Connecticut officials reacted angrily Friday after Moody’s Investors Service lowered the state’s general obligation bond rating to Aa3 from Aa2.

“Moody’s is wrong in its analysis of the state’s finances, and wrong to change Connecticut’s credit rating,” Benjamin Barnes, Gov. Dannel Malloy’s Office of Policy and Management secretary, said in a statement minutes after the rating agency announced its downgrade.

“Connecticut has done all the right things to shore up our finances, and Moody’s has responded with a downgrade intended to satisfy their internal corporate need to deflect attention from their historic lack of credibility.”

Standard & Poor’s and Fitch Ratings each assign the state’s GO credit AA, with a stable outlook.

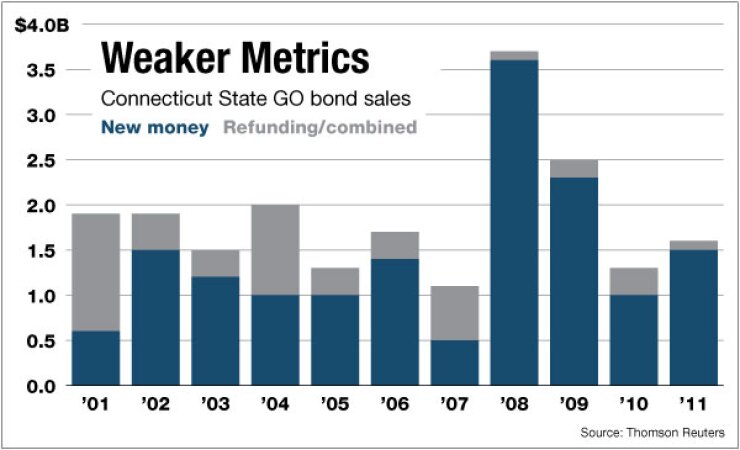

Moody’s, which revised its outlook to stable from negative, cited Connecticut’s high combined fixed costs for debt service and post-employment benefits relative to its budget, pension funded ratios among the lowest in the country, and depleted reserves.

“Connecticut has had a number of financial problems that have been building for a long time. When you look at their metrics they are weaker than other states in areas like past unbalanced budgets, low pension funded ratios, and very high debt burdens,” analyst Nicole Johnson said.

According to a Pew Center on the States study last April, Connecticut’s public sector pensions are 62% funded. Pew considers 80% an acceptable threshold. The study tabbed Connecticut’s pension liability at $41.3 million.

“The rating agencies obviously are very focused these days with respect to states. What the rating agencies are doing are looking at unfunded debt with respect to pensions,” said Kirkland & Ellis LLP restructuring lawyer Jonathan Henes.

Moody’s also said Connecticut depleted its budget reserve fund during the recession and issued deficit bonds to fill budget gaps. The state plans to use surplus funds to retire those bonds two years ahead of schedule. “However, this reduces the amount of funds that may be available to rebuild reserves in the near term,” Moody’s said in its report.

State Treasurer Denise Nappier called Moody’s decision disappointing but not a big surprise, given the negative outlook the agency assigned last June. She said she anticipates no increase in borrowing costs related to Moody’s action. Since Moody’s has had a negative outlook, she said, at least a portion of the rating change is already priced into current interest rate levels on new debt.

Senate Minority Leader John McKinney, R-Fairfield, defended the rating agency. “Moody’s downgrade is a fair and honest failing grade for the Malloy administration and Democratic legislators who have not made the necessary fiscal reforms Republicans have advocated,” he said. “Secretary Barnes’ flippant, if not slanderous, dismissal of the Moody’s downgrade and the facts that led to it are equally troubling. Secretary Barnes should immediately back up his unsubstantiated claims or retract them.”