Municipal bond traders were winding down the week, set for a quiet day with not much expected to happen on a sleepy summer Friday.

Secondary Market

U.S. Treasuries were mostly stronger on Friday. The yield on the two-year Treasury dropped to 0.68% from 0.71% on Thursday, as the 10-year Treasury yield declined to 1.49% from 1.51% and the yield on the 30-year Treasury bond was unchanged at 2.23%.

Top-shelf municipal bonds finished stronger on Thursday. The yield on the 10-year benchmark muni general obligation fell one basis point to 1.41% from 1.42% on Wednesday, while the yield on the 30-year muni dropped one basis point to 2.12% from 2.13%, according to the final read of Municipal Market Data's triple-A scale.

On Thursday, the 10-year muni to Treasury ratio was calculated at 93.3% compared to 93.7% on Wednesday, while the 30-year muni to Treasury ratio stood at 95.1% versus 95.6%, according to MMD.

MSRB: Previous Session's Activity

The Municipal Securities Rulemaking Board reported 32,369 trades on Thursday on volume of $14.27 billion.

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended July 29 were from Nebraska and California issuers, according to

In the GO bond sector, the Sarpy County School District, Neb., 3s of 2039 were traded 27 times. In the revenue bond sector, the California 4s of 2041 were traded 81 times. And in the taxable bond sector, the California 7.55s of 2039 were traded 25 times.

Week's Most Actively Quoted Issues

California and Texas issues were among the most actively quoted names in the week ended July 29, according to Markit.

On the bid side, the California taxable 7.35s of 2039 were quoted by 10 unique dealers. On the ask side, the Texas GO 5s of 2044 were quoted by 16 unique dealers. And among two-sided quotes, the California taxable 7.55s of 2039 were quoted by 12 unique dealers.

Primary Market

The week saw issuance shoehorned in around the Federal Open Market Committee meeting. The Fed held interest rates steady, but noted improvement that may set the stage for the next rate hike, although Friday's below-expectations gross domestic product number may dampen Fed enthusiasm for a hike.

JPMorgan Securities priced the Illinois Finance Authority's $1 billion of Series 2016C revenue bonds for the Presence Health Network. The deal, upsized from an expected $968 million, is rated Baa3 by Moody's Investors Service, BBB-minus by S&P Global Ratings and BBB by Fitch Ratings.

Morgan Stanley priced the California Health Facilities Financing Authority's $849.73 million of revenue bonds for Sutter Health. The deal is rated Aa3 by Moody's and AA-minus by S&P and Fitch.

Barclays Capital priced the $608.9 million Michigan Finance Authority's taxable and tax-exempt bonds for the city of Detroit under the Local Government Loan Program, (distributable state aid refunding local project bonds).

The Series 2016C-1 taxables are rated Aa2 by Moody's and AA by S&P; the Series 2016C-2 taxables are rated A1 by Moody's and A-plus by S&P; the Series 2016C-3 tax-exempts and the Series 2016C-4 taxables are rated A2 by Moody's and A-minus by Fitch.

Bank of America Merrill Lynch priced the Indiana Finance Authority's $468.05 million of highway revenue refunding bonds. The deal is rated Aa1 by Moody's and AA-plus by S&P and Fitch.

RBC Capital Markets priced the state of Wisconsin's $372.27 million of GO refunding bonds of 2016, Series 2. The deal is rated Aa2 by Moody's and AA by S&P and Fitch and Kroll Bond Rating Agency.

Citigroup priced Tennessee's $298.64 million of tax-exempt GO. The deal is rated triple-A by Moody's, S&P and Fitch.

Morgan Stanley priced the Rhode Island Health and Educational Building Corp.'s $267.18 million of Series 2016 hospital financing revenue refunding bonds for the Lifespan Obligated Group. The deal is rated BBB-plus by S&P and Fitch.

Goldman Sachs priced Ohio's $218.23 million of major new state infrastructure project revenue bonds. The 2017 maturity was offered as a sealed bid. The deal is rated Aa2 by Moody's and AA by S&P.

