An Indiana toll operator's bankruptcy may prove to be just a bump in the road as public-private partnerships expand their role in financing the nation's highways, jails, airports and other infrastructure.

The most-traded P3 bonds have rallied this year, and retained gains since the Sept. 22 bankruptcy filing by the operator of the 157-mile Indiana Toll Road, according to data from the Municipal Securities Rulemaking Board's EMMA website and Markit, which track secondary trading. The nation's crumbling infrastructure and constrained federal, state and local budgets may compel governments to turn more often to P3s, which in turn may lead to further bond issuance, mitigating the lack of new supply that has plagued the bond market this year, analysts said.

Analysts also said that the bonds typically have higher yields, which will keep buyers interested in them even if the Indiana Toll Road bankruptcy reveals some of transportation P3's risks.

"I think there will still be a market for the [P3] bonds," Dan Heckman, senior fixed income strategist at U.S. Bank, said in an interview. "I'm not sure the market is going to go away because of what happened in Indiana."

Toll Road Specific

ITR Concession Company Holdings, parent of ITR concession Company, which manages the Indiana Toll Road, filed for Chapter 11 protection on Sept. 22 — a bankruptcy that is more an example of risks associated with toll roads than with P3 deals in general, according to Heckman.

"A bigger problem than [dangers associated with P3s] is the reality for a lot of toll road authorities that the number of miles driven has been on a steady decline, so it makes it more challenging for toll roads to meet projections set forth based on revenues from a certain number of automobiles on the toll roads," Heckman said.

A Sept. 29 Congressional Research Service report said that traffic is almost 11% lower in 2013 than it was in 2007.

The same report noted that the Indiana Toll Road Authority is not the only P3 undergo financial troubles. It listed the South Bay Expressway in San Diego, the SH-130 in Texas, and the Pocahontas Parkway in Richmond, Va., as three examples of other P3s that have fiscal problems. All three are transportation P3s.

"The reality that traffic has been on a steady decline is not just an Indiana issue, its national," Heckman said.

Bond Market Demand

The buy side's appetite for P3 bonds probably won't decline because the securities are higher yielding and — outside of the recent issues with transportation P3s — have historically been secure credits, analysts said.

"The challenge in today's low-yield investment environment is that the income portion of a government bond has become very small," David Frei, vice president and senior portfolio manager of infrastructure fixed income at Montreal-based Fiera Capital, said in an interview. "Investors are therefore driven to seek yield-enhancing alternatives. Infrastructure debt is one such alternative that does not require sliding down the risk spectrum. Repayment of infrastructure bonds comes contractually through Government or quasi-government counterparties."

Anthony Valeri, senior vice president, research, of LPL financial, said in an interview that the infrastructure deficit in the U.S. boosts P3s' credit quality. The American Society of Civil Engineers gave the U.S. a "D-plus" rating in its 2013 infrastructure report. The Society estimated that the U.S. would need to invest $3.6 trillion in infrastructure by 2020.

"[P3 bonds] are typically a stronger credit quality issue because in the current environment where states' budgets are under so much stress, [states] will only allow financing on projects that are truly necessary," he said.

Frei said that P3 bonds are attractive because they are safer than similarly rated corporates.

"Studies from both Moody's and S&P have shown that default probabilities on infrastructure debt is consistent with, if not better than, that of comparably rated corporate securities," he said. "Furthermore, if a default happens, these studies have concluded that you are more likely to have greater recoveries on infrastructure debt than similarly rated corporate securities."

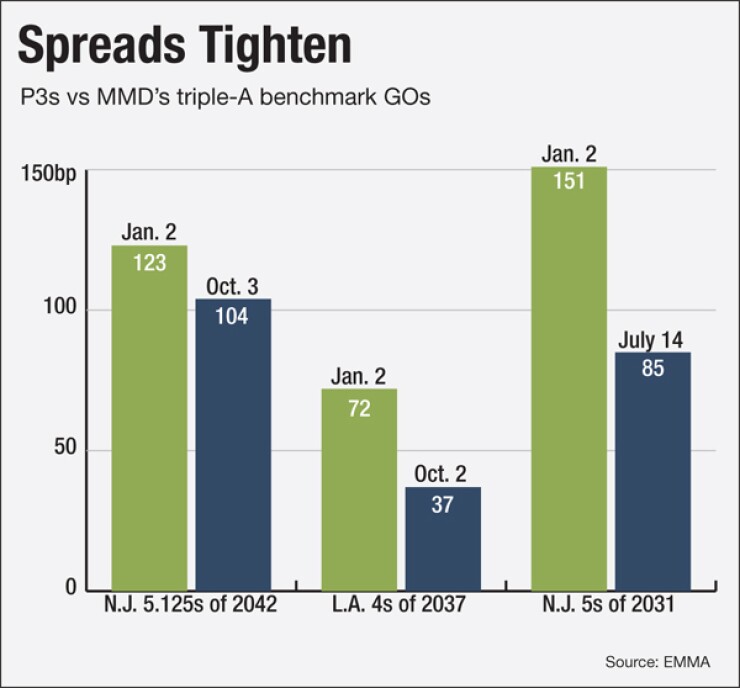

Spreads Tighten

The majority of the most actively traded P3 bonds have performed well. In a sample of five of the most actively traded P3 cusips provided by Markit, four out of the five had tighter spreads when they most recently traded than they did on Jan. 2.

The spread on New Jersey Economic Development Authority 5.125s of 2042 dropped by 19 basis points from the first trading day of the year to Oct. 3, according to EMMA. The NJ Economic Development Authority's 5s of 2031s also tightened, by 66 basis points as of their last trading day on July 14.

The spread on Los Angeles California International Airport 4s of 2037 fell by 35 basis points as of Oct. 2, while that on the Colorado Regional Transportation District 5.375s of 2025 declined by 116 basis points as of Sept 9 when they last traded.

The only cusip that widened in spread was the L.A. International Airport 5s in 2023, which widened 82 basis points by Oct 3.

All the data is taken from the highest yield the bonds were trading at on the days sampled, according to EMMA.

P3 Risks

Fred Bacani, head of fixed income and trading at Veritable LP in Newtown Square, Pa., said in an interview that in terms of infrastructure, it's important to note specific bondholder protections with respect to dilution.

"Existing bondholders can get diluted if infrastructure needs are financed with additional bonds," he said. "The indenture typically protects existing senior bondholders through a conditional 'additional bonds test' with minimum debt service coverage levels. However, subordinate bondholders oftentimes are exposed to limitless indebtedness, thus negatively impacting debt service coverage levels."

Heckman said he has noticed more P3 issuances coming more aggressive on the credit scale, and said that U.S. Bank avoids "getting involved in that section of the market."

Valeri called general obligation bonds issued by P3s a "safer sector," and said that area has a lower number of defaults.