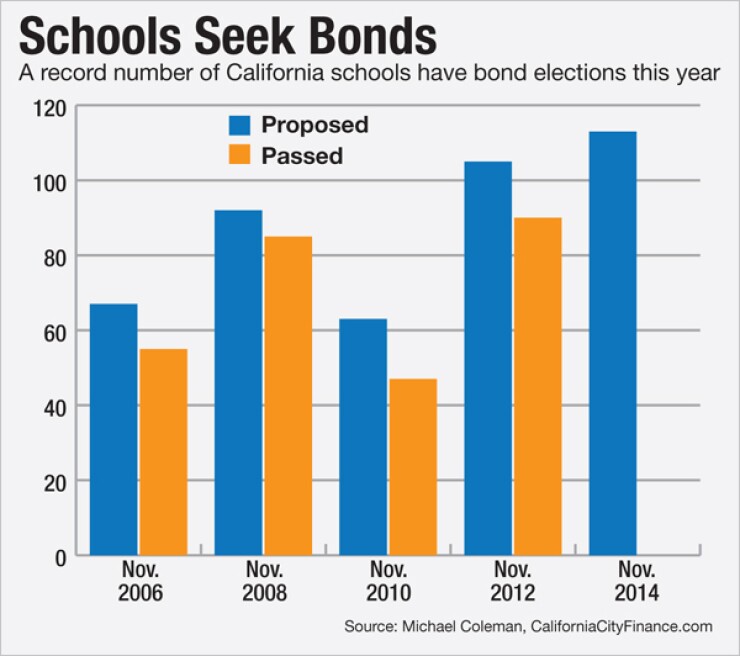

SAN FRANCISCO — On Nov. 4 California's school districts and community colleges will ask voters to approve a record high of 113 local bond measures, totaling $11.6 billion, to fund school construction, acquire equipment, and make repairs and upgrades.

That amount is higher than it was during each of the previous four gubernatorial and presidential elections, when school districts proposed 105 measures in 2012, 63 in 2010, 92 in 2008, and 67 in 2006.

"That's a lot of revenue to be asking for," said Michael Coleman, principal fiscal policy advisor to the League of California Cities, and creator of

Legislation to authorize $9 billion in state general obligation bonds for school facilities

The Brown administration said it had concerns about the state's existing school facilities program and the appropriate role for the state in financing school infrastructure.

Under the state's current school facilities program, new school construction projects are funded on a 50/50 state and local matching basis, which provides an incentive for schools to pass local bond measures.

"School districts are realizing that there's money on the table that they need to take advantage of," Coleman said.

The Moreno Valley Unified School District has one of the larger bond measures next week-a $398 million GO authorization that would help upgrade classrooms and labs, improve student safety and security, and repair, construct, and acquire classrooms.

The Committee to Improve Moreno Valley Schools said the district would be able to qualify for state matching funds if the measure passes-funds that would not otherwise be available to the school district.

"We can't rely on the state to complete these repairs," the committee said. "Measure M will provide the local funding and control necessary to fix and upgrade the prioritized projects to provide a safe and modern learning environment for our students."

Other large GO bond measures Nov. 4 include a $574 million request from North Orange County Community College District and a $419 million request from the Santa Clara Unified School District.

All 113 school bond measures need 55% voter approval to pass. Coleman said the passage rate for these types of bonds is 85%-much higher than GO bond measures from cities and other local governments, which require a two-thirds supermajority.

Of the four non-school bond measures proposed, the largest is a

The bond is the first recommendation of the city's Transportation 2030 Task Force formed by Mayor Ed Lee in January 2013.

"This November, with my support and the support of every member of the Board of Supervisors, San Francisco voters will have a historic opportunity to invest in the future of transportation in our city without raising property tax rates," Lee said of the bond.

Proposition A supporters say property taxes would remain level because the debt would only be issued as older bonds mature.

The funds would be used for repairs and upgrades to the city's transportation infrastructure. Specifically, around $360 million would go toward transit projects and $140 million would go toward street safety, according to a draft of the proposal.

The other three non-school local bond measures in California total $55.5 million.

Among the non-bond tax measures, there are 32 city, county and special district parcel taxes requiring two-thirds voter approval. These include two library measures, three street improvement measures, four parks and open space measures, sixteen emergency response measures, and five police measures.

A parcel tax is a form of property tax assessed on a per-property-parcel basis, rather than on the assessed value of the property.

Among schools, there are just eight measures to increase or extend parcel taxes — down from 25 measures in 2012, and 18 in 2010.

Coleman said the lower amount of school parcel tax measures could be due to the high amount of school bonds.

"They can't do both," he said. "Politically, it's just difficult."

In total, there are 265 local measures seeking approval for taxes or bonds, compared to 240 in 2012, and 191 in 2010.

Coleman said one reason why there are so many of these measures on the ballot this year is that a lot of communities are facing significant budgetary pressures.

"We're coming out of a recession, but a lot of communities are really struggling financially," he said. "Even though revenues are coming back — moderately so — the cost increase that we're seeing in coming years because the costs of doing business are significant and in excess of the kind of revenue that we can expect."

He pointed to higher costs of pension obligations and retiree health care obligations, which continue to increase.

"All these financial pressures are coming to bear, and that's why you're seeing a lot of tax increases for operations," he said.

Even with a more crowded ballot, the mix of local revenue measures appears to favor an overall higher success rate compared to prior years, Coleman said.

He predicts that close to 200 of the 265 local tax measures will pass, which would be a record level of local tax and bond approval in the state.

Douglas Johnson, a fellow at the Rose Institute of State and Local Government at Claremont McKenna College, said a higher percentage of measures have succeeded in recent years as local governments have increased the use of polling before putting a measure on the ballot.

"It's not really that people are more supportive of bond measures," he said. "It's that jurisdictions are doing polls, and where before they would have put the measure on the ballot and would have lost, now they see that, so they never put it on the ballot."

Another factor that will impact the passage of measures is the voter turnout. Johnson said the turnout for this election is expected to be stunningly low.

"I'll be pleasantly surprised if half of the registered voters cast ballots in November," he said. "There's just nothing turning the voters out. There's no president Obama, no high profile governor's race, no Tea Party anger."

While Brown is up for re-election, he has barely mounted a campaign as Republican challenger Neel Kashkari has not been able to dent the incumbent's appeal to voters.

Coleman said a lower turnout means those with strong opinions who are more likely to vote will prevail. For measures with a strong constituency, like those of many school, library or park measures, this is a good thing, he said. For a more general constituency, as with transportation or public safety measures, this is usually bad.

"A lot of depends on what local factors are, much more than statewide factors," Coleman said. The success of a measure will be affected if there's a local or nearby government scandal, for example, or turmoil over a property development proposal.

Other factors impact a measure's success include the type of measure, the community confidence in the financial management of the local government, and mobilization of support and opposition.

"The one thing that's in their advantage is that there's not a big statewide tax measure," Johnson said of the local revenue measures. "The governor's school funding tax a couple of years ago really pushed everything off the ballot, but there's almost nothing of statewide interest on the ballot. So this election is likely to be very locally focused."