Prices of top-rated municipal bonds finished steady on Monday, traders said, as the market prepares to take on a smaller slate of new issues, topped off by this week's $550 million sale from Massachusetts.

Secondary Market

The yield on the 10-year benchmark muni general obligation was unchanged from 2.00% on Friday, while the yield on the 30-year GO remained at 2.90%, according to the final read of MMD's triple-A scale. Trading was reported to be light in the secondary, Interactive Data reported.

Treasury prices were mixed on Monday as the yield on the two-year Treasury note increased to 0.52% from 0.51% on Friday, while the 10-year yield was flat at 1.92% and the 30-year yield decreased to 2.60% from 2.61%.

The 10-year muni to Treasury ratio was calculated on Monday at 104.0% versus 104.3% on Friday, while the 30-year muni to Treasury ratio stood at 111.1% compared to 110.8%, according to MMD.

Primary Market

Volume is falling off this week, with only around $4.7 billion of bonds scheduled to be sold. The calendar is made up of nearly $2.9 billion of negotiated deals and around $1.7 billion of competitive sales.

A forecast Friday from Ipreo and the Bond Buyer of $3.98 million in weekly volume didn't include the Massachusetts deal or a late entry by the New York State Dormitory Authority.

The state of Massachusetts is coming to market on Thursday with two separate competitive sales of general obligation bonds totaling $550 million. The offerings consist of $450 million of Series B consolidated loan of 2015 GOs and $100 million of consolidated loan of 2015 GOs. Proceeds will benefit various capital purposes.

The bonds are rated Aa1 by Moody's Investors Service and AA-plus by Standard & Poor's and Fitch Ratings.

The Bay State last sold bonds by competitive bid on Dec. 17, 2014, when it auctioned various issues.

The largest offering in the negotiated sector is a $275 million sale from DASNY.

Siebert, Brandford, Shank is expected to price the State University of New York's Series 2015A dormitory facilities revenue bonds for institutions on Thursday after a one-day retail order period on Wednesday. The DASNY issue is rated Aa3 by Moody's and AA-plus by S&P and Fitch.

Also in the competitive arena this week is a $218.01 million offering from the Humble Independent School District in Texas.

The Series 2015A unlimited tax school building and refunding bonds will go up for bidding on Tuesday. The deal is backed by the Texas Permanent School fund guarantee and rated triple-A by Moody's and Standard & Poor's.

The last time the district sold bonds competitively was on April 10, 2007, when Prager Sealy won $25 million of Series 2007A unlimited tax school building bonds with a true interest cost of 4.6243%

Also a $209 million sale is on tap from the Grossmont Healthcare District in California. Goldman, Sachs is scheduled to the price the GO on Tuesday. The bonds are rated Aa2 by Moody's.

Bank of America Merrill Lynch is expected to price Nebraska's Public Power Generation Agency's Series 2015A revenue refunding bonds for the Whelan Energy Center's Unit 2. The bonds, set to come to market on Tuesday, are rated A2 by Moody's, BBB-plus by S&P and A-minus by Fitch.

And JPMorgan Securities is slated to price the New Hampshire Health and Educational Facilities Authority's $110 million of revenue bonds for the University System of New Hampshire. The issue is expected to be priced on Tuesday after a one-day retail order period. The bonds are rated Aa3 by Moody's and A-plus by S&P.

The Week's Most Actively Traded Issues

Among the most actively traded issues in the week ended April 24, were issuers from Chicago, Ohio and California, according to Markit.

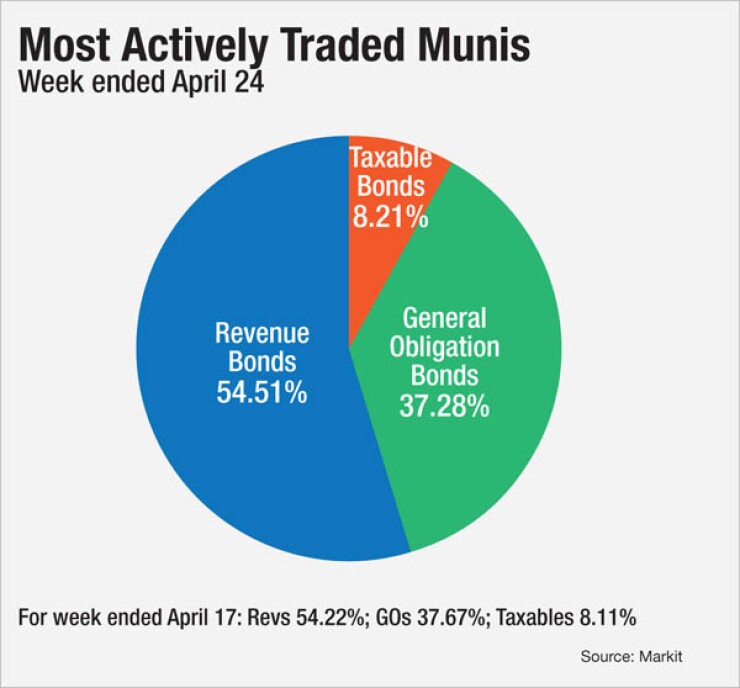

Broken down by market sector, revenue bonds comprised 54.51% of new issuance, up from 54.22% in the prior week. General obligation bonds comprised 37.28% of total issuance, down from 37.67%, while taxable bonds made up 8.21%, up from 8.11%.

In the revenue bond sector, the Allen County, Ohio, hospital facilities 4s of 2044 were traded 93 times. In the GO bond sector, the Chicago Board of Education 5 1/4s of 2039 were traded 112 times. And in the taxable bond sector, the California 1.8s of 2020 were traded 27 times, according to Markit.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 33,953 trades on Friday on volume of $12.865 billion.

The most active bond, based on the number of trades, was the Pennsylvania State Turnpike Commission's 2015 Subordinate Sub-Series A-1 revenue 4s of 2041, which traded 284 times at an average price of 99.75 with an average yield of 4.006%. The bonds were initially priced at 98.386 to yield 4.10%.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $863.8 million to $7.753 billion on Monday. The total is comprised of $3.142 billion competitive sales and $4.611 billion of negotiated deals.