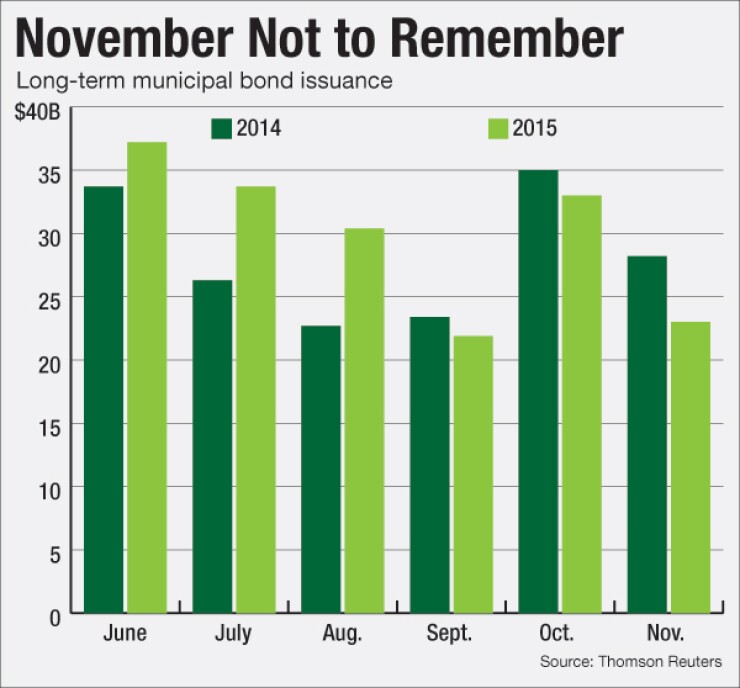

Municipal bond volume fell for a third straight month in November, as refundings declined by more than one-third from the same month last year.

Long-term muni bond issuance declined by 21.6% to $23.19 billion in 834 issues from $29.56 billion in 995 issues during the same period last year, according to Thomson Reuters data. The last November with lower volume was in 2000, when the monthly issuance totaled $19.80 billion.

"I am not totally surprised by the decline but a little surprised by the magnitude," said Dan Heckman, senior fixed income strategist at U.S. Bank Wealth Management. "It is playing out how we thought, all in and all. This trend will continue and will make for continued outperformance for munis."

The drop is "evidence of the volatility in the overall market," said Natalie Cohen, managing director at Wells Fargo Securities, who noted that Federal Reserve policymakers have continued to put off raising interest rates from historic lows. "At the end of August, there was a major equity drop and a rally in municipals," she said. "Since then we have been very bouncy. After the rates didn't rise, it took some time until we starting seeing issuance again."

Refundings have now declined in four of the past five months, plunging 39.5% to $7.42 billion in 319 deals in November from $12.26 billion in 444 deals a year earlier.

"Refundings have fallen off a cliff and it is getting more and more challenging with how much refunding has taken place, there is not much left to refund," Heckman said. "We are not issuing enough to keep up with number of bonds that have been called."

New money issuance slipped 1.7% to $11.93 billion in 449 transactions from $12.13 billion in 473 transactions a year earlier.

Issuance of revenue bonds fell 17.1% to $14.22 billion, while general obligation bond sales dropped 27.7% to $8.97 billion.

Negotiated deals were down 15.3% to $17.43 billion and competitive sales decreased by 26.8% to $5.62 billion.

Taxable bond volume was 22.7% lower to $1.69 billion from $2.19 billion, while tax-exempt issuance declined by 24% to $20.42 billion. Minimum tax bonds more than doubled to $1.08 billion from $508 million.

Bond insurance broke a three-month streak of decreases, as the par amount of deals with guarantees improved by 16.8% to $2.09 billion in 121 deals from $1.79 billion in 147 deals in November 2014.

Cities and towns saw an increase of 49.4% increase to $4.37 billion in 224 transactions from $2.92 billion in 254 transactions, while state governments, state agencies, counties and parishes, districts, local authorities, colleges and universities and direct issuers all saw decreases and hefty declines at that.

"When it comes to cities and towns, that's a reflection of some of the large borrows doing refundings in the month and a reflection of infrastructure that state and local governments are doing what they need to do. The logic is there with the rates being low so they are saying 'let's get it done'," Cohen said.

Cohen also said that while large deals by the likes of Industry City, Calif., Los Angeles municipal development corporation, Miami-beach and Anchorage had an effect, the system for bringing deals to market is more complex for cities and towns than it is for revenue bonds. The combination of delayed deals and new ones coming to market all at once could be another reason why issuance by cities and towns improved, she said.

The sectors were evenly split this month, with five seeing increases and five seeing decreases. The education, electric power, environmental facilities, housing and public facilities sectors gained.

"One of the bigger questions is why there isn't more borrowing. The rates are low and we need infrastructure. but there has been this overhang of people saying 'I can't raise taxes' but there was some change in that recently and you could see that in the local elections," said Cohen.

Both the housing and public facilities sectors saw gains despite having a lower number of transactions, compared with November 2014. Housing transactions increased 23.7% to $1.19 billion in 35 deals from $967 million in 44 deals while public facilities issuance jumped up 46% to $1.65 billion in 49 deals from $1.13 billion in 57 deals.

With only one month now left in 2015, California, Texas, New York, Florida, and Pennsylvania remain the top issuers for the year to date.

The Golden State kept the top spot with $52.29 billion of issuance thus far in 2015, while the Lone Star State is second with $44.63 billion. The Empire State is third with $39.15 billion, the Sunshine State came in fourth with $19.93 billion and the Keystone State ranked fifth with $16.63 billion.

While it had looked like the market was almost certain reach the $400 billion plateau for yearly issuance, it now seems less likely, as a volume total of roughly $23 billion would be needed in December.

"I am not sure we will reach the $400 billion plateau," Heckman said. "It will be very close – the drop off in new issuance is significant."

Heckman said his firm expects the Fed to raise the benchmark rate by 25 basis points as it takes a "patient and methodical" approach to normalization.

Cohen expects issuance to reach the $400 billion mark and rates to rise in December, but says the bigger question is what will happen in the subsequent meetings in 2016.

"Will it be raise, raise raise? I think they will take it slow, raise it a little in December and wait and see from there on out," she said. "Hopefully markets do not react dramatically. The global factor is a big one: it will be interesting to see how global events impact the market after December, once the rates are higher."