Investors established a new record for withdrawals from municipal bond mutual funds last week as headline risk continued to chase people from state and local government debt funds.

Municipal bond mutual funds that report their figures weekly posted an outflow of $4 billion during the week ended Jan. 19, according to Lipper FMI. That new mark beats the old record of $3.1 billion, set the week ended Nov. 17, by 29%.

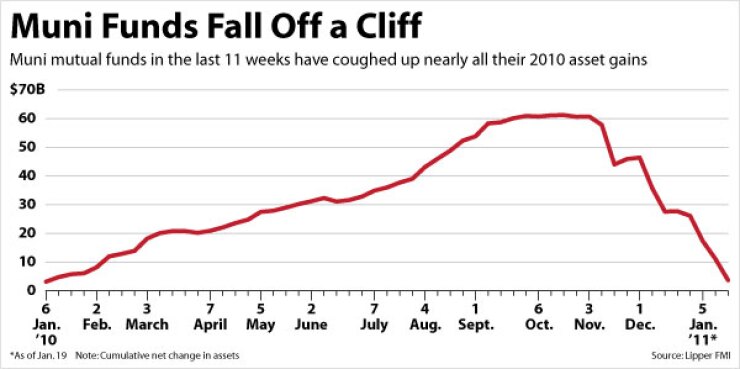

Much of the hot money that flooded the $470.6 billion municipal bond mutual fund industry the past two years has escaped the past two months.

A steady drumbeat of fear-mongering new stories about potential municipal insolvencies has clearly had a real impact on demand.

“The retail investor is just getting the impression that the entire municipal market is in trouble and all municipals are going to default,” said Ron Schwartz, who manages the $1.14 billion Investment Grade Tax-Exempt Bond fund for RidgeWorth Investments. “They’re a little bit concerned obviously, and they’re selling the mutual funds and redeeming quite a bit throughout the municipal market.”

Spooked investors have reacted by withdrawing money from muni funds at a unprecedented clip that has broken nearly every important record the past two months.

Mutual funds have now reported $29.3 billion of redemptions in the past 10 weeks. That’s 65% more than the previous record for outflows in a 10-week period of $11.5 billion established in 2000.

Funds are reporting outflows at a rate of $3.52 billion a week based on the four-week moving average, also a record.

These outflows are applying massive selling pressure during what is normally a seasonally strong time for the municipal market.

Investors normally come to market in January armed with cash from coupon payments on their bonds.

January is also the lightest month of the year for municipal issuance.

Monthly issuance has averaged less than $14 billion in January since the early 1980s, and $20 billion for the other 11 months, according to Thomson Reuters.

This January has been particularly light on supply, as municipalities have floated only $7 billion of debt so far.

Despite the dearth of new supply, the seasonal pattern is not playing out this year because mutual funds seeking to raise cash to meet redemptions have flooded the secondary market with bid lists.

Munis have delivered a return of negative 1.9% this year, according to a Standard & Poor’s index.

Unfortunately for the retail investor, the hot money came into municipal funds when yields were low and is leaving now at a time when yields are high.

Yields for triple-A rated 30-year municipal bonds have averaged about 4.8% since the outflows began in November — nearly 40 basis points higher than the average yield from the beginning of 2009 through October 2010, when investors entrusted $110 billion to muni funds.

“There’s a negative feedback loop between redemptions and negative media coverage,” said Josh Gonze, who co-manages six municipal funds with about $5.4 billion of assets at Thornburg Investment Management. “Often the retail buyers sell at the wrong time and buy at the wrong time. They sell at lows and buy at peaks because they make their decisions based on what they read in the newspapers.”

Municipal bond mutual funds are bleeding assets rapidly. Between market losses and outflows, funds have shed $54 billion of assets in the past 10 weeks.

There is compelling evidence that the selling the past few months is driven not by credit default fears but by retail’s compulsion to flee the sector altogether.

One would expect credit spreads to widen in a credit-based sell-off as issuers perceived as more likely to default are punished.

Yet the spread of the single-A 30-year municipal yield over the triple-A yield has jumped just four basis points since the end of October. Both triple-As and single-As have been sold indiscriminately.

Credit default swap spreads on Illinois have tightened 55 basis points this year, and California’s have tightened 19 basis points.

The Standard & Poor’s index tracking returns on high-yield municipal bonds — where defaults are far more probable — has fared only 70 basis points worse the past three months than the S&P general obligation municipal index.

Plus, the taxable market is not buying the panic reflected in the tax-exempt market.

The average Build America Bonds spread over the 30-year Treasury has tightened 20 basis points this year, according to a Wells Fargo index.