Puerto Rico officials are looking for new sources of revenue for the commonwealth's highways and transportation authority amid reports — quickly denied — that the entity might default on its debt the week of May 13.

Newspaper El Nuevo Día recently reported that Puerto Rico Transportation and Public Works Department Secretary Miguel Torres Díaz said the Puerto Rico Highways and Transportation Authority is in danger of defaulting as soon as the week of May 13.

A government finance official quickly refuted the report.

"The Puerto Rico Highways & Transportation Authority will not default on the payment due on its bonds payable on July 1," Government Development Bank president Javier Ferrer told The Bond Buyer.

"The funds are on deposit with the trustee and will be paid to bondholders as always. The indenture is structured as a gross pledge which requires that monies generated by the HTA are first used to pay debt service on its outstanding bonds."

A GDB spokesman added that the authority will not default in the week of May 13.

The authority's bonds traded down Friday in the wake of the report, according to market sources.

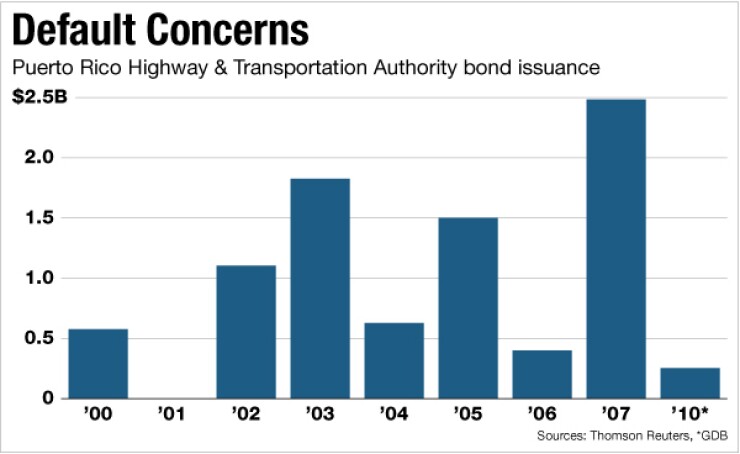

The authority has $5.2 billion in bond debt outstanding, according to Janney Capital Markets. It also owes $2.5 billion more to the development bank, according to the GDB.

On Tuesday Torres Díaz testified as to the financially difficult position of the authority to a Puerto Rico Senate committee.

The GDB and the Department of Estate have the lead in handling the problems at the authority, Torres Díaz told El Nuevo Día, adding that they are putting together revenue options to be ready by next week.

"The bankruptcy of the PRHTA is not an option," Torres Díaz said.

On May 1 Ferrer told a joint Puerto Rico legislative committee that his bank was "fragile." He pointed to the authority as being his prime area of concern. The agency accounts for 25% of the bank's loans.

Sources at Torres's department and the authority have not responded to Bond Buyer inquiries in recent days.

Moody's Investors Service rates the PRHTA's $1.5 billion of outstanding highway revenue bonds Baa2, its $3.4 billion of transportation revenue bonds Baa3 and its $300 million of subordinate transportation revenue bonds Ba1.

Standard & Poor's rates the highway revenue bonds BBB-plus, transportation revenue bonds BBB and subordinate transportation revenue bonds BBB-minus.

The authority last sold bonds in June 2010.

The PRHTA is the one Puerto Rico authority that is in danger of not being able to pay back its debt, Municipal Market Advisors managing director Robert Donahue said May 3. However, on Thursday he said, "I strongly believe that the HTA has the financial wherewithal to raise the funds to pay the debt service."

The authority may have to restructure its GDB loans to pay them, Donahue said Thursday.

If the authority does not find a way to repay these loans, the GDB would be at the end of its rope, Donahue said in the May 3 interview. Regarding Ferrer's "fragile" comment, Donahue said, "I think he is properly and appropriately alerting the legislature of the seriousness of this matter."

The GDB's books will close on June 30. The Puerto Rico government will have to find a way to generate new revenue for the transportation authority by then, Donahue said, adding that the plan will have to put the agency on a long-term road to financial solvency.

If the GDB does not find a plan by then, the bank's auditor may have to mark down the authority's debt as not likely to be paid back in full, according to Donahue. If that were to occur, the rating agencies might have to downgrade the bank.

