WASHINGTON — The Maryland Board of Public Works approved the sale of $790.3 million of general obligation bonds, Treasurer Nancy Kopp announced.

The bonds will be sold in five series, Kopp said, and will finance a variety of capital projects such as schools and hospitals. Maryland carries a triple-A bond rating from all three major rating agencies on its general obligation bonds, and has maintained that distinction for decades. Maryland is one of eight states to be unanimously triple-A rated. The others are Delaware, Virginia, North Carolina, Georgia, Missouri, Iowa, and Utah.

The first sale will be a $75 million negotiated offering, including a retail-only order period. That sale will likely open July 27. Citigroup will be the lead underwriter on the deal, and Maryland residents will receive first priority during the retail sale period.

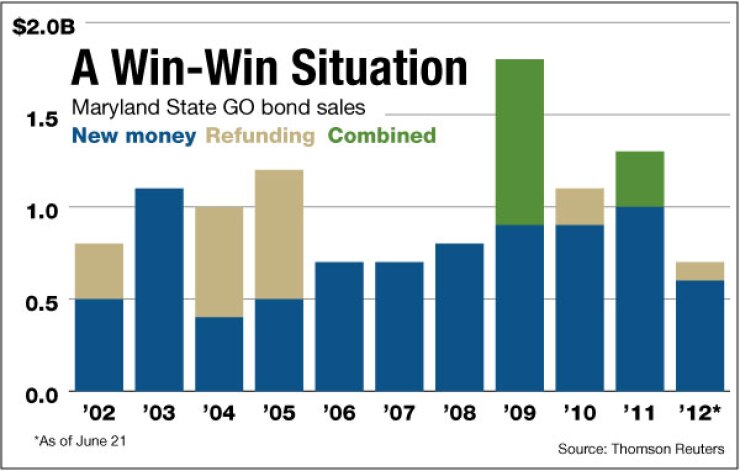

“Marylanders receive first preference in buying highly desirable, conservative quality bonds while investing in their state — a win-win situation,” she added.

The bond sale will conclude with the BPW, comprising Kopp, Gov. Martin O’Malley, and Comptroller Peter Franchot, presiding over a competitive bond sale on Aug. 1. in Annapolis. That sale will include four series of bonds that will most likely sell to institutions, Kopp said. The sale will include approximately $430 million of tax-exempt bonds, $20 million of taxable bonds, $15.3 million of taxable qualified zone academy bonds, and up to $250 million of tax-exempt refunding bonds.

This general obligation issuance is structured the same way as the state’s last GO sale, which was a historic success. That $738.4 million dollar deal in March resulted in the second-lowest interest rate since 1988. The rates varied from 1.69% to 2.42%. Amber Teitt, director of debt management in Kopp’s office, said she was hopeful the state would be able to duplicate that success.

Teitt said the bonds should receive ratings from all three agencies on or about July 19, when the preliminary official statement should also become public.