The two active municipal bond insurers benefited from the issuance boom in the third quarter, as the insurance penetration rate in munis rose even as interest rates went back down.

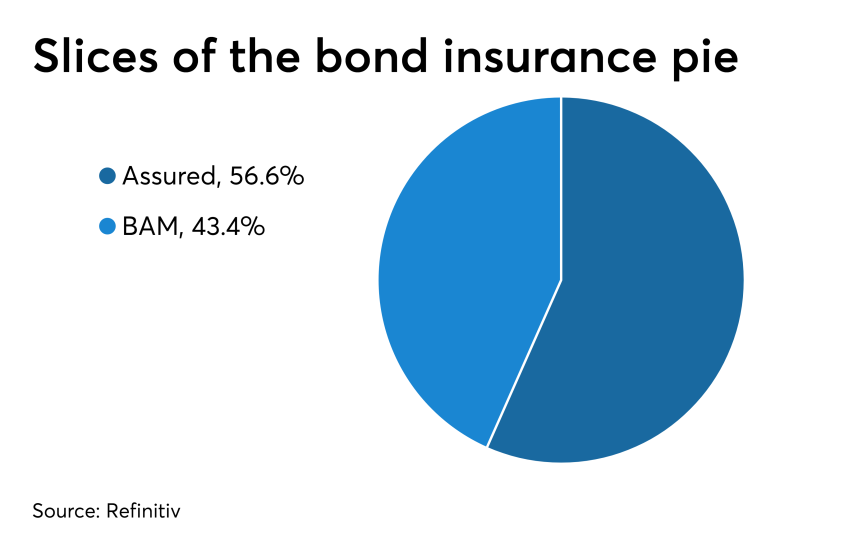

Assured Guaranty and Build America Mutual insured a total of $5.81 billion in the third quarter alone, bringing the total par amount insured to $15.56 billion — more than the $13.28 billion insured during the same time last year.

Total industry insurance penetration currently sits at 5.82%, up from the 5.54% after the first nine months of 2018.