As Puerto Rico teeters on default, more than 50% of all U.S. open-end municipal bond funds still have exposure to the island's debt, according to Morningstar Inc.

Of the 565 open end mutual funds, 298 — or 52.74% — have exposure to some type of Puerto Rico debt, including that issued by agencies and the commonwealth, as of June 29, Morningstar reported. That is down from 54.08% in February, and as much as 69.26% as previously reported by Morningstar in February 2014.

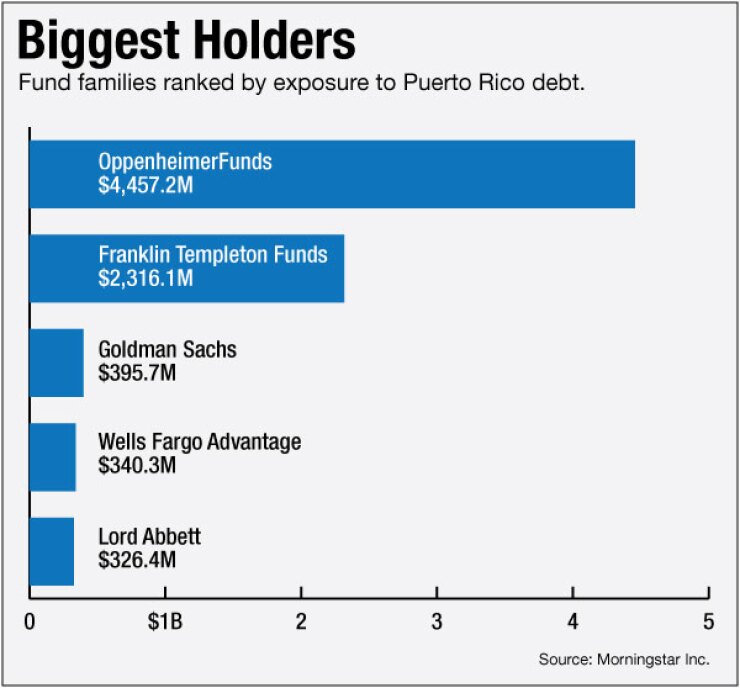

OppenheimerFunds and Franklin Templeton Investments have the highest ownership, with the market value of their exposure totaling $4.46 billion and $2.32 billion, respectively, according to the data. At Oppenheimer, 19 of 20 municipal funds are invested in the commonwealth, while 26 out of 32 municipal funds at Franklin own island debt.

On Monday, Gov. Alejandro Garcia-Padilla said the island cannot pay its $72 billion of municipal bond debt and called for a restructuring, which pressured Puerto Rico in the secondary market as prices declined and yields rose.

Municipal experts said the risks to fund investors are mitigated by bond insurance, and in some cases, the debt represents a very small allocation to their funds.

Ownership has declined in recent years as the island's fiscal and credit crisis became apparent, and could continue to diminish as traditional investors walk away and non-traditional investors step up to support the commonwealth's high-yielding debt.

"The distribution of Puerto Rico debt has changed significantly in the past two years, appearing to move away from the individual bondholder to the world of hedge funds and private equity," Jim Colby, portfolio manager of the Market Vectors suite of municipal exchange traded funds at Van Eck Global, wrote in his Muni Nation commentary on June 30.

Others say traditional high-yield funds could continue to hold island debt - albeit modestly - while an increase in non-traditional buyers is possible as Puerto Rico falls into worse fiscal shape.

Leland Crabbe, a former Federal Reserve Board economist, corporate bond strategist, and taxable bond portfolio manager, said risk management is a natural course of action when credits fall from investment grade to junk.

Under that scenario, "the bonds flow to junk specialists, and then if things get worse, from junk to distressed specialists," Crabbe said.

Due to the commonwealth's credit quality migration to below investment-grade, Colby said his firm's high-yield ETFs hold a modest amount of Puerto Rico debt.

The Market Vectors High-Yield Municipal Index ETF held 3.12% in Puerto Rico issuers, while the Market Vectors Short High-Yield Municipal Index ETF held 5.37%, as of June 26, according to the firm.

Richard Ciccarone, president of Merritt Research Services, said it is natural for the greatest exposure to be held by high-yield open and closed-end and exchange traded funds.

Traditional funds may decide to take their losses and move on - while many have already done so, experts said.

"Investment grade mutual funds have been reducing Puerto Rico for several years," Ciccarone said. "Traditional, conservative mutual funds should already have exited individual, non-insured Puerto Rico bonds."

He added, "new investments in Puerto Rico bonds are clearly speculative and should still only be for investors who are prepared to take losses if an eventual restructuring isn't all they hope it to be."

Meanwhile, reducing exposure to credits that are downgraded to junk is "standard script" for most traditional mutual bond funds, Crabbe said.

"Most of those funds practiced good risk management, reducing Puerto Rico when it was downgraded to junk, and reducing it more as it went to B, and to CCC," Crabbe said.

Crabbe said about half of municipal funds own some Puerto Rico, but the positions are small - on average about 3%.

"For a fund with, say, a 2% position, the mark-to-market hit for Puerto Rico will be about the same as the hit for guessing wrong on the move in interest rates in May-June," Crabbe said.

"If, at this point, they reduce Puerto Rico positions to zero, they can take a hit, and move on," he added. "I don't see this as systemic for the muni funds, in general, because they are not leveraged to Puerto Rico."

Others agreed that mutual funds are justified in holding Puerto Rico debt as long as their exposure is consistent with their investment policy and guidelines, and they have accurately disclosed the magnitude and risks to shareholders.

"There's no reason why the high-yield muni funds that are specifically allowed to invest in distressed, illiquid securities should steer clear of Puerto Rico within the limitations of their investment guidelines," Triet Nguyen, managing director at independent financial services firm NewOak, said on Wednesday.

"Where they may be at a disadvantage versus the hedge funds is in situations that call for direct cash investments as part of the solution," he said. "Most funds can only buy securities. Also, most funds are more income-oriented than total return-oriented."

With Puerto Rico now a distressed credit, Crabbe said traditional mutual funds that own the debt should be sensitive to the highly speculative nature of the holdings.

"The skill of evaluating whether a bond will deteriorate from AA to A is very different from the skill of negotiating a workout after default," he said.

"Investment grade portfolio management looks at duration risk, Fed policy, convexity, call optionality and the like," Crabbe added. "None of that matters for Puerto Rico. If you are involved in Puerto Rico, you need to have skills in workout negotiations and recovery analysis."

In addition, liquidity risk is a huge problem for traditional funds that own the Caribbean debt, he noted.

"By definition, mutual funds provide their investors with daily liquidity," Crabbe explained. "Yes, it may turn out that buying Puerto Rico at 50 cents on the dollar today will turn out great, but for a muni fund, that potential return will need to be tempered by the risk of liquidity from redemptions."

"Hedge funds can usually lock in investors for long horizons, which means they won't have to face the illiquidity risk that muni funds face," Crabbe added.

With Puerto Rico's restructuring hanging over the market, experts said those with and without Puerto Rico exposure should be wary of the impact of its future recovery on the overall municipal market.

"That Puerto Rico is at a clearly delineated crossroad is no longer in doubt," Colby wrote in his report. "As we have seen in the past, the municipal market has shown resilience under pressure that, in my opinion, is unsurpassed by many other asset classes. Puerto Rico, depending upon what solutions and actions are to be undertaken, promises to test that premise."