In the competitive sector, Miami-Dade County, Fla., sold two separate issues totaling $224.81 million. The $193.4 million of Series 2016B capital asset acquisition special obligation refunding bonds were won by Bank of America Merrill Lynch with a true interest cost of 2.54%. The $31.41 million of Series 2016A capital asset acquisition special obligation bonds were won by PNC Capital Markets with a TIC of 3.19%. Both deals are rated Aa3 by Moody's and AA-minus by S&P.

The Florida Board of Education competitively sold $213.1 million of lottery revenue refunding bonds, which were won by Morgan Stanley with a TIC of 1.46%. The deal is rated A1 by Moody's, AAA by S&P and AA by Fitch.

North Carolina competitively sold $200 million of general obligation public improvement bonds for Connect NC. Citi won the deal with a TIC of 2.08%. The deal is rated triple-A by Moody's, S&P and Fitch.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar increased $3.64 billion to $16.25 billion on Friday. The total is comprised of $5.31 billion of competitive sales and $10.93 billion of negotiated deals.

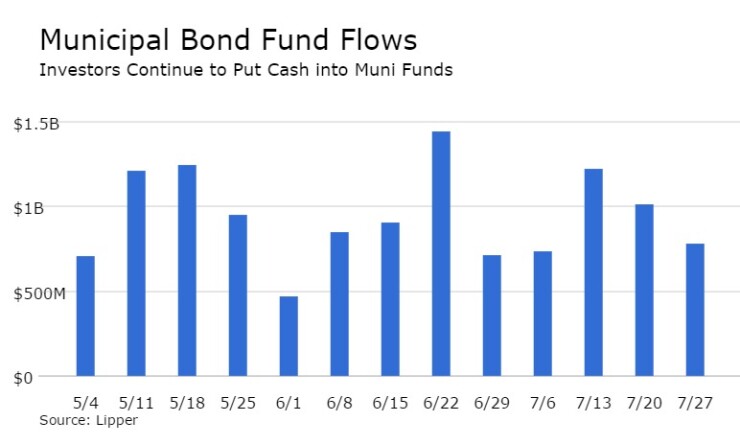

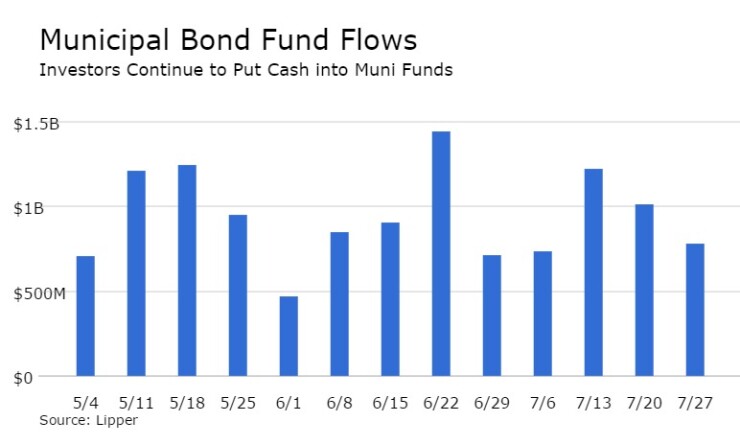

Lipper: Muni Bond Funds See Inflows

For the 43rd straight week, municipal bond funds reported inflows, according to Lipper data released on Thursday.

The weekly reporters saw $782.940 million of inflows in the week ended July 27, after inflows of $1.014 billion in the previous week, Lipper said.

The four-week moving average remained positive at $939.178 billion after being in the green at $922.446 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds experienced inflows, gaining $658.429 million in the latest week after inflows of $671.101 million in the previous week. Intermediate-term funds had inflows of $23.786 million after inflows of $254.709 million in the prior week.

National funds had inflows of $634.324 million on top of inflows of $882.469 million in the previous week. High-yield muni funds reported inflows of $206.715 million in the latest reporting week, after inflows of $281.660 million the previous week.

Exchange traded funds saw inflows of $166.130 million, after inflows of $192.991 million in the previous week.