U.S. hiring rebounded by more than forecast in October, annual wage gains topped 3% for the first time since 2009 and the jobless rate held at a 48-year low, signaling the labor market will keep driving consumption and economic growth.

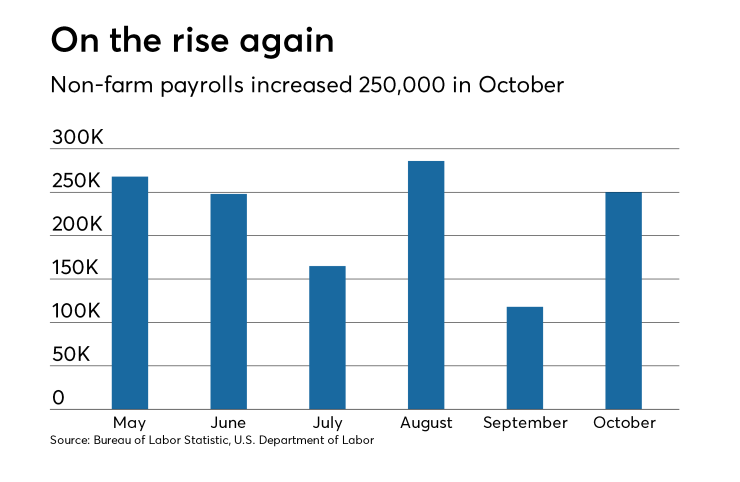

Nonfarm payrolls rose 250,000 after a downwardly revised 118,000 gain, a Labor Department report showed Friday. The median estimate in a Bloomberg survey called for an increase of 200,000 jobs.

Average hourly earnings for private workers advanced 3.1% from a year earlier and the unemployment rate was unchanged from September at 3.7%, both matching projections.

The figures give Republicans another economic accomplishment to tout ahead of Tuesday’s midterm elections as they seek to defend control of Congress from what polls indicate will be Democratic gains. The continued hiring and wage increases also reflect a tax-cut boost and reinforce expectations that the Federal Reserve will raise interest rates for a fourth time this year in December, though such an outlook may further unsettle investors who just sent U.S. stocks to their worst month since 2011.

The October data may be less of an indicator of the trend than usual because they reflect distortions from hurricanes both this year and last year. Meanwhile, the U.S. trade war with China poses a risk to further gains and companies may be slowing capital investment.

The Labor Department said 198,000 people weren’t at work due to bad weather, reflecting Hurricane Michael’s impact on Florida, following 299,000 in September amid Hurricane Florence. That compares with 36,000 people not at work due to weather in the year-ago period.

Restaurants and bars -- an industry where most workers only get paid if they show up to work -- saw a 33,500 increase in payrolls, following a 10,000 decrease in September that reflected Florence’s impact.

Average hourly earnings rose 0.2% from the prior month, also matching analyst projections, following a 0.3% gain, the report showed. The annual increase of 3.1% followed a 2.8% advance.

The year-over-year change reflects possibly storm-boosted figures in October and storm-depressed numbers the prior year, though companies have also been steadily raising pay to attract and retain workers.

Even so, the long-awaited gains follow relatively tepid increases throughout the current expansion, which in mid-2019 will become the longest in U.S. history. The advances are probably still not rapid enough, though, to spur inflation concerns among Fed officials, rather keeping them on a path of gradual interest-rate hikes.

Here are other highlights from the report:

Payrolls

Revisions were a net wash for payrolls in prior two months, as August was revised up 16,000 and September revised down 16,000; three-month average gain of 218,000 Payroll increases were broad-based, including 30,000 in construction, 32,000 in manufacturing and 179,000 in services; retailers added 2,400 following a 32,400 decline Private payrolls rose by 246,000, compared with median estimate of 195,000; government payrolls increased by 4,000.

Wages

Average hourly earnings for production and non-supervisory workers increased 3.2% from a year earlier, following 2.8% in September Average work week increased to 34.5 hours, from 34.4 hours in prior month; a shorter workweek has the effect of boosting average hourly pay.

Household Survey

Participation rate increased to 62.9% from 62.7% the prior month; measure tracks share of working- age people in labor force Employment-population ratio rose to 60.6% from 60.4% U-6, or underemployment rate, fell to 7.4% from 7.5%; includes part-time workers wanting full-time job, people who aren’t actively looking.