It has been a prosperous year for high-yield municipal bonds and the funds that invest in them.

Throughout 2012, high-yield muni funds, as a group, have seen some of the best total returns among bond funds. They have also recorded inflows throughout most of the year, and at levels disproportionate to their overall market share.

And their run should continue, muni pros say, as long as the Federal Reserve keeps interest rates at suppressed levels.

Still, some industry watchers are warning there are risks for investors who should pay close attention to the credit, liquidity and duration risks they see within the high-yield muni sector.

The popularity of high-yield bonds these days is no mystery, said Duane McAllister, a portfolio manager at BMO Global Asset Management U.S.

"I certainly understand the flows going into high yield," he said. "It's not unexpected when you're at low nominal rates like this, and the sense is that we're going to be here for some time. Investors will seek out the yield opportunity when they can."

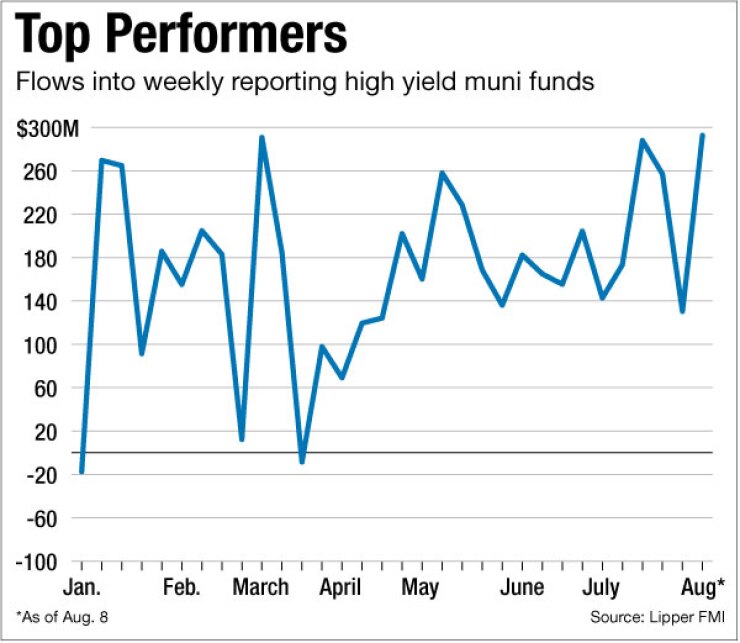

Looking at the numbers, high-yield muni bond funds have recorded positive flows for 20 consecutive weeks, and 34 of the previous 35 weeks, Lipper FMI numbers show. For the year to date through Aug. 8, flows into high-yield muni funds are up $6.3 billion, 21% of all muni bond fund inflows.

Investors continue to

Just as flows into long-bond funds have accounted for roughly 50% of all muni bond fund flows since early July, high-yields within the long-bond subsector represent about 50% of all flows into long-bond funds, Chris Mauro, head of U.S. municipals strategy for RBC Capital Markets, wrote in a research note.

However, more than 85% of the bonds in the approximately $65 billion Barclays Muni High Yield Index — a solid proxy for the muni high-yield market — are owned directly by mutual funds, according to Priscilla Hancock, a managing director and municipal strategist at JPMorgan Asset Management.

A disproportionate percentage of fund flows have been heading into high yield, of late, she said. In the second quarter, muni high-yield funds represented only about 12% of all muni fund assets, but one-third of all flows into the municipal bond fund space, Hancock added.

Muni bond funds rank among the highest-performing bond funds so far this year, according to preliminary Lipper data as of July 31. Total returns, calculated as changes in net asset values with reinvested distributions, for the high-yield municipal group stand at 10.6% for the year to date.

Within that group, four high-yield funds ranked among the top 20 best-performing bond funds, Lipper numbers showed. Nuveen HY Muni;I ranked fifth in the group, with a year-to-date total return of nearly 16%.

