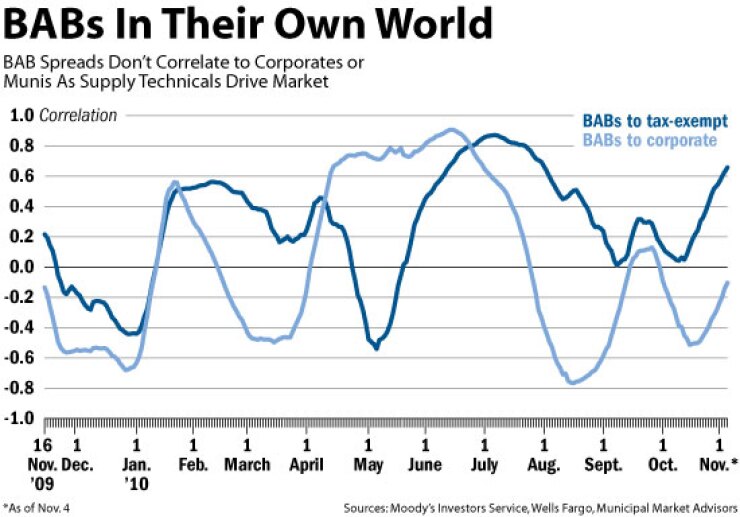

Build America Bonds have entered a world of their own.

As the market braces for a blitz of taxable state and local government debt sales to close out the year, some experts expect the already-shaky correlations between BABs and other assets to break down.

Municipalities are already ramping up their sales of BABs, the taxable municipal bonds created under the American Recovery and Reinvestment Act in February of last year.

The BAB program is scheduled to sunset at the end of the year, and the extension is questionable.

Municipal market participants anticipate a crush of BAB issuance to take advantage of the program's 35% federal interest cost subsidy before it expires.

Bloomberg LP lists $6.9 billion of taxable municipal debt slated to sell over the next month.

That supply and the looming expiration are what will drive BABs' performance over the next couple of months, experts say.

Those technicals are likely to unglue the spread between taxable municipal bonds and Treasuries from other types of spreads as investors bake bigger liquidity premiums into BAB yields.

"The biggest thing now about the BABs market is the fact that there's a lot of supply coming," said Richard Kolman, head of public finance at U.S. Bank. "There seems to be more of a nervousness that it's not going to be extended, and there's a lot of focus on the unknown supply."

BABs vs. Corporates

Earlier this year, spreads on BABs over 30-year Treasuries established a comfortable rapport with corporate bond spreads.

The rolling 60-day correlation between the spread of the average BAB yield measured by a Wells Fargo index tracking the sector and the spread of a Moody's Investor Service double-A rated corporate bond index over 30-year Treasuries reached as high as 0.9 in June. A correlation of 1 would mean they move in identical directions by the same magnitude.

BAB and corporate spreads tightened at a similar clip the first few months of the year, and widened out at comparable rates during the sovereign-debt crisis in May.

So compelling was the high correlation between BABs and corporate spreads before the summer that Mikhail Foux, a member of the Citigroup municipal team, evaluates "relative value" for BABs based on their relation to corporate spreads.

There are some good reasons spreads on BABs and corporate bonds should follow each other.

George Friedlander, municipal strategist at Citi, said BABs can be viewed as a "fairly close substitute" for corporate bonds of similar rating, maturity, and structure.

Both attract similar types of investors, and with BABs commanding a growing weight in long-duration taxable credit indexes, bond managers benchmarked to these indexes are forced to at least consider taxable municipal bonds.

Municipal participants say technical pressures are trumping these factors, unmooring the fragile linkage between BABs and corporate spreads.

Two weeks ago, Foux wrote in a report that BABs were cheap relative to corporate bonds, based on BAB spreads being higher relative to their normal distance from corporate spreads. Yet he believed corporate spreads would tighten, while "poor technicals" would prevent BAB spreads from compressing along with them.

Rob Novembre, managing director and head of municipals at Arbor Research & Trading, said theoretical arbitrage opportunities arise if corporate spreads and taxable muni spreads diverge too severely from each other.

Over the summer, Novembre pointed out that an investor could buy two taxable bonds with similar duration and credit ratings — Illinois general obligation or Goldman Sachs — and pick up 88 extra basis points by choosing the state's debt over the firm's.

Supply technicals can distort any theoretical similarities between corporate bonds and BABs, Novembre said, because not enough investors are comparing the two classes looking for arbitrage opportunities.

That allows BAB spreads in times of heavy supply to bleed out without any counterbalance from the corporate market.

"There's probably less of a correlation between corporates and BABs because the actual buyers aren't always crossing over," Novembre said. "There aren't enough people doing it, which is why there are arbitrages still available."

Since inception, BABs have traded at a spread to corporate bonds. The average yield on the Wells Fargo BABs index is 92 basis points over the yield on the Moody's double-A corporate index.

Brian Pollack, a taxable portfolio manager at Evercore Wealth Management, said much of that spread is a liquidity premium.

Earlier in the fall, Utah paid 20 basis points more on its bonds than Microsoft Corp. paid a day later.

It's hard to reconcile a technology company enjoying cheaper borrowing costs than one of the highest-quality states, Pollack said, except that he could sell Microsoft if he needed to.

Corporate bonds are usually easier to sell than taxable municipals, he said, and with the specter of BABs becoming an orphaned product, selling taxable munis could get even harder.

"That liquidity premium could grow if BABs end up not getting extended," Pollack said. "From a liquidity perspective, I would just be worried about having half or 25% of my portfolio in that sector. I know with a Microsoft bond, I'll be able to sell it. With Utah, you don't know as much. And if [the BAB program] goes away, it gets worse."

BABs vs. Tax-Exempts

Citi's Foux said the BAB deluge will do more than just delink BAB spreads from long-term tax-exempt spreads. They'll probably start to move in opposite directions. The oversupply of BABs itself means a corresponding undersupply of long-term tax-exempt bonds.

Every time a municipality sells taxable debt, it is opting not to sell tax-free debt.

The very supply overhang that drives an uptick in BAB spreads could lead to a drought pulling tax-exempt spreads lower.

"They're going to trade differently now, because $1 of BAB issuance is essentially $1 foregone of tax-exempt issuance," said Jason Hannon, a senior trader at Arbor. "It's not really following it in lockstep for that reason."

The boon to tax-exempt bonds would be temporary if the program expires.

A Bond Buyer survey last month found most participants expect long-term tax-exempt yields to back up at least 25 basis points if the BABs program expires. Some respondents thought yields would rise by more than 100 basis points.

Municipal yields in taxable and tax-exempt markets have at times borne little resemblance to each other.

The spread of the average BABs yield over the Municipal Market Advisors 30-year triple-A municipal yield has been anything but constant. The spread was 190 basis points at the end of 2009 and shrank to 114 basis points in May 2010.

At times, although the credits were the same, the taxable market was stung by speculation the BAB program would be allowed to expire at the same time the tax-exempt market was buoyed by a marked supply shortage and rampant cash flows into muni mutual funds.

"There's a lot of dealers that have a lot of new BAB issuance on their books. … People are sitting on the sidelines waiting to see what happens," Hannon said. "As long as the BAB extension is uncertain, that's going to continue."