New Hampshire plans to sell $100 million of general obligation capital improvement bonds Thursday through competitive bid.

According to Treasurer Catherine Provencher, the tax-exempt, fixed-rate Series 2011B bonds will benefit a variety of projects. They include the community college and university system, repairs to state-owned buildings, a rehabilitation of an old state building for new space for the Department of Employment security, and a new liquor store.

In New Hampshire, a liquor commission manages the sale and distribution of beer and alcohol statewide.

Payment of 60% of the principal will occur in the first 10 years, Provencher said. New Hampshire has no variable-rate debt or plans to issue any. No debt refinancing or swaps are involved. The serial bonds, callable after 10 years, will not be insured, she added.

As of June 30, the state had $939 million of outstanding GO debt.

The three major rating agencies affirmed the bonds. Fitch Ratings rates them AA-plus, Moody’s Investors Service Aa1, and Standard & Poor’s AA. All three have stable outlooks.

The state amassed a $26 million surplus during the budget year that ended June 30, Gov. John Lynch said last month, citing cost-cutting measures.

“New Hampshire’s strong credit rating reflects the successful economic strategy we have in place. It must be maintained and built upon if we are to strengthen our economy for the future,” Lynch said in a statement.

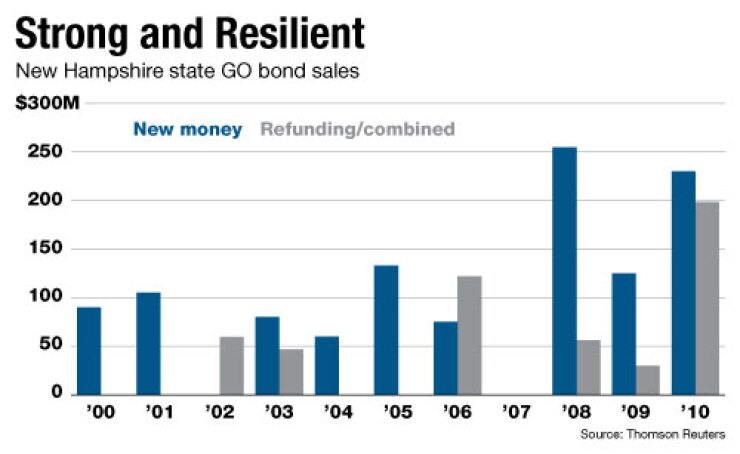

Fitch described the state’s economy as “strong and resilient” compared with neighboring states amid the economic downturn. However, it warned that New Hampshire’s reliance on business, real estate, and excise taxes — the state lacks a sales or income tax — offsets its strengths.

“This unique tax structure is volatile, especially the taxes on business profits, which are vulnerable to swings in the business cycle, and on real estate transfers, which are sensitive to housing market conditions,” Fitch analysts wrote.

New Hampshire’s debt structure is conservative with low debt levels, rapid amortization and reliance on fixed-rate GO or guaranteed debt.

Spending on the state’s pension system has declined the past few years. As of June 30, 2010, its funded ratio was 58.5%, according to Fitch, down from 89.9% in 2000.

“Debt levels are below the 50-state median but pension funded ratios are below average,” Moody’s said in its report. The Pew Center on the States, a Washington think tank, considers 80% to be an acceptable threshold for a well-funded pension plan.

Edwards Wildman Palmer LLP of Boston is bond counsel. Public Resources Advisory Group is the state’s financial advisor for the issuance.