WASHINGTON - A Chicago-area real estate company has proposed an unsolicited 60-year concession to operate the Port of Virginia that would give the state an up-front payment of $500 million and $8.9 billion over the life of the deal.

CenterPoint Properties, a for-profit Oak Brook, Ill.-based company, proposed the public-private partnership last month to state officials. Virginia Secretary of Transportation Pierce Homer last Friday signed off on the bid, opening it up to other competing proposals.

The Virginia Port Authority currently owns and operates four cargo facilities on behalf of the state. Virginia International Terminals Inc., a nonprofit corporation that was set up by the VPA in 1981, operates the state-owned marine terminals, including Norfolk International Terminals, Portsmouth Marine Terminal, Newport News Marine Terminal, and the Virginia Inland Port.

Under the proposal, CenterPoint would control and essentially lease the four facilities and a planned Craney Island terminal, but the ports would remain state-owned.

The port is the third largest on the East Coast, behind New York and Savannah, Ga., and is the sixth largest in the country, according to the VPA.

The authority is now accepting competitive bids from other private companies until July 27, after which it will form a panel to begin to evaluate proposals and whether to accept any of the bids.

John G. Milliken, chairman of the Port Authority's board of commissioners, said in an e-mail that the agency is "in the early days of a 120-day period allowing for competing proposals to be filed, so it is not appropriate for me to comment" on the proposal.

CenterPoint already has connections to the state and is building a 900-acre, $350 million warehousing and distribution center in Suffolk. The company is touting the connections to rail and highway transportation as a way to grow the port's business.

The company "would enhance the appeal of the port to shipping lines by integrating its extensive logistics and distribution real estate experience with the operating expertise of [Virginia International Terminals]," according to the proposal.

Under CenterPoint's concession, the company would pay the state $500 million up front and $7 million of profit-sharing annually, which the company says equates to $3.5 billion in 2009 dollars and $8.9 billion over the life of the lease. The $500 million payment would be used to pay off or decrease existing debt, the proposal said.

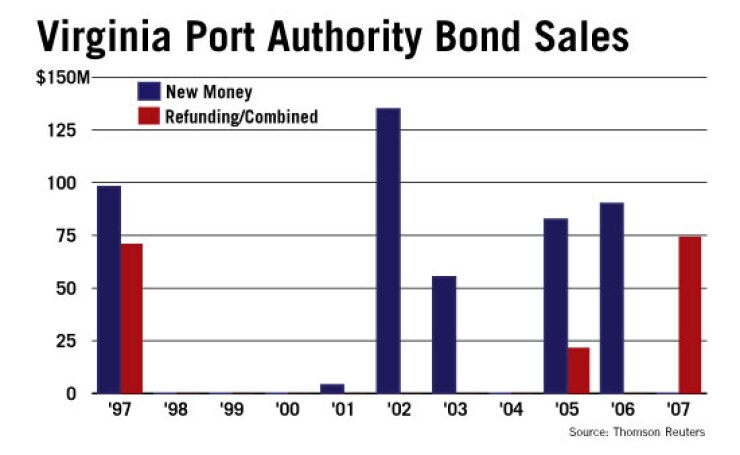

The VPA has about $485 million of port revenue bonds and commonwealth port revenue bonds outstanding. Moody's Investors Service rates the authority Aa3, while Standard & Poor's and Fitch Ratings rate it a notch lower at A-plus.

Matt Mullarkey, vice president of special projects at CenterPoint, said, "Presumably, we give the commonwealth $500 million and they could immediately repay the port revenue bonds." He added that the state has other sources of capital to defease the bonds or pay debt service, but that the payment is an option.

If the company had to assume the debt, it would have to be "negotiated during the due diligence period," according to the proposal. "If assumption of existing debt is possible, and terms are economically beneficial, such debt may be assumed by CenterPoint, but the commonwealth would be released from the related obligations."

Mullarkey said that the company is pursuing the possibility of using some form of tax-exempt financing in the future, if the deal were to be accepted by the state.

"Our concession agreement is analogous to a long-term land lease, on which we're acquiring the rights to operate the port ... It seems to me that it's still public use and public ownership," so that public financings could be possible, Mullarkey said, adding that it was too early to speculate how the company would go about it.

In addition to the up-front payment to Virginia, CenterPoint would also pay each of the host communities - Norfolk, Portsmouth, and Newport News - $5 million annually, escalating by 2.6% annually, in lieu of tax revenues that the cities cannot collect from the state-owned port. The proposed subsidy is $3.5 million more than the Port Authority currently pays local governments.

The state would receive at least $7 million annually as part of the concession to pay for VPA security and employees, but that amount could increase depending on port growth, CenterPoint officials said.

CenterPoint also would no longer collect a 4.2% allocation from Virginia's transportation trust fund, which company officials said would allow the state to use that money instead for other transportation needs. Currently the VPA gets 4.2% of the fund, which amounted to $38 million in 2008. The agency used the allocation to back bonds for capital projects at the port.

"So the commonwealth now could go into the bond market and raise several hundred million of bonds backed by this income stream and use those proceeds however it wished," Mullarkey said.

The company said that by no longer accepting the trust fund subsidy, the state would have $4 billion of additional funds over the life of the deal.

As part of the deal, CenterPoint would contribute $1.3 billion to develop Craney Island, "once the publicly funded pre-development stage is complete."

"The commonwealth and federal government [would] finance all environmental work, dike construction, road, and rail access," which CenterPoint estimates to cost $900 million over 2010 to 2014, the proposal said.

"This is essentially site preparation," the proposal said. "This public expenditure is justified by the public benefits of developing Craney Island and by the Corp of Engineers' need for expanded dredge-placement areas regardless of expansion of Craney Island."

Aaron Ellis, communications director for the American Association of Port Authorities, said his group's members are starting to look closer at the possibility of entering into public-private partnerships as "more and more of a way for ports to fund these big infrastructure developments that they couldn't do otherwise."

"This is the situation of a lot of port authorities ... They don't take the risk of running their own terminals, that risk comes off the taxpayer and goes on to a private entity, but the rewards do come back to the taxpayer and the authority because they continue to own those assets," Ellis said.

"Individual companies see the upside of investing in port facilities because of the long-term upside potential," he said. "We are going to continue being a trading nation and investing in something with that kind of long-term positive growth is smart."

Last month, the Port of Oakland agreed to a 50-year concession for five of its container-ship berths, with an option for two more. Port officials and the concession winner, Ports America Outer Harbor Terminal LLC, valued that transaction at $700 million over 50 years, with a $60 million upfront payment.

"I think it is an indication that port authorities are looking for capital and are not averse to private operators," Mullarkey said.

The port proposal is not CenterPoint's first foray into P3s. The company is awaiting U.S. Department of Transportation approval of up to $1.1 billion of tax-exempt freight transfer facilities revenue bonds for its Joliet Terminal Railroad LLC project.

The for-profit company received preliminary approval from the Illinois Finance Authority board in 2007 for the project, which relies on an allocation of tax-exempt, private-activity bonding from the DOT under a $15 billion pilot program established in 2005 that provides assistance for private intermodal rail transfer parks, toll roads, and bridges.

CenterPoint has also done projects using tax increment financings and payments in lieu of taxes.

In 2006 the company was acquired by CalEast Global Logistics, a "leading investor in logistics warehouse and related real estate whose members include the California Public Employees Retirement System and LaSalle Investment Management," for $3.4 billion, according to CenterPoint's Web site.