It may seem crazy to predict that in 2019 the municipal market will see $850 billion of new issuance, but for that to happen only one thing needs to occur: the trend of the past decade must hold steady.

Using the past 10 years as a barometer for where the market is heading isn’t scientific and is probably misleading, but it does spotlight how much the market grew from January 2000 to December 2009.

In 2000, the muni world saw $201 billion come to the primary market. During the decade the record for total issuance was then shattered four times, peaking in 2007 with nearly $430 billion of sales. Market turmoil caused issuance to drop 9.4% in 2008, but, with the help of Build America Bonds, last year was one of resilience as sales rebounded by 5.1% to $409 billion, according to preliminary totals from Thomson Reuters.

All in, annual sales jumped 104% during the decade. Municipal debt outstanding grew by more than 90% from $1.48 trillion in 2000 to $2.77 trillion through the third quarter of 2009, according to the Federal Reserve. By contrast, nominal gross domestic product — which accounts for both economic growth and inflation — grew by 48%.

The volume of new-money issuance began the decade at $165.1 billion, which at the time was an all-time high, having advanced 39.6% in the preceding 10 years.

In the last decade new-money issuance reached an apex of $274.3 billion in 2007. Like the total market numbers, new money moderated in 2008 but rebounded in 2009 with $250.8 billion coming to market, putting the decade’s advance at almost 52%.

A bigger factor of growth over the decade came from refunding, which rose 383% over the decade from $19.6 billion in 2000 to $94.8 billion last year, according to Thomson Reuters. The percentage change data, however, overstates the numbers as 2000 was a slow year for refunding. But the upward trend in recent years is evident: in the first half of the decade refunding issuance averaged $72.0 billion per year, whereas in the last five years they averaged $97.8 billion, nearly 36% more.

John Mousseau, vice president of Cumberland Advisors, said refundings are directly related to the federal funds rate target, as set by the central bank’s Federal Open Market Committee.

When the decade began the fed funds rate was 5.50%, and by May 2000 it was up to 6.50% — the highest rate since 1991 — where is stayed for the rest of the year.

Mousseau said “there was sticker shock from the standpoint of municipalities not wanting to issue as much debt in 2000.” But when the Fed began to slash rates in January 2001 — eventually lowering the target to just 1.00% in June 2003 — municipalities used the opportunity to lower debt-servicing costs.

“Issuers did two things: they enjoyed low levels so they issued more debt, and they had low levels so they refunded more debt,” Mousseau said.

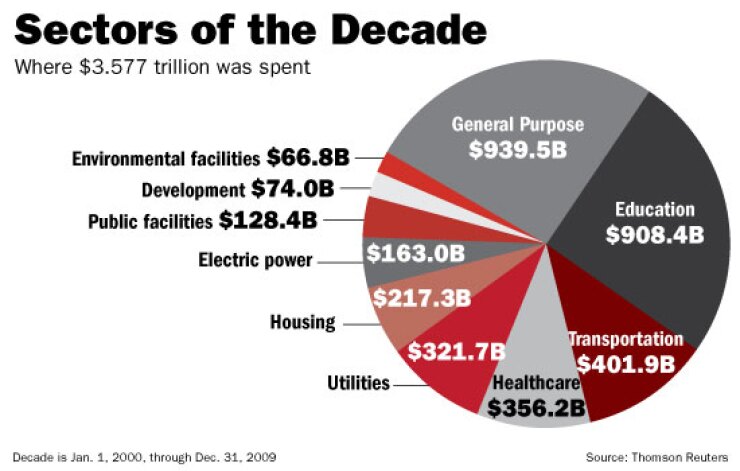

Among sectors, two areas gobbled up more than half of the decade’s volume. Of the $3.577 trillion of munis issued in the past 10 years, general purpose bonds took a 26.3% market share on 35,315 issues amounting to $939.5 billion, and education bonds absorbed 25.4% on 42,018 issues amounting to $908.4 billion.

For each of those sectors that’s an expansion compared to the 1990s. In that decade, general purpose bonds took up 23.4% of the market on $475 billion of deals, and education bonds — though still the second most active sector — accounted for only 19.5% of primary issuance.

The sector gaining the most in the 2000s was transportation. In the 1990s transportation was ranked fifth, taking up 10.4% of the market with $212 billion of total issuance. In the past decade it was the third most active sector with an 11.2% market share and $402 billion of issuance.

Heading in the other direction was environmental facilities, which saw its 4.0% share in the 1990s cut to 1.9% in the past decade. Health care bonds also fell from 11.2% of the market in the 1990s to 10.0% in the past decade. Bonds related to housing shed two percentage points to take up 6.1% of the market in the 2000s.

