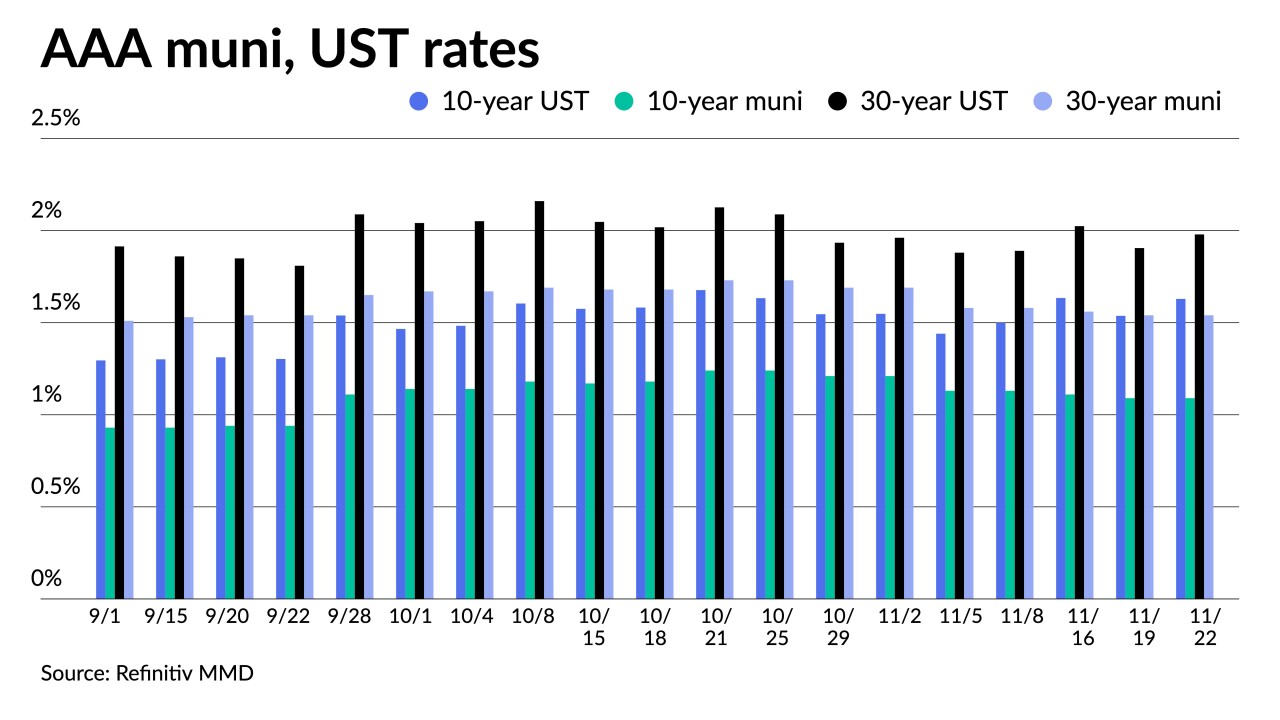

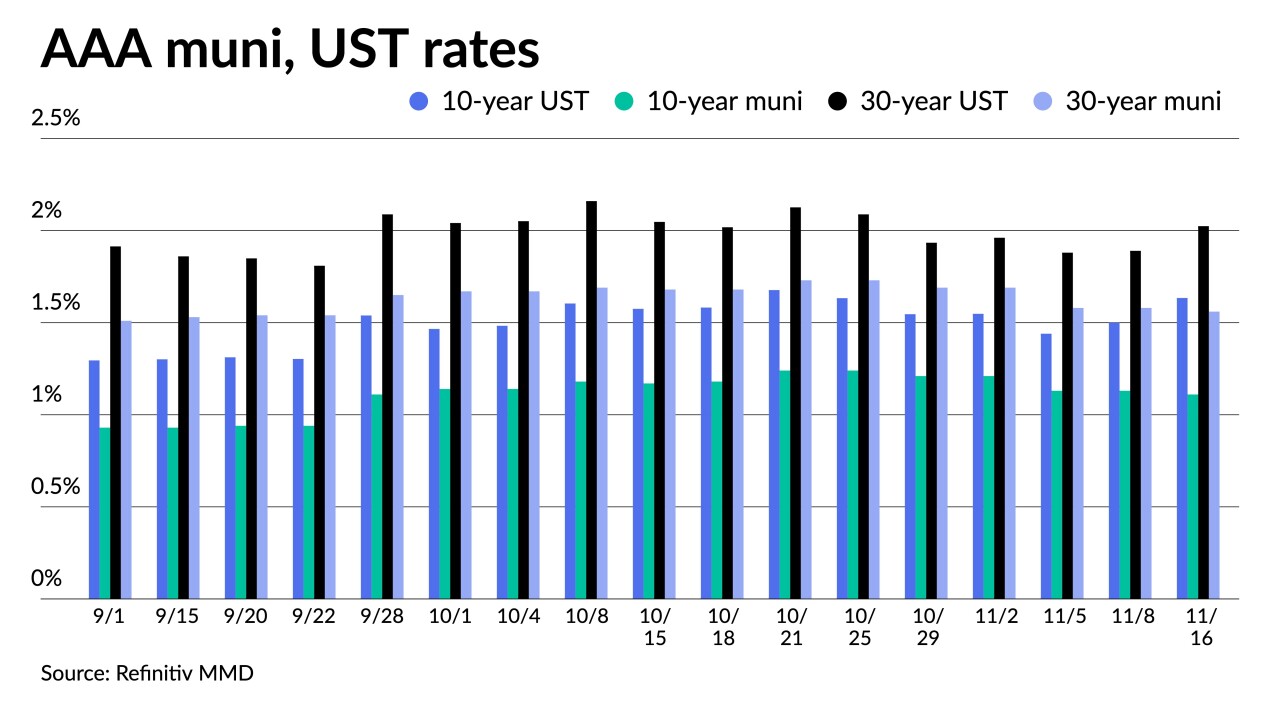

Triple-A yield curves were unchanged on the day and mostly have not budged but a basis point in spots since the end of November.

By Lynne FunkDecember 14 -

Coming off last week's $19.5 million influx of weekly new issues, supply this week is lower as the market watches the Federal Open Market Committee meeting.

December 13 -

The Investment Company Institute reported $289 million of inflows into municipal bond mutual funds in the week ending Dec. 1, down from $965 million in the previous week.

By Lynne FunkDecember 8 -

Thirty-day visible supply drops to $13.54 billion with still a large chunk of new issues to be priced Wednesday and Thursday.

By Lynne FunkDecember 7 -

The municipal market is poised to absorb the late-year burst of supply as market technicals are expected to remain positive through year end.

By Lynne FunkDecember 6 -

The weaker-than-expected employment report sent U.S. Treasury yields lower and equities sold off. Munis did what they've been doing — mostly ignored it.

By Lynne FunkDecember 3 -

Refinitiv Lipper reported a significant drop in municipal bond mutual fund inflows at $36 million in the latest week, a signal the volatility of other markets may be creeping in. High-yield saw $53 million of inflows.

By Gary SiegelDecember 2 -

The Investment Company Institute reported $974 million of inflows into municipal bond mutual funds in the week ending Nov. 23, down from $1.430 billion in the previous week.

By Lynne FunkDecember 1 -

Powell says the FOMC will consider ramping up tapering when more information about Omicron and its impacts are known, further flattening the UST yield curve.

By Lynne FunkNovember 30 -

Economists appear to be less concerned about Omicron, with some saying that even if the variant causes another pandemic wave, it is more likely to "slow rather than interrupt" the global economic recovery.

By Lynne FunkNovember 29 -

ICI reported $1.43 billion of inflows into municipal bond mutual funds in the week ending Nov. 17, down from $1.61 billion in the previous week.

By Chip BarnettNovember 24 -

With the leadership questions mostly answered, the Fed must figure out what to do about inflation. The markets expect the Fed will have to raise rates sooner than planned, and perhaps speed up taper to do so.

By Lynne FunkNovember 23 -

This week will be all about the secondary market given that the majority of issuance was priced earlier in the month while Dec. 1 coupon payments should make secondary offerings look attractive.

By Lynne FunkNovember 22 -

A large new-issue calendar began pricing in the negotiated and competitive markets, with a few deals bumped off the day-to-day calendar.

By Lynne FunkNovember 16