CHICAGO — Rising interest rates and lagging economic growth limited borrowers in the Midwest where municipal bond issuance dipped by 12% during the first half of 2013 compared to the same period last year.

The trend of rising yields in response to the Federal Reserve's plans to taper its bond buying could further hinder borrowing plans for the remainder of the year while the impact of Detroit's historic bankruptcy and other credit issues in the region pose unknowns, market participants said. Nationally, issuance dropped 13% in July as headlines over Detroit's July bankruptcy filing and a triple-notch downgrade of Chicago's general obligation debt jolted the market.

Midwestern borrowers sold $34 billion of debt in 2,217 issues during the first six months, down from $38.6 billion sold in 2,424 transactions for the first six months of 2012, according to figures from Thomson Reuters. The first quarter accounted for $13 billion of total borrowing, a figure on par with the same period last year, while the second quarter's issuance of $21 billion marked an 18% decline as interest rates spiraled up in the spring.

"You have a headwind for issuance in general and the Midwest is no different," said Richard Ciccarone, chief research officer for McDonnell Investment Management. "It will be harder to move volume along in the second half if interest rates go up."

Concerns over Detroit's bankruptcy and its treatment of debts as well as Illinois' pension mess, which impacts Chicago and other local governments, could impact issuance plans even as the region faces "overdue" infrastructure needs, Ciccarone added.

New money borrowing could be helped along if Illinois lawmakers resolve a stalemate about how to overhaul public pensions and decisions in Detroit's case abate market concerns and ease yield penalties for Michigan borrowers. A lack of resolutions to those problems could suppress issuance.

Municipal Market Advisors Managing Director Matt Fabian views rising rates as the central issue as they have choked refundings and undermined new-money borrowing plans. Lagging economic growth also has dampened issuers' willingness to borrow for projects.

It's hard to expect infrastructure investment to bolster new-money volume without stronger Midwest economic activity and growth, Fabian said.

The more notable decline occurred in general obligation borrowing — down 20% to $14.6 billion — compared to revenue-backed issuance that saw a more modest drop of 5% to $19.4 billion.

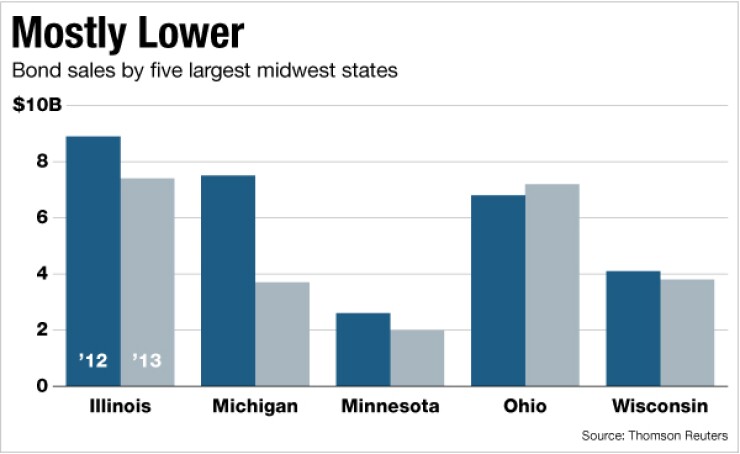

Borrowing declined in Illinois, Michigan, Minnesota, Nebraska, North Dakota, South Dakota, and Wisconsin. Borrowing increased in Indiana, Iowa, Missouri, and Ohio.

In Michigan, issuance volume was down by half year-over-year, to $3.7 billion with 205 issues from $7.5 billion on 239 issues for the same period in 2012. The first-half data includes a two-week period after Detroit emergency manager Kevyn Orr released a controversial plan to restructure the city's obligations that treats the city's GOs as unsecured.

The city declared bankruptcy on July 18, two weeks after the end of the second quarter. At least three issuers in Michigan have withdrawn deals due to the interest rate penalties demanded by investors.

Throughout the region, education-related borrowing led sector issuance accounting for $11.9 billion of borrowing, up 10.8% over the first half of 2012. General purpose borrowing followed at $7.1 billion, down nearly 42%, followed by the healthcare sector at $4.5 billion, down 20.1%.

Mergers and acquisitions continued to dominate the Midwest healthcare sector as well as the national market, as providers look to build partnerships and affiliations as federal health care law takes effect. The Detroit region provided an exception to the rule, when plans for what would have been a major merger fell apart. Six months after announcing a $6.6 billion merger, two of metro Detroit's largest health care systems, Henry Ford Health System and Beaumont Health, canceled the deal.

Beaumont may still be interested in another merger, said Allan Baumgarten, a Midwest-based health care analyst and consultant.

