Top quality municipal bonds were mostly steady at mid-session, traders said, as the market watched events unfold in the commonwealth of Puerto Rico and Atlantic City.

Debt News

Things calmed down in New Jersey this morning, as the Atlantic City Mayor Don Guardian announced the city had made its $1.8 million debt service payment for May. The mayor had brought up the prospect of defaulting on the debt late Friday. The city now faces the prospect of a vote on Thursday by the State Legislature on a takeover of its finances.

In Puerto Rico, the situation still remained murky as the Government Development Bank was set to default on its May bond payments. The GDB on Sunday said it reached an understanding on restructuring terms with a group of bondholders who own about $900 million of its outstanding debt. As part of the understanding, the bondholders and the GDB intend to talk terms over the next 30 days and forbear from pursuing legal action related to the May 1 payment during the talks.

Gov. Garcia Padilla was holding a press conference at press time to discuss the island’s responses.

Secondary Trading

The yield on the 10-year benchmark muni general obligation was as much as one basis point stronger from 1.61% on Friday, while the 30-year muni yield was unchanged from 2.58%, according to a read of Municipal Market Data's triple-A scale.

U.S. Treasuries were weaker on Monday. The yield on the two-year Treasury inched up to 0.79% from 0.77% on Friday, while the 10-year Treasury yield gained to 1.85% from 1.83% and the yield on the 30-year Treasury bond increased to 2.70% from 2.68%.

The 10-year muni to Treasury ratio was calculated at 88.5% on Friday compared with 88.3% on Thursday, while the 30-year muni to Treasury ratio stood at 96.6% versus 95.9%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 31,471 trades on Friday on volume of $9.78 billion.

Previous Week's Actively Traded Issues

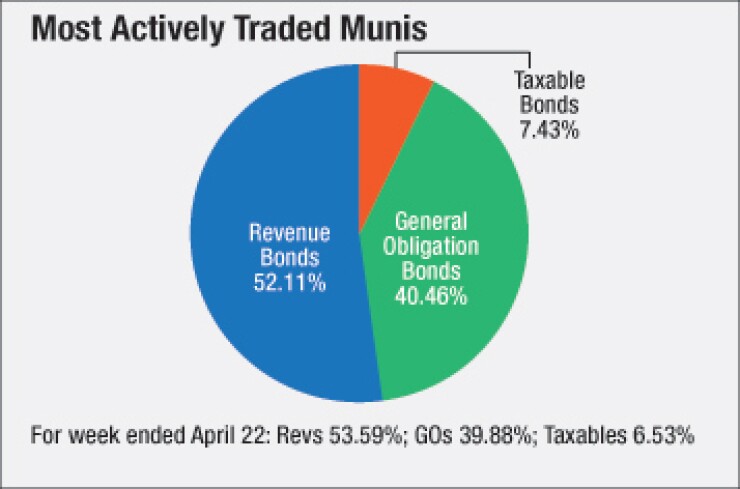

Revenue bonds comprised 52.11% of new issuance in the week ended April 29, down from 53.59% in the previous week, according to Markit. General obligation bonds comprised 40.46% of total issuance, up from 39.88%, while taxable bonds made up 7.43%, up from 6.53%.

Some of the most actively traded issues by type were from California issuers, according to data released by Markit.

In the GO bond sector, the California 3s of 2036 traded 26 times. In the revenue bond sector, the California SCDA 5 1/4s of 2056 traded 56 times. And in the taxable bond sector, the Riverside USD, Calif. 4 1/4s of 2036 traded 27 times, Markit said.

Primary Market

Municipal bond traders are set for the week’s scheduled $8.17 billion of new supply, which consists of $6.45 billion of negotiated deals and $1.72 billion of competitive sales.

Action kicks off on Monday as RBC Capital Markets gets set to price for retail the Dormitory Authority of the State of New York’s $219.29 million of Series 2016 A, B, C and D school district revenue bond financing program revenue bonds. The DASNY bonds will be priced for institutions on Tuesday.

The Series A bonds are rated A-plus by Standard & Poor’s and AA-minus by Fitch Ratings; the Series B bonds are rated Aa3 by Moody’s Investors Service and AA-minus by Fitch; the Series C bonds are rated AA-minus by S&P and Fitch; and the Series D bonds are rated A-plus by S&P and AA-minus by Fitch.

Also on Monday, Wells Fargo Securities is expected to price the Jacksonville Office of Economic Development, Fla.’s $125 million of healthcare facilities revenue refunding bonds (variable-rated demand notes) for the Mayo Clinic. The deal is rated Aa2 by Moody’s and A1-plus by S&P.

On Tuesday, Citigroup is expected to price the Louisiana Public Facilities Authority’s $150 million of revenue bonds for the Ochsner Clinic. The deal is rated Baa1 by Moody’s and A-minus by Fitch.

Bank of America Merrill Lynch is set to price Whiting, Ind.’s $120 million of Series 2016A environmental facilities revenue bonds for BP Products North America, Inc., on Tuesday. The deal is rated A2 by Moody’s and A-minus by S&P.

Citi is set to price on Tuesday for retail investors the Ohio Housing Finance Agency’s $112 million of residential housing mortgage revenue bonds under the mortgage-backed securities program. The institutional pricing is scheduled for Wednesday. The deal is rated triple-A by Moody’s.

In the competitive arena on Tuesday, Seattle, Wash, is selling three deals totaling $151 million. The sales consist of $107.54 million of Series 2016A limited tax general obligation improvement and refunding bonds; $37.75 million of Series 2016 unlimited tax GO improvement bonds; and $6.04 million of Series 2016B taxable limited tax GO improvement bonds. The Series 2016A and Series 2016B bonds are rated Aa1 by Moody’s and triple-A by S&P and Fitch and the Series 2016 bonds are rated triple-A by Moody’s, S&P and Fitch.

Also on Tuesday, the Dallas Community College District, Texas, is competitively selling $123.50 million of Series 2016 limited tax GO refunding bonds. The deal is rated triple-A by Moody’s, S&P and Fitch.

The Missouri Board of Public Buildings is competitively selling $100 million of Series 2016A special obligation bonds on Tuesday. The deal is rated Aa1 by Moody’s and AA-plus by S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $337.7 million to $12.82 billion on Monday. The total is comprised of $5.97 billion of competitive sales and $6.84 billion of negotiated deals.