LOS ANGELES — Auditors have confirmed that junk-rated Guam achieved its second consecutive budget surplus in fiscal 2013.

The Pacific territory's officials said Thursday they achieved their second consecutive budget surplus in 20 years, in a prepared statement released after its fiscal year 2013 audit posted July 1.

Fitch Ratings and Standard & Poor's have lauded Guam for efforts to right its financial position, but still rated most of the bonds junk.

Since taking office in 2011, Governor Eddie Calvo has been focused on returning Guam to financial stability by controlling expenses and implementing fiscal reform, Lester L. Carlson, Jr., manager of the Guam Economic Development Authority Public Finance Division, said in a statement.

Guam achieved a $30 million surplus on its fiscal 2012 budget and a $2.3 million fund balance as of the fiscal year ended Sept. 30, 2013, according to the auditor's report in the financial statements for fiscal 2013. Deloitte & Touche LLP prepared the audit.

Guam is roughly 3,800 miles west-southwest of Honolulu and 1,550 miles south-southeast of Tokyo. Its economy is driven by the military and tourism.

S&P upgraded the territory's general obligation bonds to BB-minus from B-plus in October 2013 and assigned a stable outlook.

Fitch doesn't rate the territory's GO bonds, but assigned a BB rating with a positive outlook to $173.9 million in water and wastewater revenue bonds issued in November 2013 by the Guam Waterworks Authority. It also revised the outlook to positive from stable on $207.3 million in outstanding water and wastewater revenues bonds affirmed at BB.

"The rating action reflects our view of the government's improved financial management practices, including improved transparency, stricter discipline, and enhanced cash flow monitoring procedures and capabilities," Standard & Poor's credit analyst Paul Dyson said in that 2013 report, S&P's most recent.

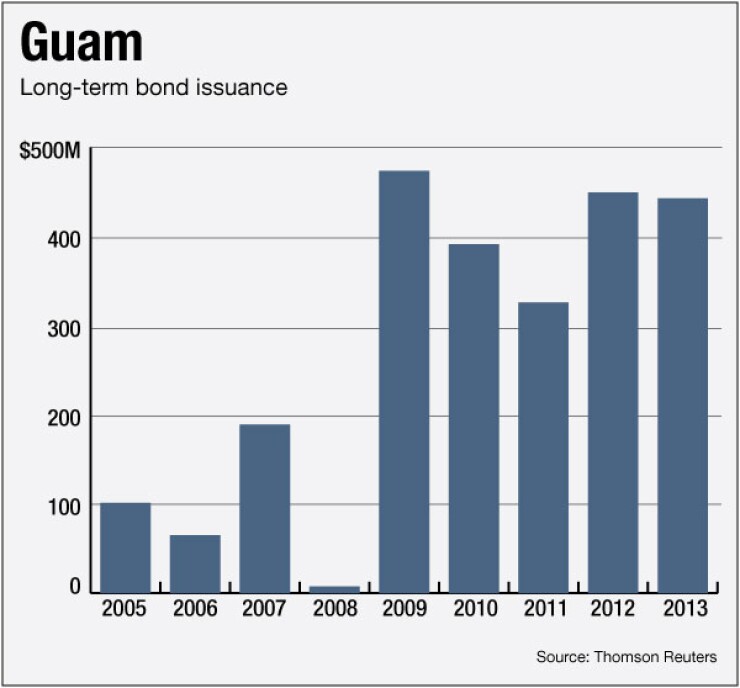

Dyson expressed concern about the government's large negative unassigned general fund balance and its high debt burden, which has grown significantly in recent years. That debt burden has resulted "in a lack of financing flexibility given that the government is within $33 million or 3% of its $1.14 billion debt ceiling," according to Dyson's report.

A large portion of the debt Guam issued in recent years has gone toward paying down other long-term liabilities such as unpaid tax refunds. Guam did receive investment-grade ratings for $235 million in business privilege tax bonds it issued in November 2011 to pay off the backlog of overdue tax refunds. S&P gave the bonds an A rating with a stable outlook while Fitch rated the bonds A-minus with a stable outlook.

According to the administration, fiscal initiatives that Calvo implemented helped Guam to achieve its first budget surplus in fiscal 2011.

While Guam continues to balance its operating revenues and expenses, fiscal year 2013 operational expenses outpaced revenues due to additional ARRA expenditures recorded in fiscal 2013 for which revenues were received in a prior year. Notable in Guam's fiscal 2013 audit was the addition of the inventory and valuation of $411 million of Chamorro Land Trust and Ancestral Lands parcels, Carlson said.

Guam is often compared to Puerto Rico due to territorial status that makes interest on its bonds exempt from state and local income tax in every state.

Carlson said in the prepared statement that Guam is on the upswing while Puerto Rico continues to struggle.

Carlson cited Calvo's pursuit of a China visa waiver program among efforts to grow Guam's economy.

That could expand Guam's primary tourism markets, Japan and Korea.

"Guam, which is just a 3-5 hour flight to many regions of Asia, has seen tremendous growth and diversification of its tourism market over the last several years," Carlson said. Hotel occupancy is approaching 90%, the tourism economy is more diverse than ever, and Guam continues to attract the interest of foreign investors who recognize the future growth potential of the visitor market, he said.

Guam had $1.08 billion of general obligation and limited obligation bonds outstanding at the end of fiscal 2013, according to the audit.