Municipal bond market participants are ready for more supply on Tuesday as the New York State Environmental Facilities Corp. issue is set to be priced for institutions.

Secondary Market

U.S. Treasuries were little changed on Tuesday. The yield on the two-year rose to 1.30% from 1.29% on Monday, while the 10-year Treasury yield was unchanged from 2.47%, and the yield on the 30-year Treasury bond decreased to 3.08% from 3.09%.

Top-rated municipal bonds ended stronger in quiet activity on Monday. The 10-year benchmark muni general obligation yield fell two basis point to 2.38% on Monday from 2.40% on Friday, while the yield on the 30-year GO dropped two basis point to 3.16% from 3.18%, according to the final read of Municipal Market Data's triple-A scale.

On Monday, the 10-year muni to Treasury ratio was calculated at 96.3%, compared with 96.0% on Friday, while the 30-year muni to Treasury ratio stood at 102.3%, versus 102.2%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 38,134 trades on Monday on volume of $7.88 billion.

Primary Market

Bank of America Merrill Lynch is set to price for institutions the New York State Environmental Facilities Corp.'s $594.39 million of state clean water and drinking water revolving funds revenue bonds for New York City Municipal Water Finance Authority projects.

The deal was priced for retail on Monday. The Series 2017A second resolution subordinated SRF bonds were priced for retail to yield from 1.14% with a 5% coupon in 2019 to 3.20% with a 3.125% coupon in in 2031, as 3 1/2s to yield 3.60% in 2035, as 4s to yield 3.47% in 2037 and as 5s to yield 3.29% in 2046. The 2017 and 2018 maturities were offered as sealed bids. There were no retail orders taken in the 2032-2035 or 2042 maturities.

The deal is rated triple-A by Moody's Investors Service, S&P Global Ratings and Fitch Ratings.

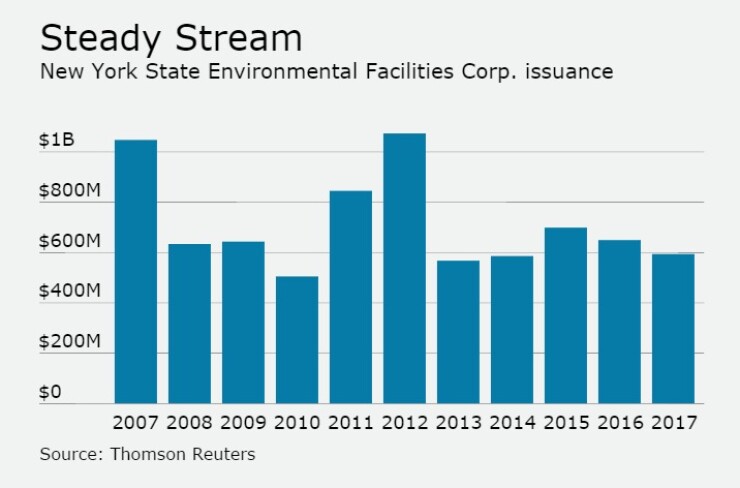

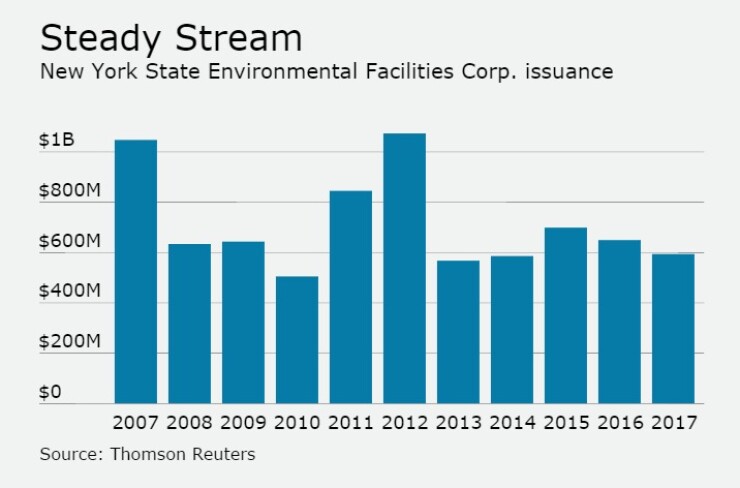

Since 2007, the NYS EFC has issued about $7.7 billion of debt, with the most issuance occurring in 2012 when it sold $1.07 billion and the least happening in 2010 when it offered $505 million.

On Tuesday Goldman Sachs is scheduled to price the Dutchess County Local Development Corp.'s $100.58 million of Series 2017 revenue refunding bonds for Vassar College.

The deal is rated Aa3 by Moody's and AA-minus by S&P.

Goldman is also set to price the Oregon Department of Administration Services' $239.32 million of tax-exempt and taxable state lottery revenue bonds for retail investors on Tuesday ahead of the institutional pricing on Wednesday.

The deal is rated Aa2 by Moody's and triple-A by S&P.

In the competitive arena, the San Francisco Unified School District will sell two deals totaling $239.9 million on Tuesday.

The offerings are composed of $180 million election of 2016 Series A general obligation bonds and $59.9 million of 2017 GO refunding bonds. Both sales are rated Aa2 by Moody's, AA-minus by S&P and triple-A by Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $75.5 million to $9.99 billion on Tuesday. The total is comprised of $3.95 billion of competitive sales and $6.04 billion of negotiated deals.