The supply-demand imbalance, a long-term volume horoscope, valuing climate change and pondering where the dust will settle on revenue pledges in post-Puerto Rico credit analysis were among the hot topics debated when the buyside and sellside converged for a conversation last week.

Meanwhile, the market digested a larger-than-usual calendar this week in a mostly steady primary market, led Thursday by Florida's Virgin Trains and a North Carolina deal.

From the conference

Loop Capital Markets managing director Christopher Mier said at The Bond Buyer’s Midwest Municipal Market Conference he is sticking with his 2019 estimate from last December of $322 billion. His team, though, expects primary issuance to “gradually build back toward $400 billion over the next four years” and that would get the market out of the current mismatch between excessive redemptions verse lackluster new-issue supply.

With rates still low and pent-up infrastructure demands, "why don’t borrowers accelerate issuance?" Mier was asked during a market panel discussion moderated by Grant Dewey, head of capital markets at Build America Mutual.

His answer?

“They are just really not able to respond to the market place like a corporation” due to rules that limit the time an issuer has to spend down bond proceeds after issuance and political considerations where rates often don’t take priority, Mier said.

Climate change is also weighing on market sentiment, as was discussed on the panel.

It’s “really become a risk factor” year-round and “we all need to get our arms around it” but there’s “no easy answer” on the best means to measure the exposure risk and building it into bond prices, said panel member Triet Nguyen, a managing partner at Axios Advisors.

Others agreed that the market has a ways to go on that front. “People are talking about it, but it’s lip service” and hard to quantify, said panel member Bill Grady, senior portfolio manager at Allstate, who equated the situation to where the pension discussion was at 15 years ago.

Shifts in coupon benefits are also afoot as investors consider how maximize their orders and some are veering from the traditional 5%. “It’s certainly an option. We’ve been looking hard at 4’s,” Grady said. With 4’s Grady said you could pick up 30-35 basis points but with “credit spreads so tight and absolute yields so low” it now closer to a 20 to 25 basis point pick up. “We are finding a little bit of competition in that space."

Grady said he’s seeing more 3% coupons in the municipal universe but he personally hasn’t shown much interest.

Panelists pondered the impact of the Puerto Rico bankruptcy rulings that have raised questions over the long-held beliefs of the inherent strengths of certain revenue pledges and special liens.

You can no long “fully decouple a revenue bond from a general obligation bond” but there are still strong legal protections in bankruptcy that lead to better negotiating positions so the market “shouldn’t completely dismiss the value,” said Steve Hlavin, portfolio manager at Nuveen Asset Management. A problem for Nuveen’s municipal analysts is the lack of sufficient legal precedent for guidance.

“Just a few years ago people were shifting into special revenue bonds from general obligation bonds. And now, if the risk is in the same bucket, why not just buy GOs?” said Bill Black, senior portfolio manager at City National Rochdale. “It gets more interesting as you go down the credit curve.”

Primary market

Morgan Stanley priced the Florida Development Finance Corp.’s $950 million of Series 2019B (Aaa-VMIG1/NR/NR) surface transportation facility revenue bonds subject to the alternative minimum tax for the Virgin Trains USA Passenger Rail project. The bonds are due Jan. 1, 2049 with a mandatory tender of March 17, 2020 and an earliest optional mode change on July 22. Proceeds will finance parts of Virgin Trains USA's project between Miami and Orlando.

The issue was priced at par to yield 1.90%. On Wednesday, the underwriter issued price guidance which had the issue priced at par to yield 1.95%.

The short-term structure is designed to allow the train company to comply with a deadline set by the U.S. Department of Transportation, which allocated the PABs in March and said they must be issued by June 30. The structure preserves the company's ability to issue long-term bonds in the future. Moody's Investors Service rated the bonds Aaa/VMIG1 because of the deal’s “strong legal structure and the high credit quality of investments” securing the debt.

In April, the FDFC sold $1.75 billion of USDOT-authorized bonds on behalf of Virgin Trains, formerly known as Brightline and All Aboard Florida. The tax-exempt bonds were sold to qualified institutional buyers under Rule 144A of the Securities Act of 1933 as a private activity placement in three series, each with mandatory puts.

A Florida trader said there was demand for the deal, especially given the timing amid reinvestment demand and yield potential in the low-rate environment. “I will be shocked if they didn’t have interest,” he said on Thursday afternoon, noting that there was a fully non-rated issue that sold on April 1 for the same project that was quickly snapped up.

Overall, he said the new-issue market is fundamentally sound and doing well; however, price gains and volume are less than robust.

“We all came into June with expectations for net-negative supply, solid demand, and continuous flow — which means constant buying and selling which continues to create price gains and high volumes — but we are not getting any of that,” the trader said.

Primary deals are seeing strong demand and getting done — at historically consistent prices — but otherwise the market is lackluster, he noted.

