An $871 million toll road deal from Texas tops the coming week's municipal bond calendar as issuance is forecast to plunge heading into income tax season.

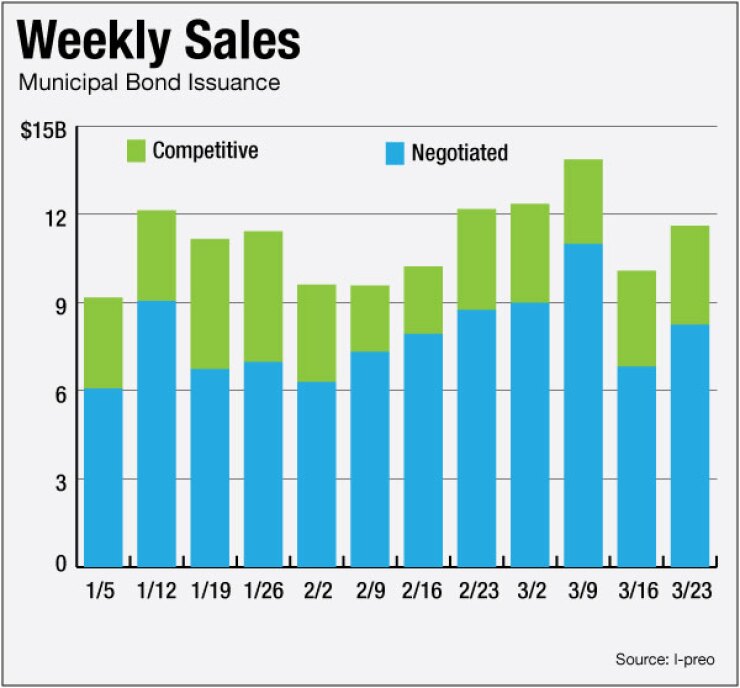

Weekly volume will drop to $6.96 billion according to Ipreo LLC and The Bond Buyer, the first time this year that forecasted issuance has dropped below $8 billion. Actual issuance was $5.22 billion in the past week, according to Thomson Reuters figures as of Thursday, compared with the $9.41 billion forecast.

Traders attributed the dip in sales to the holiday-shortened week before Easter and the looming April 15 deadline for U.S. income taxes, which typically causes a lull in issuance. First-quarter municipal volume was the highest since 2010 as issuers looked to take advantage of historically low interest rates ahead of an expected increase later this year.

"Volume is falling off a cliff as expected," a New York trader said. "It's a Thursday before a holiday and looking across the Street, volume is down 25% from yesterday."

The trader added that the lull in issuance before April 15 "is usually followed by a surge after people put Band-Aids on their wounds in the latter part of April and early May."

The North Texas Tollway Authority is expected for pricing on April 8 by JPMorgan Securities LLC.

The deal is structured to mature from 2032 to 2038, and is expected to be rated A3 by Moody's Investors Service and BBB-plus by Standard & Poor's.

One of the other large deals next week will be sold by the New York State Dormitory Authority and will be comprised of a two-pronged offering of revenue bonds on behalf of New York University.

The larger portion of the deal consists of $690.49 million of tax-exempt revenue debt, while an additional $265.96 million of taxable revenue bonds will also be priced for NYU.

Senior book-runner Morgan Stanley & Co. will price both series of bonds on Thursday with ratings of Aa3 by Moody's and AA-minus by Standard & Poor's.

The dormitory authority will sell an additional $125 million of revenue debt in a separate deal on behalf of The New School planned for pricing on April 7 by Goldman Sachs and rated A3 by Moody's and A-minus by Standard & Poor's.

Meanwhile, a $244 million sale of lease revenue and refunding bonds from the California Public Works Board will lead the activity in the Far West region after two California deals generated strong demand in the past week.

Rated A1 by Moody's and A by Standard & Poor's and Fitch Ratings, the public works bonds are expected to be priced by Goldman, Sachs on April 9, following a retail order period on April 8.

It will come to market via five different series that will be priced on the heels of this week's sale of $765.93 million California Department of Water Resources power supply revenue bonds, and a $500 million sale of taxable general revenue bonds from the Regents of the University of California.

Traders said the power bonds were attractively priced and oversubscribed. The bonds were rated Aa2 by Moody's, AA by Standard & Poor's, and AA-plus by Fitch.

Priced by JPMorgan on Wednesday for institutions, the bonds offered yields of 1.59% in 2021 and 1.78% in 2022 - both carrying split coupons of 2%, 3%, 4%, and 5% -- at a time when the generic, triple-A general obligation scale in 2021 and 2022 was yielding 1.39% and 1.58%, respectively, according to Municipal Market Data.

The university garnered demand for its bonds, which were priced at par to yield 4.767% and were rated Aa2 by Moody's and AA by two other major rating agencies.

Also ahead, a $225 million sale of North Carolina general obligation bonds is slated to be priced in the competitive market on Wednesday.

The bonds have triple-A ratings from all three major rating agencies and are structured to mature serially from 2016 to 2035.

The Pennsylvania Commonwealth Finance Authority will add to the activity in the negotiated market with a three-pronged sale totaling $196.28 million.

PNC Capital Markets will price the offering with three series -- $96 million of tax-exempt revenue bonds; $96.91 million of tax-exempt revenue refunding bonds; and $3.37 million of taxable revenue refunding bonds.