-

New Hampshire Supreme Court found that the state doesn't spend enough on education, but upheld the education property tax system.

July 7 -

It was 2024's biggest national conduit. You may not have heard of it. New Hampshire's National Finance Authority has become a big issuer with a low profile.

March 3 -

The state Supreme Court will determine if the Granite State's property tax-based school funding is constitutional.

September 4 -

"The upgrades incorporate our view of New Hampshire's improved economic and demographic growth trends that continue to perform near or above those of the U.S. and regional peers," said analyst Thomas Zemetis.

March 26 -

Meanwhile in New York, the state doubles down on climate investments and restricts investments in some big oil and gas companies as the city blasts several big banks as they pull out from the Climate Action 100+ initiative.

February 16 -

It's a color-coded controversy about how far the fight over ESG and green investing precepts will affect public finance this year, with the latest skirmishes involving Bank of America and New York and New Hampshire.

February 6 -

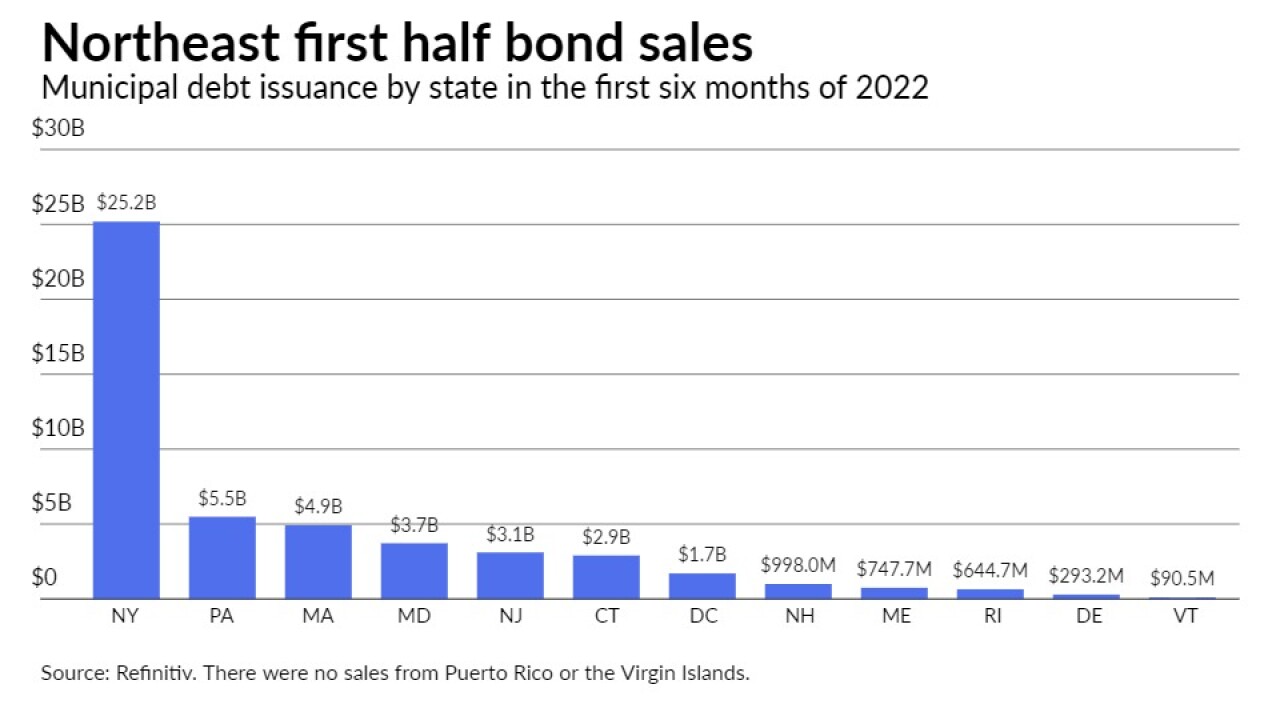

The Northeast's issuers sold $49.69 billion of municipal bonds in the first half of 2022, down more than 18% year-over-year.

August 12 -

While the report offers many positives for states, headwinds loom, according to investment management firm Conning.

May 19 -

Only two of the nine justices were in favor of adding New Hampshire v. Massachusetts to the docket for the fall term.

June 28 -

The nine justices of the Supreme Court are scheduled to hold a closed-door conference June 24 to decide whether to put the case on their docket for the fall term.

June 16 -

Greg Sullivan of Boston's Pioneer Institute explores the migration from Massachusetts and Connecticut to lower-tax states, and the ripple effects of a lawsuit regarding cross-state remote employees that could reach the U.S. Supreme Court. Paul Burton hosts. (13 minutes).

March 2 -

New Hampshire wants the Supreme Court to hear its challenge to income taxes its neighbor levies on employees who began working from home during the pandemic.

January 29 -

The case has also has fiscal implications for Arkansas, Delaware, Nebraska, New York, and Pennsylvania.

January 25 -

New Jersey and Connecticut on Tuesday joined a legal battle to stop neighboring states from taxing residents who due to the pandemic have stopped commuting over state lines and are now working remotely.

December 24 -

The state will use debt service savings from the refunding side of the deal for near-term budget relief; the deal includes its first taxable refunding bonds.

December 9 -

With both houses now under GOP control, Gov. Chris Sununu will have an easier time with his agenda.

November 18 -

The region's bond issuers sold $55.4 billion of municipal debt during the first half of 2020, a 21.1% increase from the same period in 2019.

August 21 -

Gov. Chris Sununu is preparing contingency plans as virus threatens state revenues.

March 16 -

The authority is slated to issue $41.9 million of revenue refunding bonds in a competitive deal Thursday.

October 28 -

A comprise $13B NH budget crafted this week that includes no tax increases.

September 26