“You would think some activity would spill over into the secondary — especially because of the municipal to Treasury ratios — but you’re not seeing it,” the trader explained. “Buyers are buying in the primary and the secondary is languishing,” and not moving at the primary market levels due to the low-rate environment, he said.

“Secondary traders, dealers, and hedge fund accounts who rely on activity and flow are frustrated — they are not seeing the volume and turnover they believe they should be seeing because of the positive fundamentals,” he explained.

Wells Fargo Securities priced North Carolina’s (Aa1/AA+/AA+) $300 million of Series 2019A limited obligation Build NC bonds.

Goldman Sachs priced the Orange County Water District, Calif.’s (NR/AAA/AAA) $141.47 million of Series 2019A revenue certificates of participation interim obligations and SERIES 2019B refunding obligations), SERIES 2019B

Barclays Capital priced as a remarketing the Connecticut Health and Educational Facilities Authority’s (Aaa/AAA/NR) $100 million of Series 2013A and Series 2016A revenue bonds for Yale University.

In the competitive arena, the Beverly Hills Unified School District, Calif. (Aaa/AA+/NR) sold $160 million of Series A Election of 2018 unlimited tax general obligation bonds. Mesirow Financial won the issue with a true interest cost of 2.9817%. Proceeds will finance the acquisition, construction, repairing, upgrading and equipping of district facilities. Keygent was the financial advisor; Stradling Yocca was the bond counsel.

The Metropolitan Atlanta Rapid Transit Authority, Georgia (Aa2/AA+/NR) sold $127.15 million of Series 2019A sales tax revenue bonds. Wells Fargo Securities won the issue with a TIC of 2.98%. Hilltop Securities, First Tryon Advisors and TKG & Associates were the financial advisors. Holland & Knight was bond counsel.

In the short-term sector, the Chicago Board of Education sold $250 million of Series 2018G tax anticipation notes, due Aug. 15. Proceeds will be used for educational purposes. PFM Financial Advisors and TKG & Associates were the financial advisors; Ice Miller and Pugh Jones Johnson were the bond counsel.

Pennsylvania's $887 million bond sale Wednesday generated a present value savings of $79.3 million, which equates to roughly 7.8%, according to Steve Heuer, Director of the Commonwealth's Bureau of Revenue, Capital and Debt. "The demand for the deal was high, as it garnered six bidders," he said. "The sale exceeded our expectations."

Meanwhile, one Mid-Atlantic trader said that in general, there’s still very little in the way of allocations on negotiated deals and you’re stuck buying bonds a few days later up a point or more and in the secondary bids-wanted is "okay," but mostly in bank qualified paper in the two- to 10-year range that "doesn’t trade anyway."

"The Penn State University and Commonwealth of Pennsylvania deals hit the market like a dead cat this week," the trader said. "No disruptions, no bumps, no worries. There’s still a strong bid in the street and orders are getting filled. Nothing that will change the course of yields."

Separately, bonds from this week's Los Angeles Department of Airport’s (Aa3/AA-AA-) deal on behalf of Los Angeles International Airport had a varied impact on pricing when compared to the MMD scale.

“LAX comes 10 to 12 through the scale on the short end and 10 to 20 over the scale on the long end,” John Mousseau, president and chief executive officer of Cumberland Advisors, said Thursday of the Goldman Sachs-managed deal.

“This has become a pattern in high-tax state issues,” he explained, noting that he predicts a fair amount of airport money in high-tax states has piled into the front end of the curve at levels that are barely break even — if that — versus Treasuries.

Tuesday’s bond sales

CUSIP requests 41% surge in May

Municipal CUSIP requests surged 41.4% in May after gaining 3% in April, signaling an uptick in new issuance in the near term, according to CUSIP Global Services. It was the fifth straight monthly increase, the company reported on Thursday.

The aggregate total of all municipal securities — including municipal bonds, long-term and short-term notes, and commercial paper — increased to 1,438 last month from 1,017 in April.

"Corporate and municipal issuers have been busy over the past few months, clearly taking advantage of the sustained low-rate environment to raise new debt," said Gerard Faulkner, director of operations for CUSIP Global Services. "While year-to-date CUSIP request volumes are still in negative territory for several asset classes due to a slower pace in Q1, the recent trend has been toward a significant increase in pre-market activity among North American issuers."

Drilling down, request for municipal bond identifiers gained in May to 1,195 from 843 in April, while long-term notes increased to 41 from 22 and short-term notes rose to 145 from 97 as commercial paper and other securities gained to 57 from 55 last month.

On a year-over-year basis, total muni requests rose 9.2% to 5,195 from 4,757 in the same period in 2018 while muni bond requests were up 7.9% to 4,261 from 3,949 in the same time last year.

Among top state issuers, CUSIPs for scheduled public finance offerings from Texas, New York and California were the most active in February, with Texas on top with 173 requests.