The number of total issues each year generally shrank from 2003 onwards, from more than 15,000 to fewer than 12,000 in 2009. With total issuance growing at the same time, this is an indication that deal size was growing.

Indeed, each of the 10 largest municipal deals ever was in the past decade. Topping the list is the $10 billion taxable pension general obligation deal issued by Illinois in June 2003.

The next three are all from California, including two from last year — the $6.86 billion part-BAB issue in April, which ranked fourth, and the $6.54 billion deal from late March, ranked fifth. Puerto Rico’s $4.12 billion deal in June also made the decade’s top 10 at number nine.

In terms of who holds all this debt, data from the final quarter of 2009 has yet to be released by the Federal Reserve, but the figures ending Sept. 30 show that most is still held by retail investors and their proxies.

State and local governments issued 92.5% more debt in the first three quarters of 2009 than in 2000. Broadly in line with that increase, holdings moved up 84% for households, 100% for mutual funds, and 73% for money market funds.

By contrast, nonfinancial corporate businesses held as much as $32.1 billion of muni debt in 2005, but during the financial crisis the unwinding of muni hedge fund and other strategies dropped that to $5.0 billion in 2008.

Guy Lebas, fixed-income strategist at Janney Capital Markets, said the advent of arbitrage funds and leverage options such as tender-option bonds caused a shift on the demand side during the decade.

“These structures didn’t exist before 2005, and then they blew up in 2007, so they’ve both risen and fallen over the course of the decade,” he said. “Ironically, demand today is concentrated in individual holders, mutual funds, and insurance companies — just as it was 10 years ago.”

Another remarkable trend has been the growing appetite from foreign investors.

In 2000 the Fed’s “rest of the world” category held only $8.0 billion of all outstanding muni debt. That number steadily grew throughout the decade to a high of $45.0 billion in 2008, and with the taxable market growing as a result of Build America Bonds last year, the first three quarters of 2009 saw foreign holdings rise to $53.5 billion from $41.0 billion in 2008.

Aside from the largest deals, annual volume, and sectors, the biggest change in the decade is the most obvious yet perhaps the least commented on: the Internet.

Phil Villaluz, municipal strategist at Advisors Asset Management, said that from a credit analyst’s perspective using the Internet has changed the dynamics of how transactions are performed, allowing anyone with a modem to receive daily credit updates and perform comprehensive analyses on most issuers.

“It wasn’t so long ago that buy-side analysts had to play a daily game of phone tag with the issuing authority or underwriter to receive details about a small community, whereas today simple facts like local real estate prices and photos, or details of the school district or public utility are just a few clicks away,” Villaluz said.

“The industry has made significant strides toward the virtual office or trading desk,” he added, noting that greater accessibility to information and disclosure has created greater comfort on the buy side.

In that respect, it was no accident to see major growth in the base of investors throughout the decade from the likes of hedge funds, pension funds, foreign investors and cross-over buyers.

On the issuance side the benefit from the Internet has been somewhat lopsided in favor of larger borrowers. Those entities in many cases have created websites delivering real-time updates on upcoming deals, virtual conferencing, marketing presentations and continuing disclosures.

For smaller issuers to more efficiently access the capital markets in the new decade, the power of that technology will have to be tapped into.

Looking ahead, factors outside the muni market, like historically low inflation rates and potentially higher income taxes, are reasons why tax-exempt bonds should garner increased demand this year. Bolstering the optimism are factors within the market, such as the success of BABs and increased refunding activity.

In a report Tuesday, Matt Fabian of Municipal Market Advisors predicted issuance could jump to $450 billion this year, a 10.6% annual increase.

“Although yields are likely to rise with the rest of the fixed-income market in 2010, the relative outlook for municipal bonds is bright,” he said, noting that ongoing scarcity of high-grade product was driving demand for safe, tax-exempt debt.

Mousseau said that even with tax-free yields moving lower, “the combined forces of contained inflation, higher federal and state tax rates, tax-free issuance constraints enforced by BAB issuance, and refunding activity by issuers still make tax-free bonds a compelling investment.”

However, Mousseau cautioned that the factors creating a big market for this year don’t extend into the rest of the decade.

“The market has gotten to the point where darn-near everything that could have been refunded has been refunded,” he said. “But that bodes well for the municipal bond market as a whole, because if you take away supply, and if you transfer some issues from the tax-free side to the BABs side, and you throw in higher tax rates on it, it should create a good framework for municipal bonds over the next couple of years.”