With a lot of market participants out of the office before the holiday weekend, muni yields fell in a short trading session, as the calendar dried up for the four-day week ahead.

Primary Market

Total volume for the July 4th holiday shortened week ahead is estimated by Ipreo at just $1.5 billion, after a revised total of $8.7 billion was sold in the past week, according to Thomson Reuters data. The calendar includes $764 million of negotiated deals and $740 million of competitive sales.

"It is a great time to come to the market as an issuer," said Mikhail Foux, director, research, at Barclays Capital. "A back-up in yields should bring even more money into the asset class, but munis are already benefitting from domestic and foreign inflows as a relatively safe, high quality fixed income product."

There are only three deals that are larger than $100 million on the calendar.

"The few deals selling next week should see good demand, with cash needing to be deployed based on continued strong mutual fund inflows," said Alan Schankel, municipal strategist at Janney. "It's notable that inflows continue, despite record low interest rates."

The largest deal next week will be a competitive offering of $204.015 million from the South Carolina Transportation and Infrastructure Bank. The revenue refunding bonds will be sold on Thursday and the deal is rated A1 by Moody's Investors Service and A by Fitch Ratings.

Wells Fargo Securities is expected to price the largest negotiated offering, also on Thursday, for Wake Forest University's $175 million of educational facilities revenue and revenue refunding bonds.

Raymond James is scheduled to price the Coppell Independent School District's $137.485 million of unlimited tax school building and refunding bonds on Thursday. It is expected to mature serially from 2017-2046.

"Deals might be struggling a little bit this week after a large drop in yields, but the market unease is likely to be short-lived, in our view," said Foux. "Higher yields would help even more, but we could see very few market developments that could negatively affect the muni market, taking yields substantially higher from current levels. The U.S. presidential election is likely the biggest possible challenge on the horizon."

The other sizeable deal on the calendar that is expected to price before Thursday is a $97 million offering by Chester County, Pa. RBC Capital Markets is scheduled to run the books on the GO bonds on Wednesday. The deal is rated triple-A by Moody's, S&P Global Ratings and Fitch.

Schankel said that one of the more notable things he has seen is the uptick in new money deals.

"Based on [Bond Buyer numbers on volume], we are closing the gap between 2015 and 2016, and are only 3.6% behind," Schankel said. "More notable is the increase in new money financing this year, which is up 12.9%, which indicates to me that state and local government is moving beyond the general caution of the post recessionary period."

Secondary Market

Top-rated municipal bonds finished stronger on Friday, traders said, as yields fell by as much as three basis points.

The yield on 10-year benchmark muni general obligation dropped one basis point to 1.34% from 1.35% on Thursday, while the 30-year muni yield declined three basis points to 1.99% from 2.02%, according to the final read of Municipal Market Data's triple-A scale.

U.S. Treasuries were mixed on Friday. The yield on the two-year Treasury rose to 0.60% from 0.58% on Thursday, while the 10-year Treasury yield declined to 1.46% from 1.47% and the yield on the 30-year Treasury bond decreased to 2.25% from 2.28%.

The 10-year muni to Treasury ratio was calculated at 91.8% on Friday compared to 91.0% on Thursday, while the 30-year muni to Treasury ratio stood at 88.5% versus 87.7%, according to MMD.

