With a wild week in the rear view mirror, municipal market participants are eagerly anticipating a spike in weekly issuance.

Munis were slightly stronger at midday Friday as yields on some maturities were up to two basis points lower, while other maturities were steady, according to traders.

Secondary Market

On Friday, the yield on the 10-year benchmark muni general obligation was steady from 1.66% on Thursday, while the 30-year muni yield was flat at 2.72%, according to a recent read of Municipal Market Data's triple-A scale.

Treasuries were weaker on Friday at midday. The yield on the two-year Treasury was up to 0.73% from 0.71% on Thursday, while the 10-year Treasury yield was higher, at 1.87% from 1.86%, and the 30-year Treasury bond yield rose to 2.71% from 2.70%.

The 10-year muni to Treasury ratio was calculated on Thursday at 89.2% compared to 85.8% on Wednesday, while the 30-year muni to Treasury ratio stood at 100.9% versus 99.6%, according to MMD.

Primary Market

Municipal bond volume is estimated at $9.1 billion for next week, according to Ipero, which is a big step up from the revised total of $4.5 billion this week, according to Thomson Reuters.

The most discussed and maligned bond sale so far this year came to market this week. On Wednesday, JP Morgan released the pricing on the Chicago Board of Education's $725 million of unlimited tax general obligation bonds. The bonds were priced to yield 7.75% with a 7% coupon in 2026 and 8.5% with a 7% coupon in 2044. The deal was downsized, from the originally planned $875 million, then got dropped to $795 million and ended up even lower, at $725 million.

The 8.50% yield is 580 basis points over the Municipal Market Data's top-rated benchmark of a similar maturity and nearly 500 basis points over a BBB credit. The yield on the 10-year maturity landed 607 basis points over a similar top-rated maturity and 515 basis points over a BBB credit.

Chicago Public Schools dropped the taxable piece while the yield on the deal's long bond shot up by 75 basis points over what CPS had been aiming for last week.

"Borrowing money was never a decision that we took lightly and though some wanted our efforts to fail, CPS needed to move forward in order to keep our doors open so we could educate our children," Ron DeNard, the CPS vice president of finance, said in a statement Wednesday night. "Along with the tough cuts announced yesterday and earlier this year, the sale of these bonds will produce sufficient proceeds to mitigate our cash flow challenges through the end of the fiscal year."

DeNard's comments appeared directed at Gov. Bruce Rauner, whose talk over the past week of a state takeover and possible bankruptcy for the district rattled the market, even though Democrats who control the General Assembly have called the legislative effort dead on arrival.

Several market participants said the fact the deal got done is an accomplishment for the beleaguered district, but its market access came at a dramatic cost.

"The numbers suggest they are on the brink of losing market access," said Richard Ciccarone, president of Merritt Research Services. "The numbers suggest there is a lot of doubt about whether CPS can find a method and means to solve its financial problems. Can this be a catalyst to bring together what looks like a polarized political situation?"

The CPS deal ended up being the largest deal of the week. The $1.2 billion Florida Hurricane Catastrophe Fund deal that topped the calendar, was "accidently placed" on the roster, and on Monday, JPMorgan said the deal would not hit the market this week.

On Monday, King County, Wash., sold $279.08 million of Series 2016A sewer refunding revenue bonds, with Bank of America Merrill Lynch winning the bid with a true interest cost of 3.27%. The bonds were priced to yield from 0.40% with a 3% coupon in 2016 to 3.22% with a 4% coupon in 2041.

On Tuesday, Barclays Capital won $120.14 million Nassau County, N.Y., Series 2016B general improvement bonds, as with a true interest cost of 2.45%. The bonds were priced to yield from 0.73% with a 5% coupon in 2017 to 2.63% with a 5% coupon in 2030.

Piper Jaffray priced San Antonio's $217.73 million of water system junior lien revenue refunding bonds consisting of Series 2016A and Series 2016B taxable bonds. The $174.955 million of tax-exempt bonds were priced to yield from 0.74% with a 5% coupon in 2018 to 3.39% with a 3.25% coupon in 2040.

The $42.775 million of taxable bonds were priced 30 basis points above the comparable Treasury maturity in the 2018 and 2019 maturities; 115 basis points above the comparable Treasury maturity in 2028; 125 basis points above the comparable Treasury maturity and 133 basis points above the comparable Treasury maturity in 2030.

The Florida State Board of Education sold $118.43 million of public education capital outlay refunding bonds to Wells Fargo at a true interest cost of 1.74%. The bonds were priced to yield from 0.45% with a 5% coupon in 2017 to 1.94% with a 5% coupon in 2028.

On Thursday, Morgan Stanley priced and then repriced Dallas Area Rapid Transit's $482.53 million of Series 2016A senior lien sales tax revenue refunding bonds. The bonds were repriced to yield from 1.92% with a 5% coupon in 2026 to 2.66% with a 5% coupon in 2036. Term bonds in 2041, 2046 and 2048 were repriced as 5s to yield 2.94%, 3.00% and 3.06%, respectively. The DART deal is rated Aa2 by Moody's and AA-plus by S&P.

In the competitive arena, the Metropolitan Atlanta Rapid Transit Authority, Ga., sold $242.985 million of refunding series 2016B sales tax revenue bonds, Third Indenture Series. The bonds were won by Morgan Stanley with a true interest cost of 3.30%. The bonds were priced to yield from 2.22% with a 5% coupon in 2030 to 2.64% with a 5% coupon in 2037. The deal is rated Aa2 by Moody's and AA-plus by S&P.

