Municipal bond market participants will look with interest as the city of Detroit returns to the market with its first post-bankruptcy bond sale on Wednesday.

Barclays Capital will price the Motor City's $245 million of local government loan program revenue bonds, which are being issued through the Michigan Finance Authority.

The deal will consist of Series 2014F 1 and 2 bonds: $134.73 million tax-exempts and $110.28 million of taxables. The issue is being converted from variable-rate bonds owned by Barclays to fixed-rate current interest bonds.

According to the investor roadshow, proceeds will be used to "refund $120 million debtor-in-possession/quality of life financing; finance reinvestment and revitalization incentive projects in the city; pay all or a portion of the city's obligations with respect to certain classes of claims; fund a debt service reserve account; and pay costs of issuance."

The documents add "on the conversion date, [Sept. 1] the city will retire $30 million of the taxable portion of the original December 2014 transaction, reducing its borrowing to $245 million from $275 million."

The bonds are enhanced with a statutory lien and intercept feature on Detroit's income tax, which will pay off the bonds. These protections, along with debt-service coverage levels of 6.5 times, helped the deal get an A rating from Standard & Poor's.

Several market participants on Tuesday said preliminary pricing scales put the yield on a tax-exempt term bond due in 2029 at 4.75%, about 225 basis points over the Municipal Market Data's top-rated benchmark and 150 basis points over an A-rated one.

The taxable piece with an average five-year life was expected to price at about 300 basis points over comparable Treasuries, market sources said.

"It's not a bad deal for the city. Everybody's got a short memory," one buyside representative told The Bond Buyer, referring to the steep haircut many bondholders suffered before Detroit exited Chapter 9 late last year.

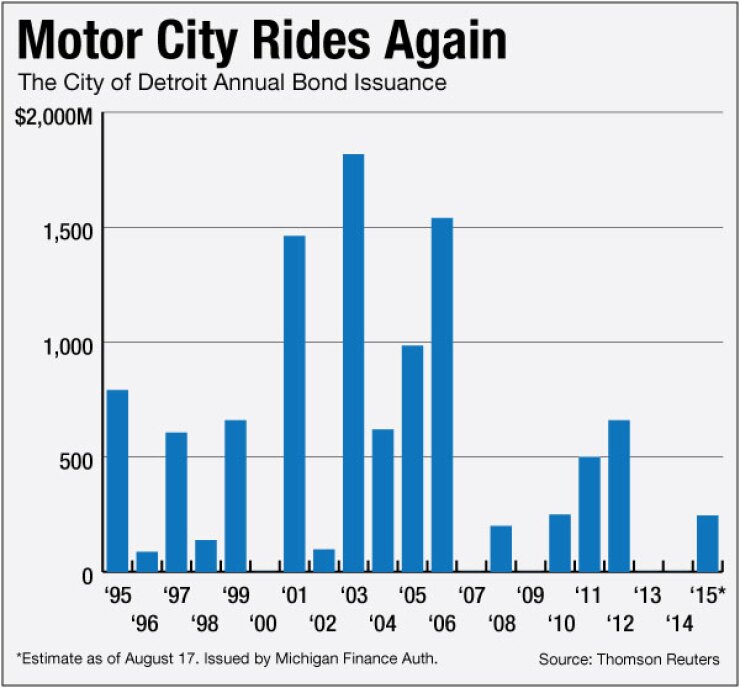

Since 1995, the city of Detroit has issued roughly $10.65 billion of debt. The years of 2003 and 2006 saw the most issuance with $1.82 billion and $1.54 billion, respectively. The Motor City did not issue any debt in 2000, 2007, 2009, 2013 and 2014.

Barclays is also set to price the Illinois Finance Authority's $400 million of Series 2015A revenue bonds for the University of Chicago. The issue is rated Aa2 by Moody's Investors Service, AA by S&P and AA-plus by Fitch Ratings.

Goldman, Sachs is slated to price the New York Metropolitan Transportation Authority's $398 million of Series 2015D transportation revenue refunding bonds for retail. The institutional pricing is set for Thursday.

Secondary Trading

Treasury prices were mixed on Wednesday, with the yield on the two-year Treasury note rising to 0.72% from 0.71% on Tuesday, while the 10-year yield rose to 2.20% from 2.19% and the 30-year yield flat at 2.86%.

The yield on the 10-year benchmark muni general obligation on Tuesday rose one basis point to 2.21% from 2.20% on Monday, while the yield on the 30-year GO increased by two basis points to 3.08% from 3.06%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated on Tuesday at 100.6% versus 102.2% on Monday, while the 30-year muni to Treasury ratio stood at 107.6% compared to 109.1%, according to MMD.

MSRB Previous Session's Activity

The Municipal Securities Rulemaking Board reported 37,668 trades on Tuesday on volume of $7.682 billion.

The most active bond, based on the number of trades, was the Washington state Series r-2015C various purpose general obligation refunding 5s of 2029, which traded 201 times at a high/low price of 118.225/117.912, and a high/low yield of 2.81%/2.775%. The bonds were initially priced at 124.013 to yield 2.33%.

Bond Buyer Visible Supply

The Bond Buyer's 30-day visible supply calendar decreased $982.0 million to $8.83 billion on Wednesday. The total is comprised of $2.46 billion competitive sales and $6.37 billion of negotiated deals.

Yvette Shields contributed to this report