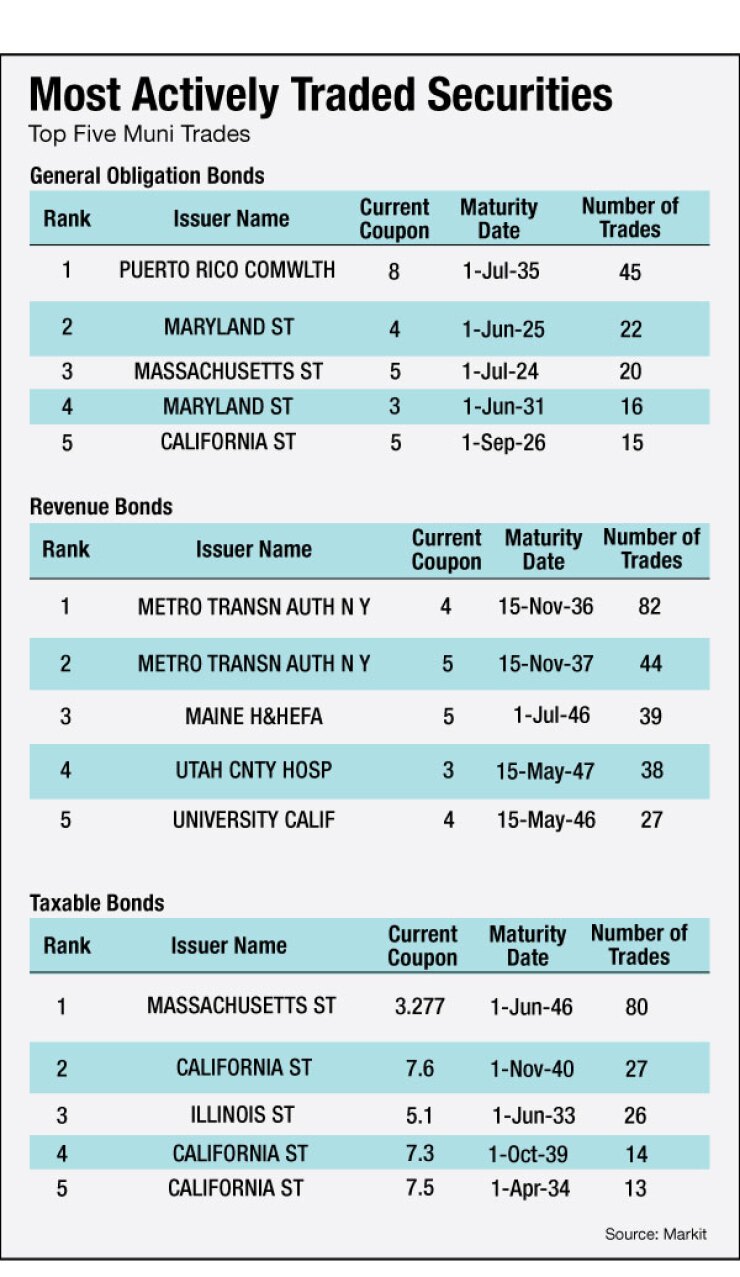

Week's Most Actively Traded Issues

Some of the most actively traded issues by type in the week ended July 1 were from Puerto Rico, New York and Massachusetts, according to

In the GO bond sector, the Puerto Rico Commonwealth 8s of 2035 were traded 45 times. In the revenue bond sector, the N.Y. MTA 4s of 2036 were traded 82 times. And in the taxable bond sector, the Massachusetts 3.277s of 2046 were traded 80 times.

