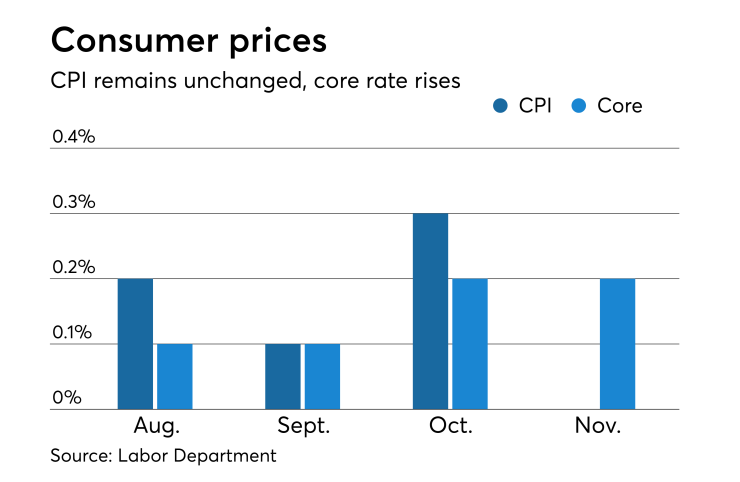

WASHINGTON - The CPI data suggest that consumer inflation was steady in November, with the headline and core measures in line with expectations and the year/year rate for the overall measure down slightly from October, data released Wednesday morning by the Bureau of Labor Statistics showed.

Overall CPI posted a flat reading as expected by analysts, but below the 0.3% gain expected by market participants. The core CPI rose 0.2%, as expected. MNI analysis released Tuesday showed a tendency by analysts to accurately predict CPI, with misses to the high side when they do miss. Today's data continued that trend.

Unrounded, the month/month gain for overall CPI was 0.019%, on the high side of the flat reading, and the unrounded increase for core CPI was 0.209%, on the higher side of a 0.2% increase.

Overall, the data point to contained consumer inflation, as the year/year rate for the overall measure fell while the core measure rose only slightly.

The year/year rate for overall CPI slowed to 2.2% from 2.5%, while the year/year rate for core CPI was up slightly to 2.2% from 2.1% in October.

The large owners' equivalent rents category rose 0.3%, medical care was up 0.4% and used vehicle prices rose 2.4%. However, apparel prices fell 0.9% and new vehicle prices were flat.

Energy prices fell by 2.2% for November after a 2.4% rebound in October. Gasoline prices declined 4.2% and fuel oil prices fell 2.9%, but electricity prices were up 0.3% and gas utilities prices were up 0.7% to provide some offset. CPI excluding only energy was up 0.2%.

Food prices rose 0.2% in November, with food at home prices up 0.2% and food away from home prices up 0.3%.