As tax-exempt yields have lingered around record-low levels, investors anxious for yield have ventured down the credit scale into high-yield territory. For investors in muni bond funds, two dynamics are at play, said John Hallacy, manager of municipal bond research at Bank of America Merrill Lynch.

First, funds whose primary focus is high yield will be on the hunt for paper, he said. Second, other, more generic funds looking to boost returns must come up with a higher blended yield than just what the high-grade market provides, so they might make up to 20% of their portfolio high yield to bump their returns.

Rock-bottom nominal yields are definitely pushing investors into the high-yield market, and the cash flow directed there is causing spreads to collapse a little bit, said Alex Grant, portfolio manager of the High Yield Municipal Bond and Tax-Exempt funds at RS Investments. But there is no question that high-yield bonds are performing better than investment grades, Grant said.

"If you look at the dividend distribution that you're getting from high-yield funds versus high-grade funds, there's probably quite a bit of difference there," he said. "Even in terms of overall performance, looking at total rate of return, the high-yield market is outperforming the high-grade market."

The majority of Grant's high-yield fund is nestled between triple-B and single-A rated securities. But it's not entirely a high-yield fund — it also contains some high-grade names for liquidity purposes.

There are some triple-As and double-As in the fund, according to Grant. Those bonds are more liquid and can be sold them more easily if he starts to see redemptions. "We stick to the specialty states to ensure that liquidity," he said. "Our line of defense would be selling high-grades."

The yield for the RS High Income Municipal Bond Fund is 3.67%, excluding the monthly distribution figure for A shares, Grant said. The equivalent yield for the RS Tax-Exempt Fund is 2.85%.

For his part, McAllister is co-manager of the BMO intermediate tax-free fund, which is not a high-yield fund but has nonetheless seen its assets grow to more than $1 billion from $85 million in just five years. He views high-yield funds as a possible supplement to an investor's core portfolio. "That's the satellite investment," he said. "If you have $100 to invest, $75 would be an intermediate portfolio. And then you take your extra $25 dollars and buy high-yield, or you buy an ultra-short or a state-specific fund just to meet your individual needs."

Investors agree that the market for high-grades will stay hot until the Fed decides to raise interest rates substantially. Currently, it has said it will leave rates where they are until at least late 2014.

B of A Merrill economists predict that the Fed won't make a move until 2015, Hallacy said, and even then, the markets will see only a gradual tightening. "You're looking at 2014," Grant added, "but it's going to be a while before we normalize."

Though the high-yield space is relatively small, the risks therein are many, Hancock said, and the potential impact on portfolios could be painful.

Because bond prices move inversely to rates, rising interest rates would cause long-term bond prices to fall in general. High-yield bonds would suffer more than high-grade names in a sell-off.

Much of the high-yield market lies below investment grade. Around 75% of the market, Hancock said, consists of tobacco, airline, and nursing-home and life-care center bonds, and special assessment and special tax district bonds, such as unrated "dirt" deals. "So, not much diversification, and sectors that have relatively more credit risk than traditional munis," she said.

The high-yield market is extremely illiquid, she added. Most of the market comprises many small deals, with the average issue size of those in the index being roughly $23 million, Hancock said. Therefore, in many cases, a single fund will own an entire deal, often resulting in no one else following the credit and no active secondary market for it.

"That lack of liquidity is a real concern," Hancock said, "maybe not now, as we're seeing all the money flow into the market, but more if there's a risk-off trade or some other kind of stress in the market."

Finally, high-yield bonds tend to have high duration risk, or the measure of how susceptible your fund is to rising or falling rates. The duration of the muni high-yield index is almost 10 years, Hancock said, compared with slightly more than four years for the corporate high-yield index.

Most outstanding bonds today are priced at a premium, as they were sold when coupons and yields were higher. When bonds trade at a premium, they trade to the call.

So the muni high-yield duration of 10 years is the duration to the call, and if rates rise enough and prices extend so that bonds are pricing to maturity, she added, the duration of that muni high-yield marketplace could be a lot longer, possibly in the teens.