Muni money market funds see outflows

Tax-exempt municipal money market fund assets fell $938.1 million, with total net assets dropping to $135.19 billion in the week ended June 10, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for the 187 tax-free and municipal money-market funds decreased to 1.06% from 1.11% in the previous week.

Taxable money-fund assets increased $13.12 billion in the week ended June 11, bringing total net assets to $2.998 trillion. The average, seven-day simple yield for the 805 taxable reporting funds fell to 2.01% from 2.04% in the prior week.

Overall, the combined total net assets of the 992 reporting money funds rose $12.18 billion to $3.134 trillion in the week ended June 11.

Secondary market

Munis were mixed on the

On Refinitiv Municipal Market Data’s AAA benchmark scale, the yield on the 10-year muni GO rose one basis point to 1.66% while the 30-year muni yield remained unchanged at 2.35%.

The 10-year muni-to-Treasury ratio was calculated at 79.5% while the 30-year muni-to-Treasury ratio stood at 90.5%, according to MMD.

“The muni bond market remains focused on new issues,” ICE Data Services said in a market comment. “Yields are steady in both investment-grade and high-yield names. Taxable yields are lower, generally in line with the movement in Treasuries today.”

Treasuries were stronger as stocks traded higher. The Treasury three-month was yielding 2.205%, the two-year was yielding 1.832%, the five-year was yielding 1.826%, the 10-year was yielding 2.098% and the 30-year was yielding 2.603%.

Previous session's activity

The MSRB reported 38,817 trades Wednesday on volume of $14.80 billion. The 30-day average trade summary showed on a par amount basis of $12.68 million that customers bought $6.28 million, customers sold $4.26 million and interdealer trades totaled $2.15 million.

California, Texas and New York were most traded, with the Golden State taking 16.612% of the market, Lone Star State taking 11.299% and the Empire State taking 10.248%.

The most actively traded security was the Michigan Finance Authority McLaren Series 2019A 4s of 2047, which traded 17 times on volume of $29.5 million.

Treasury auctions announced

The Treasury Department announced these auctions:

- $15 billion four-year 10-month TIPs selling on June 20;

- $26 billion 364-day bills selling on June 18;

- $36 billion 182-day bills selling on June 17; and

- $36 billion 91-day bills selling on June 17.

Treasury auctions bills

The Treasury Department Thursday auctioned $40 billion of four-week bills at a 2.215% high yield, a price of 99.827722. The coupon equivalent was 2.256%. The bid-to-cover ratio was 2.88. Tenders at the high rate were allotted 83.59%. The median rate was 2.180%. The low rate was 2.130%.

Treasury also auctioned $35 billion of eight-week bills at a 2.200% high yield, a price of 99.657778. The coupon equivalent was 2.244%. The bid-to-cover ratio was 3.12. Tenders at the high rate were allotted 81.48%. The median rate was 2.185%. The low rate was 2.150%.

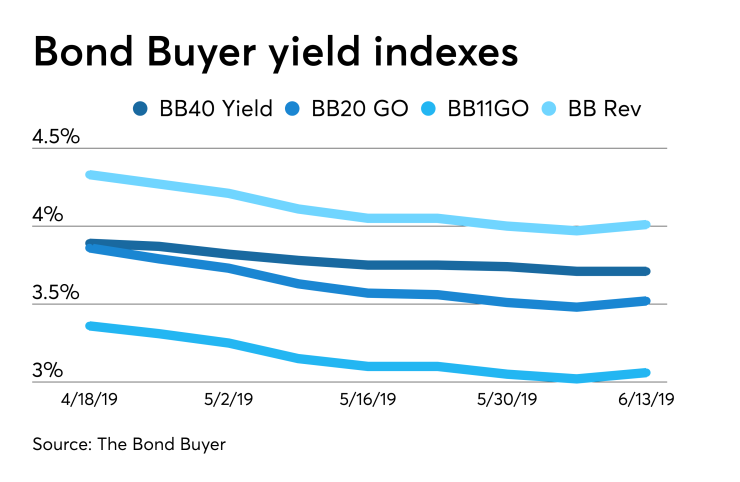

Bond Buyer yield indexes move mostly higher

The weekly average yield to maturity of The Bond Buyer Municipal Bond Index, which is based on 40 long-term bond prices, was unchanged at 3.71% the week before.

The Bond Buyer's 20-bond GO Index of 20-year general obligation yields increased to 3.52% from 3.48% the previous week.

The 11-bond GO Index of higher-grade 11-year GOs gained to 3.06% from 3.02% the previous week.

The Bond Buyer's Revenue Bond Index moved up to 4.01% from 3.97% from the week before. It is at its lowest level since Jan. 4, 2018, when it was at 3.92%.

The yield on the U.S. Treasury's 10-year note fell to 2.10% from 2.13%, while the yield on the 30-year Treasury dipped to 2.61% from 2.62%.

Shelly Sigo, Aaron Weitzman and Gary E. Siegel contributed to this report.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.