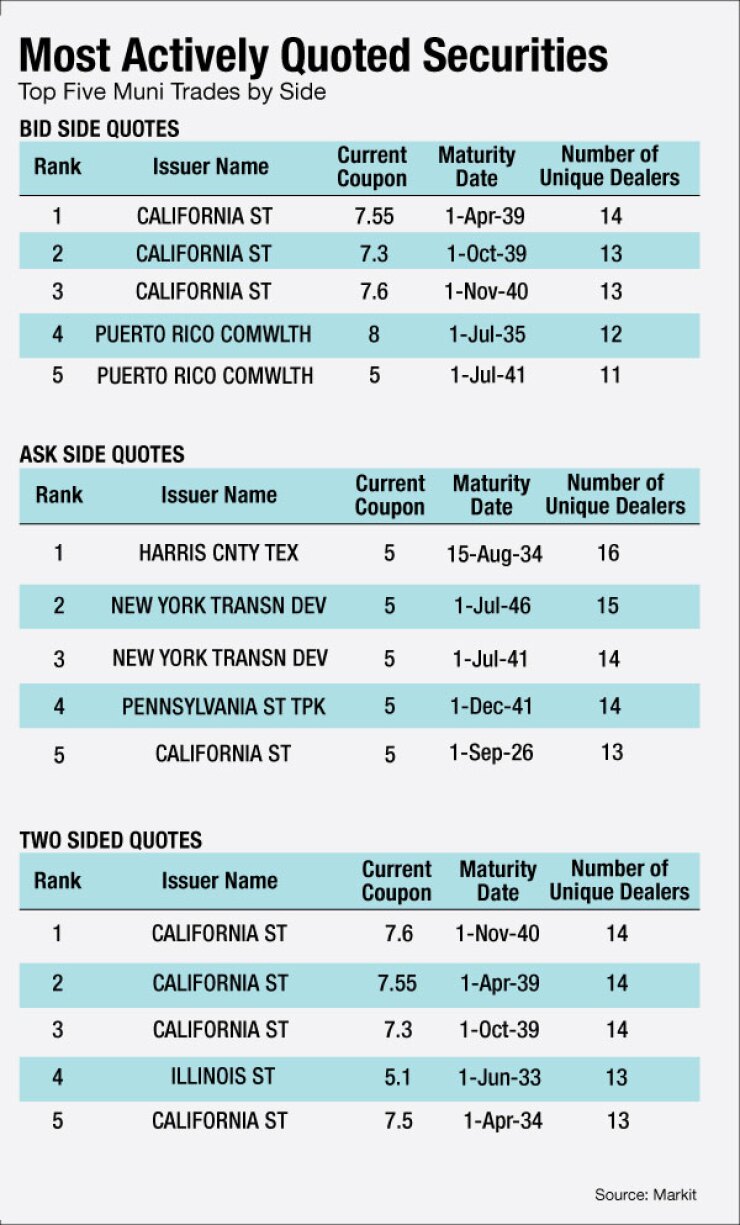

Week's Most Actively Quoted Issues

California and Texas issues were among the most actively quoted names in the week ended July 1, according to Markit.

On the bid side, the California taxable 7.55s of 2039 were quoted by 14 unique dealers. On the ask side, the Harris County, Texas revenue 5s of 2034 were quoted by 16 unique dealers. And among two-sided quotes, the California taxable 7.6s of 2040 were quoted by 14 dealers.

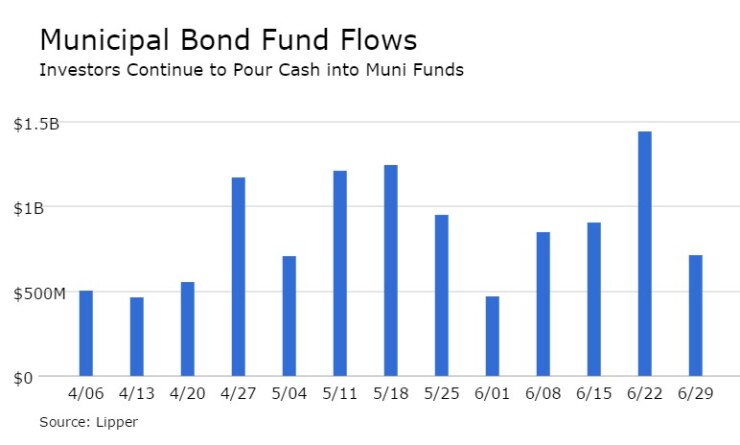

Muni Bond Funds Again See Inflows

For the 39th straight week, municipal bond funds reported inflows, according to Lipper data released Thursday. Weekly reporting funds saw $716.009 million of inflows in the week ended June 29, after inflows of $1.442 billion in the previous week, Lipper said.

The four-week moving average remained positive at $978.741 million after being in the green at $918.028 million in the previous week. A moving average is an analytical tool used to smooth out price changes by filtering out fluctuations.

Long-term muni bond funds also experienced inflows, gaining $671.567 million in the latest week after inflows of $1.039 billion in the previous week. Intermediate-term funds had inflows of $124.510 million after inflows of $240.123 million in the prior week.

National funds had inflows of $614.091 million on top of inflows of $1.304 billion in the previous week. High-yield muni funds reported inflows of $380.466 million in the latest reporting week, after inflows of $321.166 million the previous week.

Exchange traded funds saw inflows of $66.835 million, after inflows of $184.881 million in the previous week.