Top quality municipal bonds finished weaker on Tuesday, traders said, as several big healthcare offerings hit the market, headlined by the largest deal of the week.

Morgan Stanley priced Ascension Health Alliance's $1.2 billion healthcare deal through four conduit issuers for the Ascension Senior Credit Group.

The Wisconsin Health & Educational Facilities Authority's $1.02 billion of Series 2016A revenue bonds were priced to yield from 0.75% with a 3% coupon in 2018 to 3.27% with a 3.125% coupon, 3.17% with a 4% coupon and 2.77% with a 5% coupon in a 2036 triple-split maturity. A 2039 triple-split maturity was priced with 4%, 4.50% and 5% coupons to yield 3.27%, 3.07% and 2.87% respectively. A 2046 term bond was priced as 4s to yield 3.38%.

The Alabama Special Care Facilities Authority of Birmingham's $73.15 million of Series 2016B revenue bonds were priced as 5s to yield 2.98% in a 2046 bullet maturity. The Alabama Special Care Facilities Authority of Mobile's $87.89 million of Series 2016C revenue bonds were priced as 5s to yield 2.98% in a 2046 bullet maturity.

The Michigan Finance Authority's $65.63 million of Series 2016E-1 hospital project and refunding revenue bonds were priced at par to yield 1.25% in a 2046 bullet maturity.

Bank of America Merrill Lynch priced the Harris County, Texas, Cultural Education Facilities Financing Corp.'s $139.92 million of Series 2016 medical facilities mortgage revenue refunding bonds for the Baylor College of Medicine.

The issue was priced to yield from 0.04% with a 5% coupon in 2018 to approximately 3.236% with a 3% coupon in 2032. The deal is rated A by S&P.

Barclays Capital Markets priced Scioto County, Ohio's $123.64 million of Series 2016 hospital facilities refunding revenue bonds for the Southern Ohio Medical Center.

The issue was priced to yield from 0.73% with a 3% coupon in 2017 to 3.51% with a 3.375% coupon; a 2038 term was priced as 3 1/2s to yield 3.64%. The bonds are rated A2 by Moody's.

In the competitive arena, Miami-Dade County, Fla., sold $350 million of Series 2016A general obligation refunding bonds under the Building Better Communities Program.

Wells Fargo Securities won the bonds with a true interest cost of 3.04%. The issue was priced as 5s to yield from 0.94% in 2019 to 2.71% in 2038. The sale is rated Aa2 by Moody's and AA by S&P.

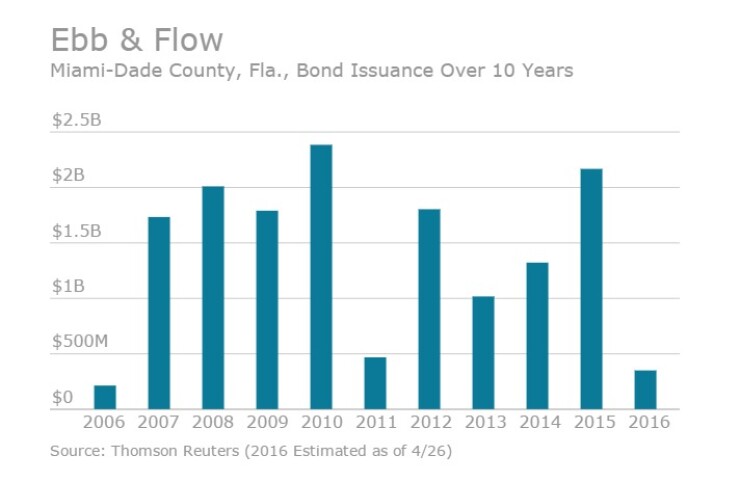

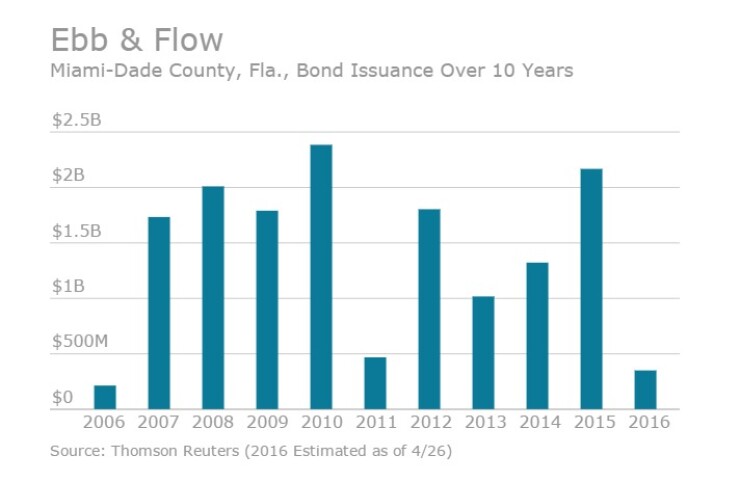

Since 2006, the county has sold about $15 billion of debt, with the most issuance occurring in 2010 when it sold $2.39 billion of bonds. The county sold the least amount of debt in 2006 when it issued $214.4 million of bonds.

The Horry County School District, S.C., competitively sold $125 million of Series 2016 GOs.

BAML won the deal with a TIC of 1.35%. The issue was priced as 5s to yield from 0.83% in 2019 to 1.61% in 2025. The bonds are rated Aa1 by Moody's and AA by S&P.

The Illinois Regional Transportation Authority competitively sold $150 million of Series 2016C taxable GO working cash notes. Wells Fargo won the notes with a TIC of 1.43% The issue was priced Information was at par to yield 1.25%, or about 86 basis points over the comparable Treasury security, in 2018.

The RTA's working cash notes will help the agency manage cash flow amid ongoing state aid payment delays. The deal is rated AA by S&P and Fitch.

Secondary Market

The yield on the 10-year benchmark muni general obligation rose one basis point to 1.66% from 1.65% on Monday while the 30-year muni yield increased two basis points to 2.63% from 2.61%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Tuesday. The yield on the two-year Treasury increased to 0.86% from 0.83% on Monday, while the 10-year Treasury yield rose to 1.93% from 1.90% and the yield on the 30-year Treasury bond gained to 2.75% from 2.72%.

The 10-year muni to Treasury ratio was calculated at 86.0% on Tuesday compared with 86.8% on Monday, while the 30-year muni to Treasury ratio stood at 95.4% versus 95.8%, according to MMD.