Municipal bond volume increased for the second month in a row and the seventh out of eight months this year, as both new money issuance and refunding volume rose 20.8% for the month of August.

Long-term muni bond issuance increased by 24.4% to $30.76 billion in 853 issues, from $24.73 billion in 924 issues in August of last year, according to Thomson Reuters data. The volume was greater this month, even though there were 71 fewer issues than a year earlier.

"Rates did increase during the first part of August, and we have seen various times throughout the year when people thought the Fed was going to raise rates, and we front loaded a lot of the issuance but we might have exhausted those issues and prevented some issues from coming," said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management.

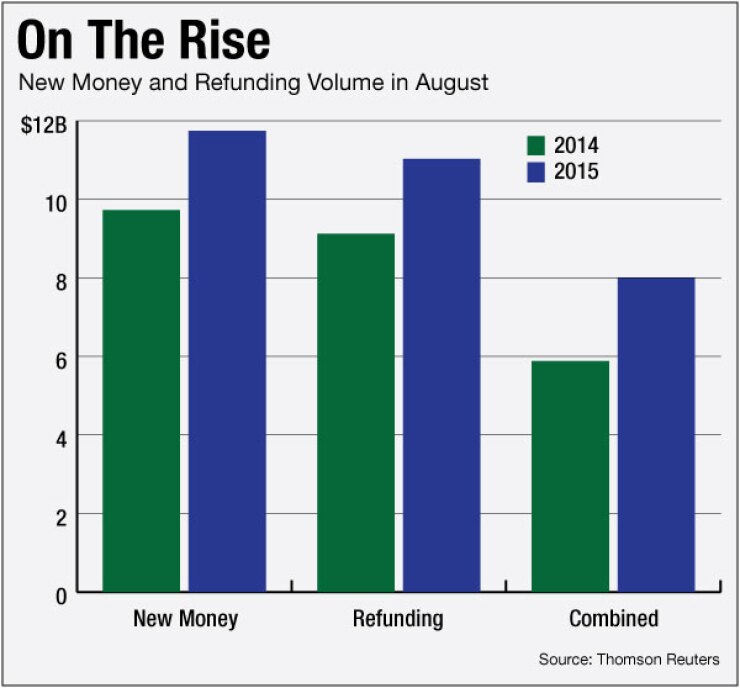

Refundings have been the biggest driver as issuance surged this year. Refundings began to trend downward the past two months, but that has reversed in August, increasing 20.8% to $11.02 billion in 302 issues, from $9.12 billion in 361 issues.

"The monthly fluctuation in refundings, is not surprising," said Vikram Rai, head of municipal strategy at Citi. "Typically a spike in rates leads to a drop in advance refundings as the savings decline dramatically when the curve steepens. We saw that happen in spring 2015. But, if ultra-short rates move up very slowly, it is quite likely the curve will flatten over time (the 18-to-20 year part of the curve is likely to sell-off less) and that might alleviate the negative arbitrage, as it will enhance the yield from the escrow account."

Rai expects some kind of a knee-jerk sell-off across the curve when the Fed hikes at first, but says that should be temporary. "So yes, a flatter curve, which will result from a slow and measured hiking regimen, should actually benefit refundings," he said.

New money issuance jumped for a third straight month, rising 20.8% to $11.75 billion in 484 transactions, from $9.72 billion in 480 transactions during the same time frame last year. Combined new money and refunding transactions improved by 35.9% to $7.99 billion from $5.88 billion.

"Fundamentally, there is no reason why new money issuance should not increase. I am optimistic going forward, as it is impossible for refundings to maintain this pace and new money will pick up slack," said Rai.

Heckman continues to expect issuance to start to dwindle for the remainder of the year.

"A lot of the refunding activity is behind us," he said. "When we get a drop off that we forecast will happen later in the year compared to last year it will be largely due to two factors: A lot of municipalities might not have to issue debt, and a lot of issuers are having trouble getting approval of long term and big deals."

Issuance of revenue bonds was 18.3% higher to $17.53 billion and general obligation bond sales rose by 33.4% to $13.23 billion.

Negotiated deals jumped up 46.2%% to $24.59 billion and competitive sales declined by 5.7% to $5.53 billion. Private placement deals plummeted 69% to $603 million.

Taxable bond volume surged to $3.89 billion from $1.40 billion, while tax-exempt issuance improved by 15.1% to $25.97 billion. Minimum tax bonds registered a 16.1% improvement to $887 million from $764 million.

"We expect taxable issuance to be up," said Rai. "The healthcare and education sectors produce a lot of taxable CUSIPS and we expect these sectors to be robust going forward."

Bond insurance took a step backward in the month of August, as the volume of deals wrapped with insurance declined by 25.2% to $2.10 billion from $2.81 billion.

Issuance increased in seven out of 10 sectors for the month, with health care, transportation and utilities as the only sectors to see decreases - of 1.7%, 6.8% and 1.2%, respectively.

The education sector posted a gain of 36% to $8.66 billion from $6.37 billion. The development sector increased sales by 36.4% to $1.08 billion from $790 million. Housing issuance was up 24.7% to $1.51 billion from $1.21 billion.

Variable-rate short put issues declined 39.1% to $524 million from $862 million, while variable-rate long with no put more than doubled to $248 million from $113 million.

Fixed-rate issues increased 28% to $29.16 billion in 821 issues from $22.78 billion in 872 issues from August of 2014.

"We expect an increase in floating rate issuance as well," said Rai. "This is because a lot of the sophisticated issuers understand that if the pace of the hike is slow and measured, the Fed may not have enough time to achieve a high terminal fed funds rate. On the other hand, there is strong demand from investors who view floating rate securities as way to hedge rising rate exposure. Thus, demand for floating rate notes may overwhelm supply and sophisticated issuers may be able to issue floating rate debt at attractive levels."

Heckman agrees with Rai that when the rates rise occurs it will put most of the pressure on the short end.

"That is a strong possibility [that issuers will try to issuer more floating rate debt versus long-term, 30 year debt]. There are a lot of people who are try to perfectly time that move from fixed rate to floating rate, but the rate rise will be low, slow and methodical according to what the Fed has been saying," Heckman said.

Zero-coupon issuance declined 23% to $122 million from $159 million.

"Issuers believe that zero coupon debt is prohibitively costly and some large issuers have changed their policies to curtail the issuance of long dated zero coupon debt. The drop in zero coupon issuance is a manifestation of these changes," said Rai.

California, Texas, New York, Florida and Pennsylvania remain the top issuers for the year to date.

The Golden State remained in the top spot with $41.14 billion of issuance thus far in 2015, while the Lone Star State is close behind in second with $34.56 billion. The Empire State is third with $27.29 billion, the Sunshine State came in fourth with $15.67 billion and the Keystone State fifth with $14.44 billion.