WASHINGTON – U.S. lawmakers appear to be leaning toward the idea of a federal oversight board for Puerto Rico that would be authorized to tackle the commonwealth's debt, pension, and economic crises through broad restructuring.

The latest discussions on Puerto Rico's many problems, including an approximately $70 billion debt burden that has been deemed unpayable, took place in two House panel hearings on Thursday.

Legislators said the two hearings, one on the Treasury Department's proposal for the commonwealth and the other on possible ramifications of a restructuring on the municipal bond market, were the last scheduled before they prepare to draft a legislative package before a March 31 deadline imposed by House Speaker Rep. Paul Ryan, R-Wis.

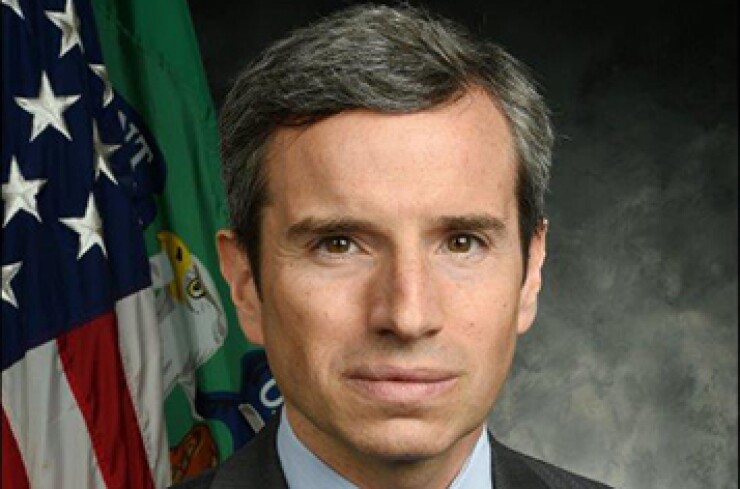

Antonio Weiss, a counselor to Treasury Secretary Jack Lew, told representatives during the Natural Resources Committee hearing that Treasury believes the best solution is for Congress to allow for territorial restructuring authority using the powers Congress has under the U.S. Constitution's Territorial Clause.

"This would give Puerto Rico the tools it needs to reach a resolution with creditors and adjust its debts to a sustainable level," Weiss said. "Importantly, this authority would expressly not apply to states, which have an entirely different relationship with the federal government under the 10th Amendment."

Weiss's comments were a departure from Treasury's previous proposal that Congress give Puerto Rico the ability to restructure all of its debts under Chapter 9 bankruptcy protections. That proposal, known as "Super Chapter 9," never gained traction in Congress because of concerns that debt-burdened states like Illinois and California would try to follow suit.

Weiss told the lawmakers that Treasury is "deeply concerned about the pensions in Puerto Rico" but denied a press report that it is proposing to put the territory's pension obligations above its debt obligations in a restructuring hierarchy. Instead he said everyone should come to the table in a restructuring.

The Treasury official said there should be three parts to a restructuring and a balanced approach to any federal board's authority: a temporary stay on litigation to allow for voluntary negotiations between creditors and the commonwealth; a voting mechanism to prevent a few hold-out creditors from blocking a reasonable compromise; and a court-supervised structure to assure an orderly resolution if negotiations fail.

Weiss and the legislators said there would be room for further Puerto Rico proposals for things like boosting economic growth, reforming tax systems, and improving the territory's access to federal healthcare programs. "We believe it is for Puerto Rican legislators and the governor to identify the reforms that are needed structurally, but we think it is equally important that the oversight board makes sure that those reforms that are identified are implemented," Weiss said.

Weiss additionally addressed the concern that a commonwealth-wide Puerto Rico restructuring could negatively impact the municipal bond market by making the comparison between an orderly restructuring under a legislative package and "cascading defaults and litigation" over the next ten years.

"It doesn't come close," he said. "The best thing for municipal bond markets is for this to be brought to an orderly solution."

Natural Resources Committee chair Rob Bishop, R-Utah, told reporters after the hearing that any entity given oversight authority in Puerto Rico would also need to have the power to restructure.

"Some organization that is going to do a restructuring in this situation has to be the logical solution and there's no other way around it," Bishop said. "But it's not necessarily going to be a remake of other control boards that have happened in the past. It has to be dictated by the specific situation."

Meanwhile, Mark Zandi, chief economist for Moody's Analytics, told Rep. Sean Duffy, R-Wis., the chair of the House Financial Services Committee's panel of oversight and investigations, that his bill is "a very positive step in the right direction," but doesn't go far enough.

Zandi said Puerto Rico needs a much broader restructuring of all of its debts and its unfunded pension liabilities.

Duffy proposed a bill (H.R. 4199) in December that would provide public authorities in Puerto Rico with Chapter 9 bankruptcy protection in return for the commonwealth's acceptance of a newly created five-member Financial Stability Council that would review and approve its financial plans, budget and borrowing plans.

Zandi said Chapter 9 might only help restructure 30% of Puerto Rico's debt and while that number might rise to 75% if COFINA bonds are included, that could spark lengthy litigation, taking time that Puerto Rico doesn't have.

He suggested the Financial Stability Council be empowered to implement a temporary stay of perhaps 12 to 18 months on all debt payments and then use the time to "fashion a sustainable restructuring."

Anne Krueger, a senior research professor of international economics at Johns Hopkins University who led a study on Puerto Rico's economic situation and prospects, told lawmakers the Commonwealth needs to reform its financial policies to become sustainable.

She stressed that Puerto Rico must deal with its unfunded pension liabilities, reform its tax and business policies, as well as be put on an equal footing with states is such areas as Medicaid.

Rep. Mick Mulvaney, R-S.C., asked those testifying about concerns that the Treasury Department is recommending pensioners be paid before bondholders and said that does not seem fair. He also said these recommendations "smack of a bail-out."

But Zandi agreed with Rep. Emanuel Cleaver, D-Mo., that, "We're going to pay one way or another," meaning that if the U.S. does not help Puerto Rico it will be hit with a massive influx of people coming into the states from the commonwealth.

Zandi also pointed out that pensioners are all Puerto Ricans and that not paying them may cause them to leave or put them into poverty and hurt Puerto Rico. Creditors, he said, are spread out across the globe.

Rep. Nydia Velazquez, D-N.Y., said during the panel hearing that Puerto Rico must be allowed to restructure all of its debt and that any control board established should not be a "power grab." She said she hopes Congress can move from holding hearings to considering legislation.

William Isaac, senior managing director and global head of financial institutions for FTI Consulting, told lawmakers at the panel hearing that giving bankruptcy authority to the territory, "would be unprecedented and would have far-reaching implications, including raising the costs of borrowers for the fifty states."

Subcommittee members noted that Iowa Gov. Terry Branstad raised the same concerns in a recent letter to House leaders.

But Velazquez said "There's no evidence of this." She asked Zandi about it and he said, "Investors have said quite clearly that Puerto Rico's situation is Puerto Rico's situation and it's no one else's problem."

Rep. Carolyn Maloney, D-N.Y. said Puerto Rico needs "territorial restructuring" and asked Zandi if stronger tools are needed for the Commonwealth. He agreed and said it's wrong to say this will hurt the muni market. "Investors who have money on the line are saying this is not going to be a problem for the rest of the country."