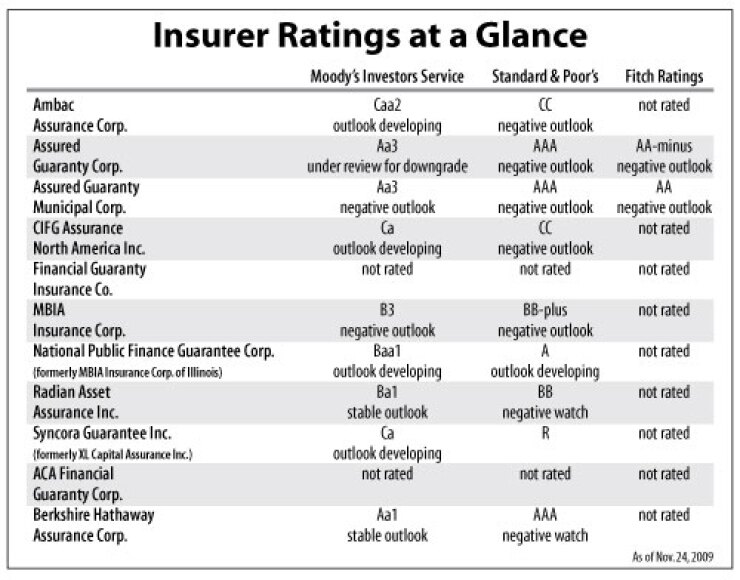

Standard & Poor’s yesterday downgraded to BB from BBB-minus the financial strength, financial enhancement, and corporate credit ratings of bond insurer Radian Asset Assurance Inc. Radian will remain on negative watch.

Standard and Poor’s, which last downgraded Radian Asset Assurance by two notches in early April, said in a press release that the New York-based monoline “has significant exposure to several asset classes that have experienced deterioration and higher capital charges and that could result in losses.” The rating agency noted the insurer is being run off by its parent company, Radian Guaranty Inc.

Radian’s corporate exposure to collateralized debt obligations “represents more than 42% of total exposure,” Standard & Poor’s said. “This concentration, in our view, exposes the company to significant loss in certain adverse scenarios.”

“The rating action reflects adverse loss development in Radian Asset Assurance Inc.’s insured portfolio that has resulted in higher capital charges and which could result in losses,” said credit analyst Dick Smith.

The now below-investment grade insurer will face an additional downgrade if the parent company — currently rated BB-minus and on negative watch — is lowered, Standard & Poor’s said.