The Maryland University System competitively sold two issues totaling $201.33 million. The deals consist of $140 million of Series 2016A auxiliary facility and tuition revenue bonds and $61.33 million of refunding Series 2016B auxiliary facility and tuition revenue bonds. Both sales are rated Aa2 by Moody's and AA-plus by S&P.

The Series 2016A bonds were won by Citi with a TIC of 2.55%. The bonds were priced to yield from 0.41% with a 5% coupon in 2017 to 3.08% with a 3% coupon in 2036.

Citi also won the Series 2016B bonds with a TIC of 1.85%. The bonds were priced to yield from 0.41% with a 2% coupon in 2017 to 2.50% with a 2.375% coupon in 2030.

Municipal Bond Funds Saw Inflows for 18th Straight Week

Municipal bond funds reported inflows for the 18th week in a row, according to Lipper data released on Thursday.

Weekly reporting funds said they had $673.322 million of inflows in the week ended Feb. 3, after inflows of $594.785 million in the previous week, Lipper said.

The four-week moving average remained positive at $698.176 million after being in the green at $778.033 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $309.068 million in the latest week, on top of inflows of $485.450 million in the previous week. Intermediate-term funds had inflows of $302.935 million after inflows of $164.233 million in the prior week.

National funds saw inflows of $557.545 million after inflows of $531.623 million in the prior week. High-yield muni funds reported inflows of $78.600 million in the latest reporting week, after inflows of $221.250 million the previous week.

Exchange traded funds saw inflows of $87.774 million, after inflows of $93.222 million in the previous week.

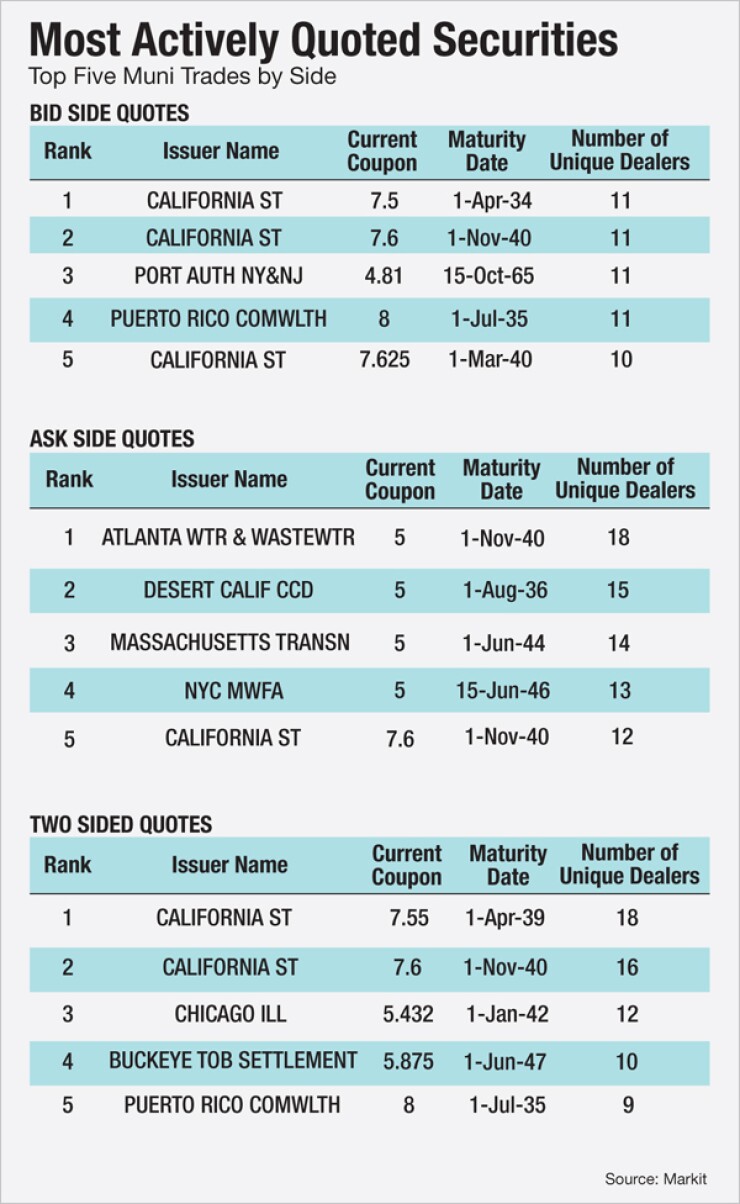

The Week's Most Actively Quoted Issues

California and Georgia were among some of the most actively quoted names in the week ended Feb. 5, according to data released by Markit.

On the bid side, the state of California taxable 7.5s of 2034 were quoted by 11 unique dealers. On the ask side, the Atlanta, Ga., water and wastewater revenue 5s of 2040 were quoted by 18 unique dealers. And among two-sided quotes, the state of California taxable 7.55s of 2039 were quoted by 18 dealers.

The Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended Feb. 5 were in Puerto Rico, New York and California, according to Markit.

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 traded 63 times. In the revenue bond sector, the New York state Thruway Authority 5s of 2019 traded 28 times. And in the taxable bond sector, the state of California 7.6s of 2040 traded 26 times, Markit said.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 36,370 trades on Thursday on volume of $8.063 billion.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar rose $7.18 billion to $11.93 billion on Friday. The total is comprised of $3.77 billion of competitive sales and $8.16 billion of negotiated deals.

Yvette Shields contributed to this report