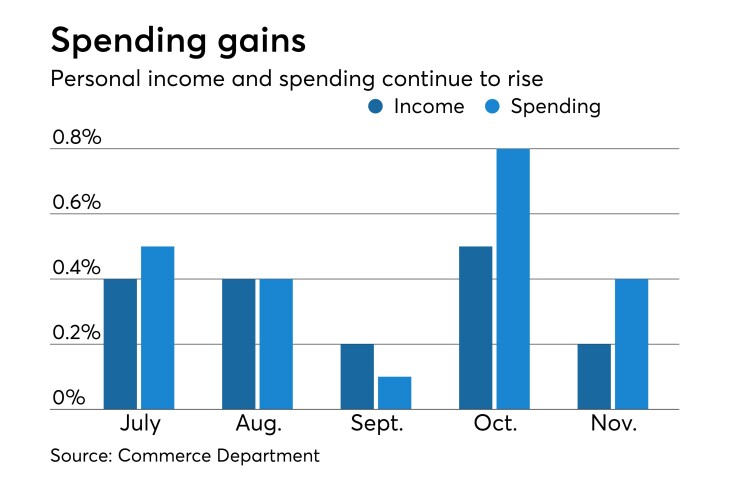

WASHINGTON — Personal income grew 0.2% in November, while spending rose 0.4%, according to data released Friday by the Bureau of Economic Analysis.

The data suggest inflation is still well contained, with the year/year growth rate for the core measure rising to 1.9% after an upward revision to the September reading to +2.0% from +1.9% that was mostly due to rounding, and no revision to the +1.8% October reading. The overall PCE price index was +1.8% y/y, compared to +2.0% in October. Personal income was slightly lower than expected, and spending was in line with expectations, but the softer inflation picture is likely be more closely viewed by markets.

The core PCE price index rose 0.1% m/m (+0.148% unrounded), below expectations, following a +0.1% (+0.120%) reading in October. The y/y rate rose to +1.9% vs +1.8% in Oct, as the month/month gain was 0.1% a year ago. The overall PCE price index was up 0.1% and the y/y rate fell to +1.8%, below the levels seen in the summer.

Current dollar PCE was up 0.4%, in line with expectations that were rooted in a strong retail sales report. A 0.9% gain in durable goods spending followed a 0.8% gain in October. Nondurable goods spending was up 0.2% on a 2.1% drop in energy prices and services spending was up 0.4%.

Real PCE was up 0.3% after a 0.6% gain in October. Through two months, real PCE is running +3.4% SAAR from the Q3 average, a slowdown from the 3.5% rate reported Q3 GDP report earlier this morning.

Personal income was up 0.2%, below the 0.3% gain expected, with wages and salaries up 0.2% and income gains for proprietors' income, current transfer receipts, and rental income. Personal taxes were up 0.1% after a 0.2% gain in October. Disposable personal income was up 0.2% while real disposable income was up 0.2%. The savings rate fell to 6.0% from 6.1% in October.