The Treasury Department is seeking comments from tribal governments on the tribal economic development bonds authorized by the stimulus law, including whether Congress should permanently repeal the “essential governmental function” standard for all tribal bonds.

The Treasury

In its solicitation, the Treasury said House and Senate taxwriting committees asked whether lawmakers should eliminate the current “essential governmental function” standard that applies to most tax-exempt tribal bonds, but not to TED bonds or other tax-exempt bonds.

The standard has been a point of contention between the Internal Revenue Service and tribal governments, which argue that it is overly restrictive. The ARRA provided tribes with more flexibility by not requiring TED bonds to adhere to that standard and by allowing them to be sold as Build America Bonds.

The Treasury is asking for input on whether tribal governments should be treated more like state and local governments and allowed to finance the same kinds of projects with bonds. It also is asking whether tribal governments should be allowed to pay for their bonds with revenue sources that are unique to them, such as gaming, tribal lands held in trust by the Interior Department, or oil, gas, and other natural resources on tribal lands.

In addition, the Treasury wants to know if some sort of private-activity bond volume cap, perhaps based on tribal population, would be appropriate if tax-exempt financing was expanded for tribal governments.

Further, it is seeking feedback on the two specific restrictions that ARRA applies to TED bonds. Tribes are prevented from using the bonds to finance projects involving gaming or located outside Indian reservations.

Comments should be submitted to the department by Sept. 10, the Treasury said in the release.

While tribal governments have rushed to request TED bond allocations, few have actually issued the bonds. The Treasury received 134 applications totaling $4.3 billion for the $2 billion of TED bonds authorized by ARRA. It allocated the bonds to the all of the qualified applicants on a pro rata basis.

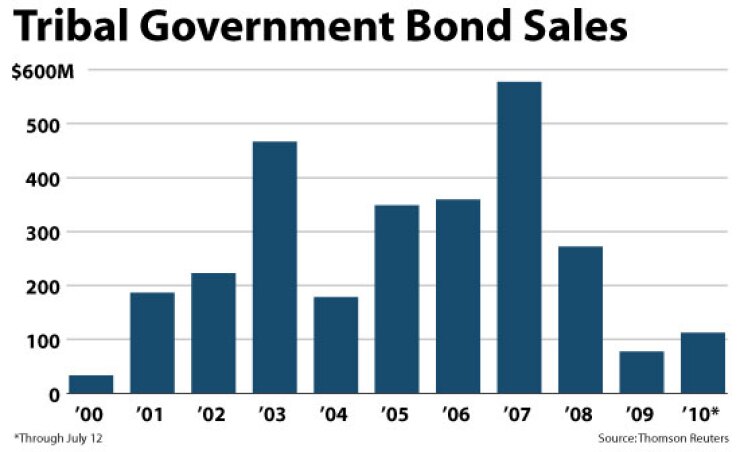

However, only five transactions totaling $189.5 million have been done by tribal governments since February 2009 when the ARRA was enacted, according to data from Thomson Reuters. Those figures, however, do not include potential private placements of TED bonds.

The Advisory Committee on Tax-Exempt and Government Entities warned the IRS last month that the Treasury’s report on the effectiveness of TED bonds may be premature, since both issuers and investors are grappling with the recession and still familiarizing themselves with the tool. Nonetheless, the group of market participants, which makes annual recommendations to the IRS, said there is clear demand for the bonds, and called for the cap be raised or removed.

Townsend Hyatt, a partner with Orrick, Herrington & Sutcliffe LLP in Portland, said tribes have had a tough time accessing the capital markets for their bonds because of the recession. “Unfortunately, the TED bond program came out … at the depths of the recession,” he said. “My guess is that the vast majority of projects that received allocation will have a difficult time getting financed and I think we’ll see a lot of allocation, at least for the initial round, come back to the common pot for reallocation at the end of the year.”

The TED bond program is “the largest adjustment in tax-exempt financing opportunities for tribes in the last 20, 25 years,” and may provide some momentum for modifying or removing the essential governmental function standard for tribal bonds, Hyatt said.