LOS ANGELES — The Los Angeles Metropolitan Transportation Authority will price $514.8 million in bonds this week to pay for a line connecting its rail network to an airport people mover and pay down short-term debt.

The sale comes fresh off last week's passage of a new half-cent L.A. Metro sales tax measure.

The bonds are being marketed for retail sales on Wednesday and institutional pricing on Thursday.

Bank of America Merrill Lynch is senior manager. Fieldman, Rolapp (& Associates) is transaction financial advisor. Montague DeRose and Associates, LLC is general financial advisor. Kutak Rock LLP is bond counsel.

The bonds, backed by the authority's Measure R sales tax, carry Aa1 and AAA ratings with stable outlooks from Moody's Investors Service and S&P Global Ratings.

Passage of the sales tax is positive even though the new tax is not the tax backing the bonds, said Daniel Wiles, a principal with Fieldman, Rolapp. This week's bond sale is supported by revenue from Measure R passed in 2008,

Measure M, the new sales tax, adds a half cent sales tax through 2039 when Measure R was originally slated to sunset, but also continues Measure R in perpetuity, so that M morphs into a one-cent sales measure after 2039.

Metro is supported with three separate sales tax measures, approved by voters in 1980, 1998, and 2008.

Moody's deemed passage of Metro's sales tax a credit positive in a report last week.

"I can't tell you if it will add to investor demand or not, but it is clearly a positive," Wiles said.

The passage of the new sales tax was described in the preliminary offering statement.

Metro wanted the bond sale to be far enough away from any changes wrought by last week's election, Wiles said.

"We wanted to get out of the way of the election, but I don't think anyone anticipated that what happened in the markets on Wednesday and Thursday would happen," Wiles said.

The bond sale is expected to bring in $601.1 million in proceeds including an $86.2 million bond premium, according to an online investor road show. The proceeds will pay $300 million toward the cost of the Crenshaw/LAX Transit project and rail vehicle costs and $300 million to eliminate short-term debt.

If interest rates remain at the higher post-election levels, it could result in a higher cost to Metro and decrease the amount of premium generated and the amount of bonds that have to be issued, Wiles said.

"That is just bond math," Wiles said.

The anticipated bond premium was based on an initial presumption of issuing predominately 5% coupons with some 4% and 3% in the mix, which would generate significant premiums, he said.

The bonds are backed by 85% of revenues from Measure R. The other 15% of Measure R money goes for local road projects. Measure R revenues were $634 million in fiscal 2015 and $650.2 million in fiscal 2016, according to bond documents.

Metro, which serves a 1,433-square mile territory with 9.6 million people, has been using its voter approved sales taxes and the debt they back to build new transit lines.

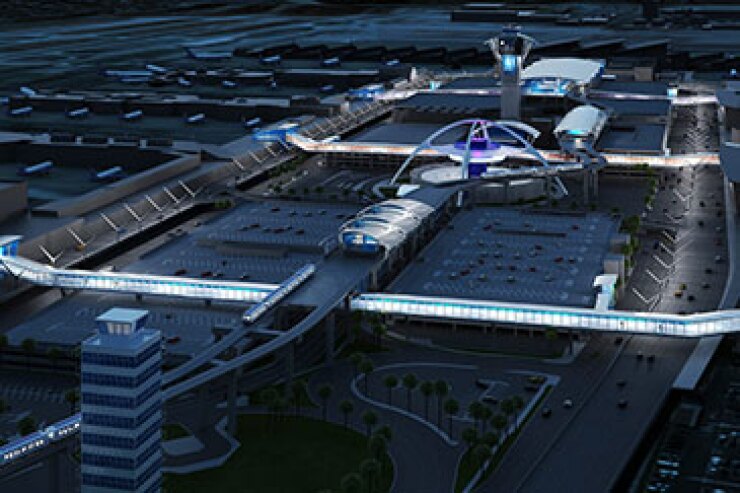

The $2.01 billion Crenshaw/Los Angeles International Airport project is one of 12 transit projects funded by Measure R. The 8.5-mile line runs from the Metro Exposition Line at Crenshaw and Exposition boulevards to the Metro Green Line Aviation/LAX station.

The Airport Metro Connector transit station at Aviation Boulevard and 96th Street will provide the connection to a future automated people mover to be built and operated by Los Angeles World Airports. Following the sale, Metro will have $1.176 million in senior bonds outstanding under Measure R and no subordinate debt, because $300 million currently outstanding would be take out with the sale, LuAnne Schurtz, Metro's assistant treasurer, said in the online road show.