A $387 million Kentucky issue came to market on Wednesday even as much of the municipal bond market was still digging out and getting back to normal after an East Coast snowstorm curtailed trading activity on Monday and Tuesday.

Prices of high-quality municipal bonds were stronger along with Treasuries, traders said, after the Federal Open Market Committee kept interest rates unchanged.

The Federal Reserve indicated a steady monetary policy, preaching patience while calling "risks to the outlook for economic activity and the labor market" nearly balanced. Muni yields were down as much as three basis points at close of trading.

Primary Market

Citigroup Global Markets priced the $386.845 million Kentucky State Property and Building Commission bonds in two series.

The $132.095 million of new money revenue bonds, Project No. 108 Series A, were priced to yield from 0.40% with a 2% coupon in 2016 to 2.97% with a 5% coupon in 2034; a 2015 maturity was offered as a sealed bid.

The $254.75 million of refunding revenue bonds, Project No. 108 Series B, were priced to yield from 0.40% with a 5% coupon in 2016 to 2.49% with a 5% coupon in 2026; a 2015 maturity was offered as a sealed bid.

Both series are rated Aa3 by Moody's Investors Service and A-plus by Standard & Poor's and Fitch Ratings.

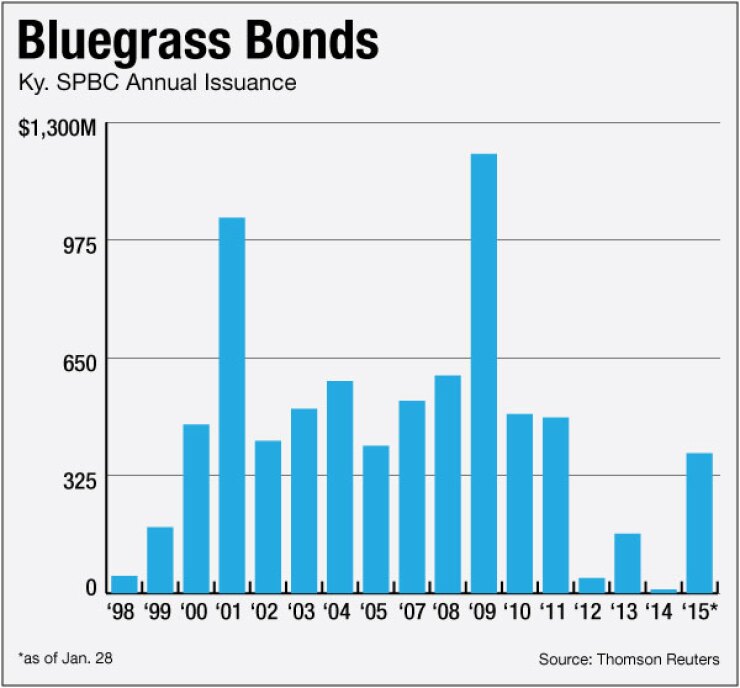

Since 1998, the commission has issued almost $7.6 billion of bonds. The biggest issuances were seen in 2001 and 2009 when over $1 billion of bonds were sold while the lowest issuance was in 1998, 2012 and 2014 when less than $50 million of bonds were sold.

In the current interest rate environment, the SPBC estimates the refunding's present value savings at about $30.6 million, or 11% of refunded par, Ryan Barrow, executive director of Kentucky's Office of Financial Management, told The Bond Buyer on Monday.

Elsewhere, Morgan Stanley priced $119.095 million Glendale, Ariz., senior lien water and sewer revenue refunding obligations. The bonds were priced to yield from 0.83% with a 4% coupon in 2018 to 2.54% with a 5% coupon in 2028. The issue is rated A1 by Moody's an AA by S&P.

Meanwhile, the Florida state Board of Education said it will sell $236.495 million of full faith and credit public education capital outlay refunding bonds in a competitive sale on Thursday. The bonds are rated Aa1 by Moody's and AAA by S&P and Fitch.

On Monday, Morgan Stanley priced the Utah Transit Authority's $854.19 million Series 2015A sales tax revenue refunding bonds and 2015 subordinated sales tax revenue refunding bonds. The 2015A bonds were priced with a top yield of 3.08% in 2036 and the 2015 bonds were priced with a top yield of 3.13% in 2037. The UTA saw net present value savings of $77.7 million or 8.8% on the deal, according to Robert Biles, UTA chief financial officer.

Atlantic City, N.J., earlier this week postponed its $12 million bond anticipation note competitive sale, originally scheduled for Tuesday, due to the weather. The BAN sale is still being planned for the end of the week or at the start of next week, but no final decision has been made, officials said on Wednesday.

Secondary Market

Prices of top-rated munis were stronger, traders said, with yields falling from one to three basis points.

The yield on the 10-year benchmark general obligation was down three basis points to 1.75% from 1.78% on Tuesday, while the yield on 30-year GOs fell three basis points to 2.54% from 2.57%, according to the final read of MMD's triple-A benchmark scale.

Treasury prices were higher, with the two-year note yield falling to 0.49% from 0.52% on Tuesday. The 10-year yield dropped to 1.73% from 1.82%, while the 30-year yield declined to 2.32% from 2.39%.

The 10-year muni to Treasury ratio increased to 101.7% from 97.8% on Tuesday, while the 30-year muni to Treasury ratio rose to 110.9% from 107.1%

MSRB Reports Previous Session's Activity

The Municipal Securities Rulemaking Board reported 29,414 trades on Tuesday on volume of $6.134 billion. Most active on Tuesday, based on the number of trades, was the Hawaii State Department of Budget and Finance's 2015 Series A special purpose revenue bonds for the Queens Health System 4s of 2040, which traded 58 times with an average price of 104.211 and an average yield of 3.514%.