Health care providers in the Detroit area and all of Michigan may be impacted by the Motor City's bankruptcy, Baumgarten said.

"Both the health insurance companies and the hospitals are creditors of the city, so I think they're a little concerned about that," he said. "I also think there is a nervousness which I think extends to the health care organizations looking to refinance or bond for new capital investments, they might be hesitant."

In the region, tax-exempt borrowing represented $27 billion of volume, down 22.5% from the first half of 2012, while taxable made up $6.1 billion, up 71%. Private placements fell 8% to $1.3 billion in 83 transactions. Use of bond insurance and letters of credit remained modest with coverage on just $622.5 million of securities. Fixed-rate structures accounted for $30.8 billion of issuance.

State agencies led borrowers accounting for $8.8 billion of debt, down 7.4%; followed by districts, issuing $6.8 billion, up by 5.6%; and then state governments at $5.9 billion, down by 7.2%.

The Midwest saw four billion-dollar-plus deals in the first half, led by January's $1.5 billion sale of JobsOhio Beverage System's economic development bonds, senior managed by JPMorgan and Citi.

Gov. John Kasich crafted the plan in 2012 as a way to patch a budget shortfall and raise cash to fund economic development projects. Proceeds financed a 25-year privatization of the lucrative liquor distribution system in exchange for a $1.4 billion upfront cash payment. The sale, originally expected in 2012, was delayed for months amid litigation challenging the state law that created JobsOhio and authorized the bond sale.

The state of Illinois followed with a $1.3 billion new-money GO sale in June to fund an ongoing $31 billion capital program. The sale followed downgrades by two rating agencies after the General Assembly ended its regular session without action on reforms to address $95 billion of unfunded obligations and rising annual payments that are straining the state's balance sheet. Illinois is now the lowest rated state — at the low single-A level.

Posey County, Indiana in late June sold $1.26 billion of short-term bonds under the Midwestern Disaster Area Bond program for a controversial fertilizer plant.

The county sold the debt on behalf of a Pakistan-based conglomerate after the state pulled support for the local project due to reports that U.S. defense officials were concerned about the company's fertilizer being used in bombs targeting American troops in Afghanistan. Posey County expects to refinance the notes in October before rolling the debt over into long-term bonds early next year.

The deal followed the Iowa Finance Authority's April long-term financing of $1.2 billion of junk-rated paper for a similar fertilizer project being undertaken by the Egypt-based company Orascom Construction Industries under the MDAB program.

The state of Illinois was the region's top issuer in the first half with new money and refunding deals totaling $3 billion. In addition to its $1.3 billion June sale, the state issued $800 million of tax-exempt and taxable new money in April, $300 million of taxable new money sales tax backed bonds in May, and $600 million of refunding sales tax bonds in June.

JobsOhio ranked second among issuers, followed by the Iowa Finance Authority, the Indiana Finance Authority, and the Missouri Higher Education Loan Authority, which made the list with one $956 million taxable sale in May.

Big Midwestern issues kept coming as the second half commenced. Recent large sales include a $1.1 billion Ohio Turnpike deal and a Minnesota GO issue. Chicago has several deals planned along with a Minnesota issue for the new Vikings football stadium.

JPMorgan led the senior managers regional league table, credited with 34 transactions valued at $3.4 billion. Bank of America Merrill Lynch followed with 35 deals totaling $3.3 billion, and then Citi with 23 deals at nearly $3.3 billion. Stifel Nicolaus & Co. Inc., Barclays Capital, Morgan Stanley, Robert W. Baird & Co. Inc., Wells Fargo Securities, Piper Jaffray & Co., and Fifth Third Securities Inc. wrapped up the top 10 list.

Public Financial Management Inc. led among financial advisors, credited with 140 deals totaling more than $3.4 billion. Peralta Garcia Solutions captured the second slot advising on just three deals but with a value of $1.4 billion, buoyed by its role in Illinois' $1.3 billion GO issue. Kaufman Hall followed with 13 deals totaling $1.3 billion. Baird, Stauder Barch & Associates, Acacia Financial Group, Ehlers, A.C. Advisory Inc., Public Resources Advisory Group, and Springsted Inc. rounded out the top 10.

Squire Sanders LLP topped bond counsel rankings, credited with 78 deals for $3.2 billion, followed by Chapman and Cutler LLP with 218 transactions worth $2.9 billion, and then Dorsey & Whitney LLP with 139 deals valued at $2.1 billion. Quarles & Brady LLP, Kutak Rock LLP, Mayer Brown LLP, Barnes & Thornburg LLP, Gilmore & Bell PC, Peck Shaffer & Williams LLP, and Bricker & Eckler LLP rounded out the top 10.