Moody's gives the GDB's senior-most debt a Baa3 rating with a negative outlook.

Any downgrade by Moody's would push the bank into speculative-grade. If the GDB were downgraded it would jeopardize its ability to raise capital, Donahue said. Since the bank has served as a provider of liquidity for governmental authorities, a downgrade of the bank would be a blow to all the agencies.

Alan Schankel, managing director of fixed-income research at Janney Capital Markets, was more optimistic about the GDB. He said if the auditors marked down its debt, the bank might stop making loans to the authorities. However, the bank would be okay, he said.

Ferrer and Puerto Rico Treasury Secretary Melba Acosta Febo met Wednesday in New York with S&P, Fitch and Moody's in New York, according to a news release from the government, to reassure them that Gov. Alejandro García Padilla, elected in January, is on track with efforts to stabilize the commonwealth's budget.

CREDIT FACTORS

The Highways & Transportation Authority is responsible for the construction, operation and maintenance of Puerto Rico's toll road network, major highways and mass transportation facilities.

It has been bleeding money for years.

According to the GDB, the authority's annual fiscal deficit was $371 million in fiscal 2009, $360 million in fiscal 2010, $372 million in fiscal 2011, $345 million in fiscal 2012 and $245 million in fiscal 2013.

Its debt to the GDB has grown from $751 million on June 30, 2009, to $2.05 billion in Dec. 31, 2012.

While the bulk of the debt has been used for capital improvements, a substantial amount of the debt since fiscal 2010 has been used to cover operating expenses.

It is not good to see the authority depending on the GDB to cover its operating expenses, Schankel noted.

The authority's revenue stream is pretty good, said John Hallacy, manager of municipal research at Bank of America Merrill Lynch. The amount of driving in the commonwealth has a big effect on the authority's revenues, he said, and that is influenced by economic activity and gas prices.

The authority is subsidizing the Tren Urbano rapid-transit rail system in San Juan and its suburbs, Donahue said, and the expense is a growing problem.

Hallacy was more positive about the urban rail system. He said that it started in December 2004 and added that all systems take time to build up ridership.

The authority's bonds are backed by a gross pledge of a diverse revenue stream, Moody's analyst Emily Raimes wrote in a 2011 report.

The stream consists of highway system tolls, motor fuel taxes, vehicle fees, subway fares and excise taxes on imported petroleum.

Additionally, the PRHTA introduced significant toll increases in 2006 and new tolls around the capital city, San Juan.

Raimes also noted that Puerto Rico's legislature and the GDB provides support for the authority.

Raimes went on to say that the commonwealth's general obligation bonds get priority claim on the authority's tax revenue, though not its toll revenues.

Thus, if the commonwealth could otherwise not find the money to pay its GO bond interest or principal, the authority's tax revenues would be diverted to pay the GO debt.

The PRHTA has already spun off two of its most attractive highway assets in a privatization deal, receiving a lump-sum payment of $1.136 billion in 2011 from a concessionaire backed by Abertis Infraestructuras and Goldman Sachs Infrastructure Partners for the concession of the existing highway 22 and highway 5 toll roads.

NEW REVENUE

Puerto Rico leaders and analysts are generally agreed that the PRHTA needs to find new forms of revenue.

In his budget speech in April, Puerto Rico Gov. Alejandro García Padilla proposed extending the Tren Urbano to Caguas, a city to the south of San Juan. With $400 million capital investment, the subway line would gain an extra 12,000 riders, he said.

He also rejected earlier plans to raise the highway tolls, instead advocating a revamp of car registration fees to reduce fees for cheaper cars while raising them for luxury vehicles enough to be a net positive for the authority.

He also said that the "big oil companies and large stores" would be tapped for authority revenues. The governor has not provided further explanation.

García Padilla has been saying that all of Puerto Rico's authorities must stop seeking financial support from the commonwealth for operating expenses.

In the last few days a vigorous discussion has developed about what sources of revenues the authority should use to improve its finances.

The GDB, the authority, the Treasury Department, García Padilla and leaders of the Puerto Rico legislature are working out proposals, according to a GDB spokesman and press accounts.

On Tuesday a Puerto Rico Senate committee had a hearing on the PRHTA's financial problems.

The authority needs to raise revenues to gain financial stability, Donahue said, adding that "it remains to be seen if the political will exists."