DALLAS — Alternative funding methods for transportation projects such as public-private partnerships should be considered on a case-by-case basis, not as an overall solution for state infrastructure problems, the National Association of State Budget Officials said Thursday in a new report on capital budgeting.

P3s transfer the state's fiscal and construction risks to private investors and can provide new transportation infrastructure without drawing on public funds, the report noted. On the other hand, it said, many road projects can be completed cheaper using conventional tax-exempt financing without a P3's risk premium or profit margin.

"Public benefits and costs must be analyzed extensively for individual projects to avoid sacrificing public interests for private returns," the NASBO report said. "The fiscal and political advantages and disadvantages of alternative financing methods should be weighed in the context of a particular project proposal, rather than ascribed as a panacea for solving state infrastructure problems."

Twenty states use P3s to finance capital projects, mostly involving transportation infrastructure, the NASBO study said. Lease-purchase agreements are used to fund capital projects by 35 states and revolving loan fund programs are used by 23 states for water projects.

Scott Pattison, executive director of the budget officers association, said the report on how states plan, budget, and fund capital projects comes at a time when infrastructure funding is at a crossroads.

"State budgets have stabilized after the Great Recession," Pattison said. "States have made it through that crisis, and infrastructure and maintenance issues that have been on the back burner are now getting more attention."

The infrastructure funding situation is complicated by uncertainty over the future of federal support for transportation that hampers the ability of states to plan and budget for large projects, he said.

"We're highlighting the best practices in budgeting for infrastructure so states can see how others ensure that projects are prioritized on the basis of need and not politics," Pattison said. "No state does everything right, but everybody does something right."

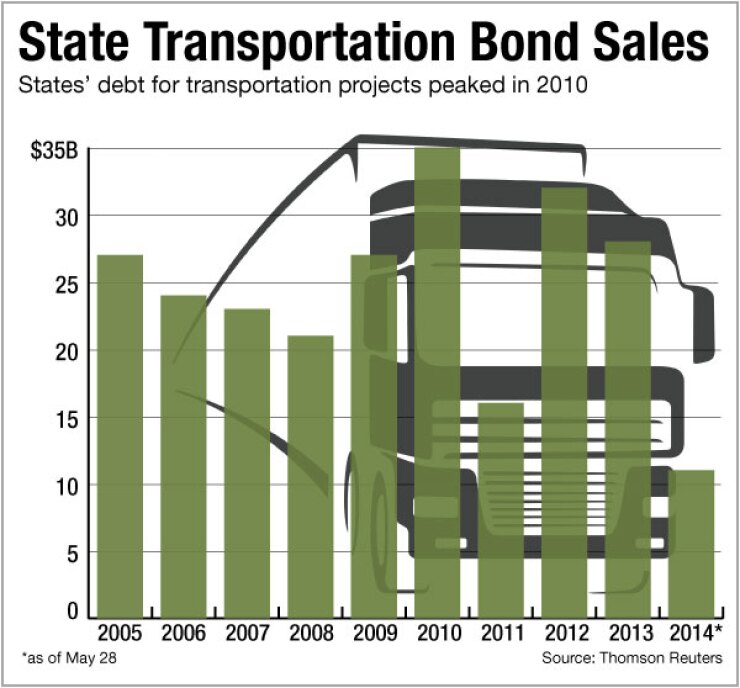

States have been cautious about issuing new debt for capital projects, Pattison said.

"The level of state debt has been flat, with a 12% decrease in overall tax-exempt debt sales in 2013," he said. "Some states like Illinois and California are comfortable with a high debt level and others are not."

Most states have some restriction on how much debt can be issued, Pattison said, but a number of states have available debt capacity that is not being used.

"It would be interesting to see why they are not issuing debt in an era of historically low interest rates," he said.

A report on P3s issued in late April by Eno Center for Transportation said P3 partnerships are hampered in the U.S. by regulatory and legislative barriers at the state and national levels. The barriers are beginning to fall, the Eno report said, with P3 laws now on the books in 33 states, Puerto Rico, and the District of Columbia.